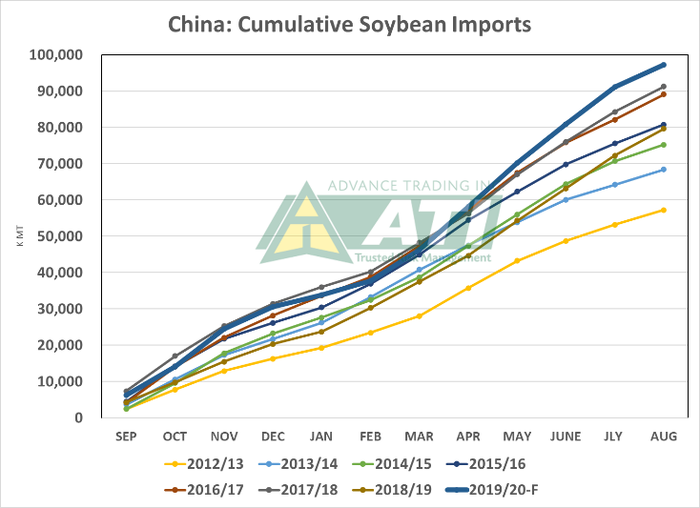

China has been taking soybeans from the three major exporters at a record pace. Preliminary data for the September-June period indicate that together, Argentina, Brazil and the U.S. have shipped an estimated 81 million metric tonnes to China. That’s an increase of 28%/18 MMT over the same 10-month period last year and even exceeds the 2013/14 crop year when Sept-June shipments to China rose 23%/11 MMT year to year (see graph below—July and August are ATI estimates).

Inside intel on Chinese import explosion

The explosion in Chinese soybean imports has confounded most of the trade and including the professional economists at the USDA. A year ago at this time, the August WASDE (USDA monthly Supply and Demand report) was forecasting China’s 19-20 soybean imports at 85 million tonnes and THAT was down 2 from the July estimate. 12 months later the forecast has gradually been revised upwards by a not-so-small 13 million! No fault of the USDA, as between the trade war and the impact of swine flu, China’s consumption of the 8 major protein meals had taken a 3 MMT hit in 18/19 as a result and such a recovery was not quite expected.

Several reasons have been put forth as to what are the driving forces behind this rapid pick-up in demand. Perhaps one of the best examples was reported in the June 29th USDA Oilseeds and Products Update for China. The document stated “An official report from Shandong, one of the largest feed-producing provinces (accounting for 16.5 percent of China’s total feed production in 2019), indicated that the province’s feed production reached 13.1 MMT in the first 4 months of 2020, 19% higher than the previous year.

In particular, the report has swine feed up 37% while feed for gilt is doubled and feed for piglets is up 56%. Large feed companies reported increase(s) of production in the first months of 2020. For instance, a Liaoning based feed company (with yearly production at about 3 MMT) reported feed sales up 47 percent in the first months of 2020 as compared to the previous year.”

Increased rations

Other sources have reported that China’s livestock and poultry industries have increased the amount of soybean meal included in rations by as much as 10%, or from 20% so in the rations to as much as 25% in order to increase the rate of weight gain. And accordingly, China’s soybean crush has likewise been revised upwards from 85 million to 90.1 this past August.

Crush had been running as much as 20-20% above year ago levels in recent weeks but with meal inventories beginning to accumulate, the pace of crush and possibly imports, is likely to slow somewhat. Still, the demand does appear to be for real.

Nevertheless, there are reports in the trade that Brazil has over-committed on its soybean export program. Brazil alone had a 19MMT increase from their previous exports.

As a result and based on reported year-to-date exports and crush, Brazil’s soybean stocks the first of September are estimated to be 35% or 14 MMT SMALLER than a year ago and at a 5-year low.

The country typically crushes about 3.3-3.5 MMT of soybeans per month during the Sept-Jan period with much of this going to meet domestic livestock needs. This sector will likely have first call on the remaining beans in the country and there was even talk of reducing or even eliminating the 8% tariff on imported soybeans from non-Mercosur countries to meet domestic demand and prevent beans from leaving the country. Others suggest the major export houses will simply switch sales that had been made from Brazil, to the U.S.

Fewer Brazilian soy exports?

Regardless, the short supply suggests Brazil will likely be exporting 425-450 mbu FEWER soybeans during the Sept-Jan period compared to 2019-2020. While Argentina might be expected to pick up some of the slack, so far soybean export estimates for that country are expected to be down 30% or 3 MMT or more this year and in part due to a 5-6 million metric tonne smaller crop.

So with reduced South American availability until the Brazil harvest begins in full force after the first of the year AND providing China continues to buy and import soybeans, the U.S. producer should be in a very enviable position for the next several months to supply the world with protein.

The one real concern would be if China began to draw on its reserve stocks as opposed to buying from the U.S. However, China already has a record amount of U.S. business on the books as we start the 20-21 marketing year. And, another 24 million in sales were just announced this morning.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com

Information provided may include opinions of the author and is subject to the following disclosures: The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like