Does anybody remember that amazing trade deal we finalized on February 15th with China? I only mention it because

U.S. agriculture sacrificed a great deal the last two years to make it happen and

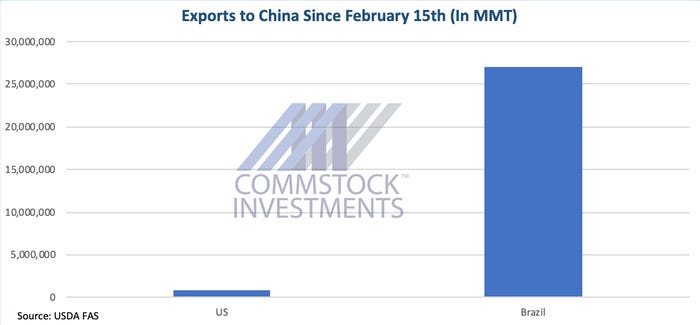

We could really use China to start buying our commodities right about now. Despite COVID-19 China did not quit buying; in fact they are buying quite a bit. They just are not buying from us.

Brazil soybean exports are hot right now, well above where they were last year at this time. They are expected to surpass 14 MMT for April. They have exported 27.1 MMT so far for 2020, roughly 5 MMT more than last year at this time.

Virtually all of which is headed to China. And yet China has bought almost nothing from us since we signed the deal on February 15th.

Brazilian soybeans (Brazilian anything for that matter) are much cheaper right now due to currency weakness. But the deal with China was not predicated on us having the cheapest grain in the world for them to initiate purchases. At what point is China no longer complying with the agreement?

I would argue we are about there.

The South China Morning Post reported it was unlikely Beijing would be able to keep their end of the bargain. At the rate they are going, something would have to change dramatically for that to happen.

China lost some 60% of its hog herd last year from African Swine Fever, but they knew that going into the agreement. That is not a reason for them to get a pass. They are actively working on repopulating their herd right now.

We know we are going to have a big supply this year, especially if we plant anywhere near 97 million acres of corn. April weather forecasts are currently favorable, which improves chances for trendline yields. What this means is we have a big crop coming our way. The only way to reduce our carryover is on the demand side --demand which is currently getting hammered due to COVID-19.

If we don’t start exporting more, $3 corn and $8 beans are going to be the new normal.

Brazil is booming

With China buying up all the grain in Brazil, it has helped push their prices to record highs in their local currency. The situation in Brazil could not be more different than it is here. They are currently experiencing their highest recorded prices in the history of soybean cultivation.

When I was in Brazil this past January with a group of American farmers, we asked one Brazilian farmer what his profit margins were. He told me he wasn’t sure he wanted to answer truthfully. When I asked why, he said because the last time he had asked an American farmer what his profit margins were, he thought he had lied. When I asked why he thought that, he said, “because his margins showed he was losing money.” The group told him that that was accurate, and the American farmer had been telling him the truth.

This whole time the Brazilian farmer could not conceive that the American farmer was losing money and so thought the American was not being honest.

Holding China’s feet to the fire makes a lot of sense. If we focus on keeping China accountable to the agreement, that would boost prices. If we boost prices, it would reduce the need for financial assistance from the government.

We sacrificed a great deal because we were told we would be better off in the long run. I think it is time we cashed in on that.

Matthew Kruse is President of Commstock Investments. He can be reached at 712-227-1110 or emailed at [email protected].

utures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like