Soybean bulls are hoping the USDA on Thursday will once again take a small step towards reducing U.S. ending stocks. The trade seems to be bracing for a small -10 to -15 million bushel reduction based on increased demand estimates.

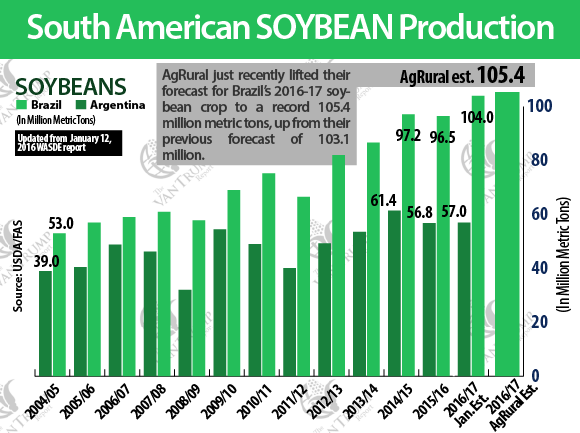

There's also bullish hope in the fact the Argentine production estimate will be lowered more aggressively than the Brazilian crop will be raised. I'm personally thinking the Argentine crop will be lowered from 57.0 down to 54.5 MMTs, while the Brazilian crop will be raised form 104.0 to 105.0 MMTs. I argue that globally we are really starting to see the technological advances pushing the yields higher.

Just think, we blew away the previous U.S. record average yield this year by more than +8%, Brazil is starting to look as if they are also going to blow away their previous record yield. Yes, you can argue "weather" has been cooperative, but "weather" has been "weather" for all of time, yields are massively jumping higher and setting big records and there is clearly more to it than just weather.

As producers we have to make certain we are adjusting our break-evens and accounting for the technogical gains in productivity. I know we want to be conservative by nature, but by more accurately forecasting our yield potential we can get a more accurate assessment of our gross margins.

Many producers who might currently think they are locking in a loser by making sales at this level, could be kicking themselves following the 2017 harvest if yields again surprise by +5 to +8 pushes per acre. I'm really preaching to myself as I feel I've underestimated my upside yield potential the past few years and put more weight on my downside fears.

With technology moving so quickly and my tendency to always look out the rearview mirror, referencing and comparing to years past, it's just tough for me to get an accurate gauge on how many bushels to award to technology and the intangibles? I think really understanding "change" and how it will impact our fields during the next 10-years is going to be critical, especially if the commodity markets stay in this low-cost provider environment.

As a spec I suspect we could see a few of the bulls move to the sideline ahead of the USDA report, just incase the numbers aren't as market friendly as most are forecasting. Longer-term I continue to like the thought of buying a much deeper fundamental break in price.

About the Author(s)

You May Also Like