Volatility! What a week for the corn market! While last week’s USDA report continued to deliver long term friendly news, the data released was not friendly enough to justify grain taking another run higher in the short term. Therefore, funds began to sell, triggering sell stops, which then triggered additional technical selling.

Big bull markets have big corrections along the way.

Looking back at years with triumphant price rallies, there were plenty of times along the way where a swift price correction occurred to the downside.

Two steps forward, one step back is the mentality it takes to achieve lofty price objectives.

Specifically in this current rally for December 2021 corn futures, if you look at the overall price rally we have had since last August, there have been four major price runs up, with four significant corrections along the way. Each correction, of each separate segmented rally, achieved a 50% to 61% Fibonacci retracement correction.

The reason I bring this up now is because if you take the early spring low for the December 2021 corn futures contract, (March 31 price low of $4.49-3/4) to the recent high (May 7 price high of $6.38), the recent price pull back over the past week pushed prices down to a low of $5.20-3/4, exactly a 61% Fibonacci retracement correction. This price was also specifically an additional price support area of the 50-day moving average. Technically speaking, this should be a tremendous price support area for the December contract going forward.

But what about those large planted acres projected?

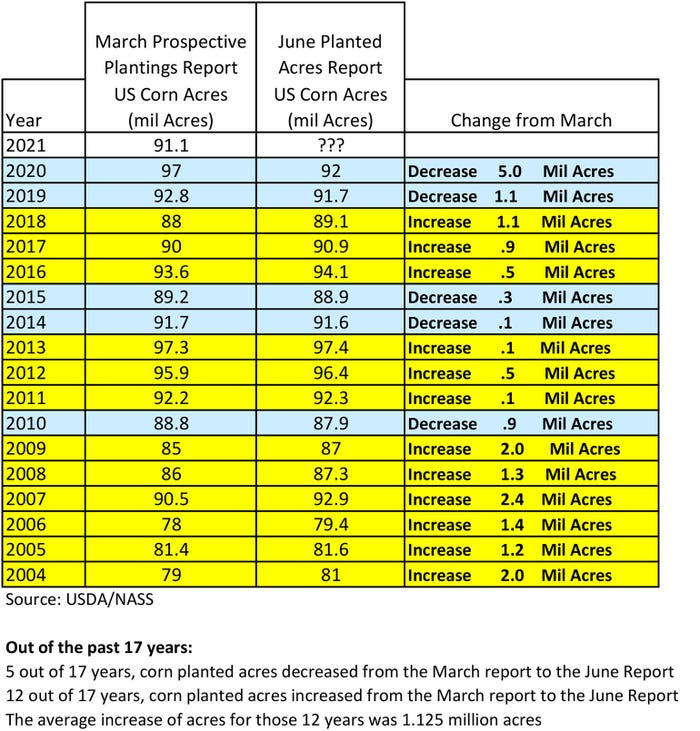

According to the March 31 Prospective Plantings Report, there will be 91.9 million acres of corn planted in the United States this spring, and 87.6 million acres of soybeans planted. The next update on those planted acres will be on June 30th. Currently trade overall anticipates both of those planted acreage numbers to increase. I agree. To know how large of an increase to realistically expect, I thought it prudent to take a historical perspective to gain insight.

For the purpose of this blog, I looked back at the past 17 years. Why 17 years? 2004 was a year that saw the beginning of increased market volatility for agriculture. (Plus, 17 is my lucky number. I hail from Cambridge, Wisconsin, and if you are a NASCAR fan you understand the significance of #17!)

The results were interesting:

For corn looking back, 5 out of 17 years the USDA/NASS decreased planted corn acres from the March report to the June report. 12 out of 17 years, acres were increased from the March report to the June report. And on average, the increase for those 12 years was 1.125 million acres.

I emphasize this data because there are plenty of industry rumblings that corn acres for the June 30th report may increase from 91.1 million acres to 96-97 million acres. If true, it would be a giant out-of-the-norm move for the USDA/NASS to make such an acres jump, when compared to the past 17 years.

While past performance is not indicative of future results, it makes me question if such a lofty increase in acres is achievable for the June report.

Using past historical NASS data, the most USDA has increased acres over the past 17 years is 2 million acres. Putting that into context of the most recent supply/demand tables, 93.3 million acres of corn planted, with current demand and USDA record yield printed on the May 12th report of 179.5 bu./acre would put ending stocks near 1.88 billion bushels. However, using that 2 million acre increase and suggesting that yield is anything less, say 172 bpa, puts ending stocks for the 2021-22 crop year at 1.3 million bushels.

Regardless, the price volatility between now and mid-August will continue to be nauseating. Continue to forge ahead with cash sales, and be ready to both defend unpriced bushels and potentially re-own recently priced cash sales should a weather event occur.

Reach Naomi Blohm: 800-334-9779 Twitter: @naomiblohm and [email protected]

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like