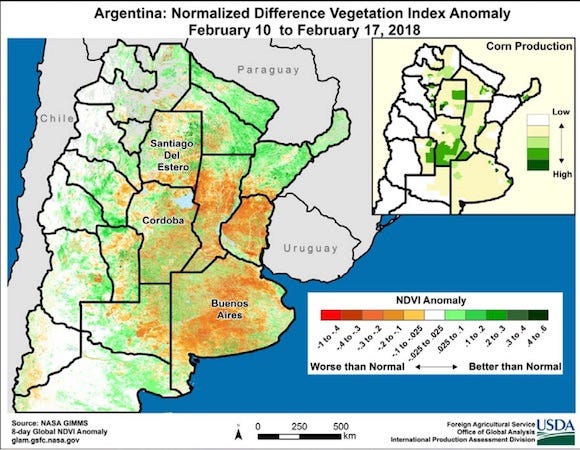

Corn bulls are happy to see the USDA adjust both domestic and global ending stocks lower. Global corn production was left largely unchanged as gains for the European Union, India, and South Africa virtually offset reductions for Argentina, Brazil, and Russia.

I was personally surprised to see the South African crop bumped higher, I was thinking it would be left "unchanged". I was also hoping to see the Brazilian crop estimate reduced a bit further, as it was only lowered from 95.0 down to 94.5 MMTs. The trade was thinking the Brazilian corn estimate would be lowered down to between 91 and 92 MMTs. It seems like the recent rally in domestic corn prices inside Brazil has prompted interest in planting more second-crop acres. Meaning perhaps Brazilian second-crop corn production won't get hit as hard as we were originally thinking.

Weather inside Brazil obviously remains a major wild-card so we need to keep paying close attention. I still don't feel like the Brazilian producers are going to be spending a lot of money on inputs or throwing a lot at the crop. Therefore shaky or questionable weather could create more yield drag or complications than we would normally expect to see.

The USDA pushed their Chinese corn import demand higher from 3.0 to 4.0 MMTs. Here at home, the USDA also made some bullish adjustment to the demand side of the balance sheet, raising exports by +175 million bushel and raising corn used for ethanol by +50 million bushels. Net-net, U.S. ending stocks were lower by -225 million bushels.

Technically, the old-crop JUL18 contract has pushed above psychological resistance at $4.00 per bushel, the first time we've closed back above $4.00 since mid-August. The next level of nearby resistance seems to be in the $4.10 to $4.15 area, then up between $4.25 and $4.35. A move north of these levels would signal a clear longer-term breakout.

On a continuation chart, we really haven't seen the front-end of corn trade above $4.44 since late-June of 2014. New-crop DEC18 corn closed above $4.10 for the first time since mid-August. The next level of nearby chart resistance seems to be in the $4.15 to $4.20 area. With the previous high of $4.29^4 posted back on July 11th of last year.

As both a producer and a spec, I continue to keep a bullish tilt.

About the Author(s)

You May Also Like