Typhoons have ripped China’s major corn producing areas a key potential factor in surging U.S. corn exports.

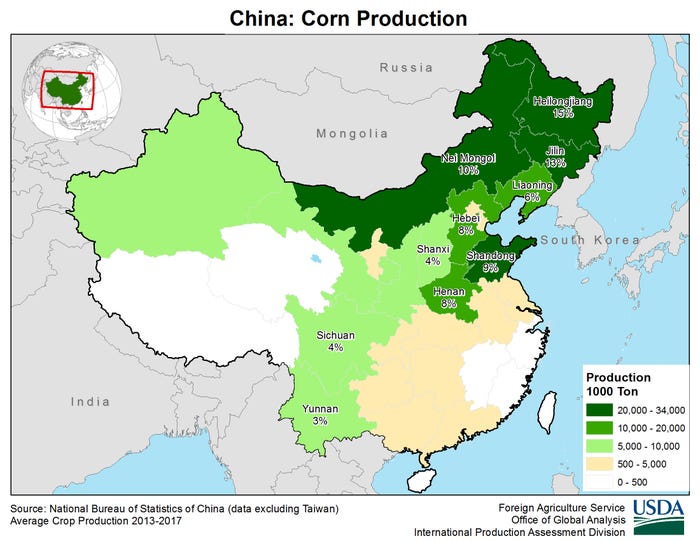

If one believes some initial estimates, 30% to 70% of the corn in China’s Jilin Province has been impacted. This is a major producing area (see map), but only time will tell how much of the crop was actually damaged.

China was hit by three typhoons late in the production year, each making landfall along some key producing areas. Typhoon Bavi moved into Liaoning Province on Aug. 27th. Typhoon Maysak struck neighboring Jilin on Sept. 3rd, and a week after that, Typhoon Haishen hit Jilin once again.

The Jilin Province is no slouch when it comes to the makeup of Chinese agricultural production. Looking at previous history, the potential impacts of bushels lost on China’s balance sheet may loom quite large. Think of the Derecho wind damage in the Midwest primarily in Iowa; that same kind of damage in China is on a potentially much larger scale.

Closer look at China corn demand

As of the latest USDA WASDE Report, China was expected to produce 260 million metric tons of corn (around 10.23 billion bushels). Even that is not enough considering China’s demand estimates are hovering around 280 to 288 million metric tons (or 11.02 - 11.34 billion bushels). That is a difference of 20 to 28 MMT or 787 million to 1.102 billion bushels that China will have to import from various countries like The United States, Ukraine, and South America over time, due to particularly strong feed demand in the hog sector trying to rebuild from African Swine Fever within the last 16 months, along with the rebuilding of the government reserves.

The geographical Provinces of China and respective corn production.

In Jilin, much like the rest of the country, the percentages of Corn production vary from year to year. But if one uses USDA FAS data, Jilin has been producing around 13% of China’s total corn supply, or around 1.33 billion bushels of this years 2020 potential supply of 260 MMT.

Startling numbers

If one uses the ranges of the damaged or detroyed corn (30% to 70%) specifically in the Jilin province then the numbers are actually quite startling.

So if Jilin produces 13% of 260MMT Chinese Total, that is 33.8MMT of production in Jilin (generally speaking).

If 30% is damaged or destroyed as some Chinese reporting agencies are claiming currently of the Jilin 33.8MMT production, that would equal 10.14MMT or nearly 400 million bushels!

If 70% is damaged or destroyed then that would be 23.66 MMT or well over 900 million bushels!

The potential impacts on China’s accelerated and definitively increased need to import more corn from other nations becomes quite clear if the prior numbers are remotely close.

Currently the market is fixated on the first 20-23 MMT of shortfall in Chinese supply and how much of that market share the U.S. will eventually send to China. But is anyone considering the production loss potentials in China and what that means for an additional 10MMT to 20 MMT if the stories of damage/destruction prove true over time?

Long-term export potential

If those shortfalls are indeed realized, and the U.S. is the majority provider of the additionally needed bushels, it will make the U.S. balance sheet (eventually) look quite interesting.

As of the last WASDE Report the U.S expected exports to China would remain unchanged at 7.0 MMT even though as of yesterday morning sales had approached 9.4 MMT. Export sales pace will need to continue. One could expect the USDA to increase Chinese export numbers over the next several months, but to what degree, and by how much, who knows?

If China is in a situation where the bushel shorfalls are almost doubling current levels, U.S. corn exports could surge. Time will tell!

Advance Trading

Contact ATI at

800-664-2321

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like