Those who cannot remember the past are condemned to repeat it. – G. Sanayana.

If we’re really honest with ourselves, I think we would all have to admit that we tend to have short memories in certain areas of our business lives, especially marketing.

What are some beneficial lessons we can glean as we review past marketing years? Start with how much money you could have made or lost, based on average price volatility over time.

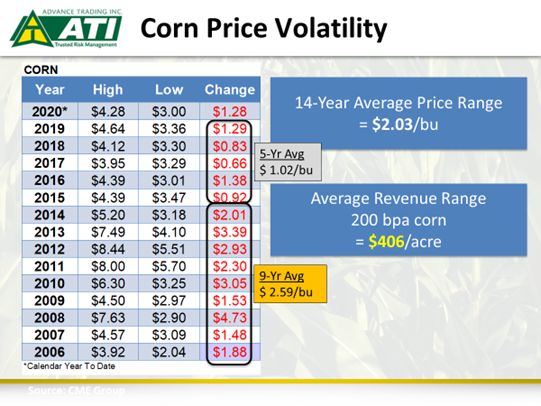

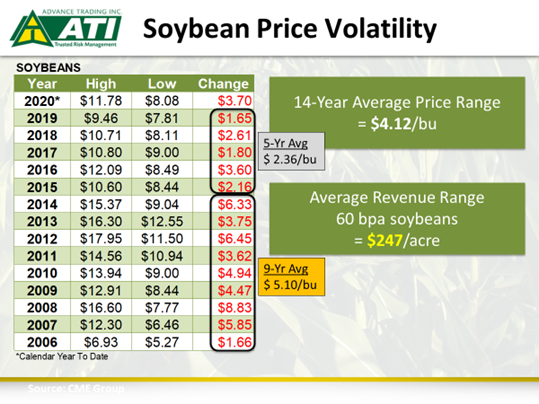

Let’s look at some price ranges for the past 14 years for front-month corn and soybean futures.

High low ranges and average revenue ranges

On average, the high to low price range for corn futures has been $2.03/bushel. The narrowest was in the 2017 calendar year at only 66 cents, and the widest was 4.73 in 2008 (7.63 to 2.90).

Taken a step further, on a 200 bushel per acre corn yield, there has been an average revenue range over the past 14 years of $406/acre!

In soybeans, the high to low price range has averaged $4.12/bushel. The quietest period was 2019 and 2006 with only $1.65 and $1.66 ranges, and the biggest being in 2008 at $8.83 (16.60 to 7.77). Using a 60 bushel per acre yield, there has been an average revenue range of $247/acre.

Lesson 1: Expect that prices will likely move much higher or much lower than what you think

In dealings with producers over my 26-year career, I’ve many times heard the comment “I don’t think prices are going to do much.” Is it just our human nature, in general, that we tend to think that everything will stay pretty much the same?

History shows that prices have very rarely remained in a narrow range for very long. World demand continues to expand. In the U.S., the corn demand base in recent years has been around 14-14.5 billion bushels per marketing year (likely more this year) and soybean demand has been between 4-4.5 bbu. When balanced against the ability to grow very large crops in the U.S. and abroad, while acknowledging the very real risk of crop shortfalls, it is relatively easy for the supply-demand balance sheets to get out of whack in a hurry. What does that produce? Price volatility! Expand your horizons and understand there is so much that can change-- and often those changes produce dramatic price moves far in excess of what was expected.

Lesson 2: Don’t bet against the farmer’s ability to produce huge crops

We can see how severely adverse weather can cut into final yields. With improving farming practices, technology, and even stronger genetics, combined with beneficial growing conditions, yield potential continues to grow at a fast pace.

Personally, I tend to believe the United States has the best producers in the world. In a 5-year period (2014-2018), record corn yields were printed in four of those years. In that same period, there were three consecutive record soybean yield years. It is very rare to have three years in a row of record yields. However, it is important to understand that each year stands on its own. Don’t assume that just because there have been two records in a row that the 3rd year has to be more average or even below trend. Betting against the American farmers’ ability to produce big crops has been unwise over the years. Instead, expect big crops and defend against lower prices, while still leaving plenty of flexibility to the upside.

Lesson 3: Stay positioned for the really big price move years

After multiple crop years in a row (2015-2019) of somewhat quieter price ranges ($1.02/bu. corn and $2.36/bu. soybeans), it is easy to become conditioned into believing that the next few years will continue that way. With marketing, it is so critical to stay consistent and disciplined in your marketing plan.

In the risk management approach that we have espoused over the decades, call options are consistently purchased on a majority of the bushels that are sold (cash sales, hedge-to-arrive, futures sales). However, when this sale and call option strategy is executed for several years in a row, with prices subsequently dropping and calls expiring with no value, even the most experienced risk manager can start to have doubts.

When the really big price range years come along, having the call options bought back on sales is a huge benefit! Managing the equity in those calls in those years is likewise of paramount importance.

From what we have experienced, even though the much higher volatility years don’t happen as frequently, when they actually do, the gains from the calls in those years literally dwarf the previous year cumulative call losses.

Lesson 4: Stay consistent in managing your floor price protection in a disciplined fashion

Buying put options on unsold bushels and selling corn or soybean bushels with call options attached is a solid first step to initially defend against lower prices, while keeping upside potential. In order to be successful though, it cannot end there. In other words, if puts are purchased to defend the 2021 crop and they are, so to speak, shoved into the desk drawer until expiration, the chance of being pleased with your marketing performance is greatly diminished.

On the other hand, if prices move significantly higher and there is a disciplined plan in place for raising the put floors and managing the more valuable call options (from the earlier sold bushels), then the chance for marketing success is greatly enhanced.

At the other end of the spectrum, how are positions (puts, futures sales, etc.) managed in sharply lower markets? In 2008, after corn futures had dropped by approximately $1.50/bu. from $7.50-plus futures price levels, some marketing professionals were urging clients to liquidate their puts (covering unsold bushels); their feeling was that there would be a price recovery from these “depressed” price levels. Little did they know that there was another $3 per bu. decline still ahead!

Instead of trying to pick the lows, managing the very high-valued puts by consistently rolling down to lower strikes to capture equity worked much better as floors were still in place for those unsold bushels. The same can be said of managing calls in a sharply higher market. Trying to pick the highs by selling off the valuable call options could cause you to miss out if prices surge $1,$2, or $3/bu. higher. Don’t try to “time it”; manage floors in a disciplined and consistent fashion.

These are exciting times in agriculture, with prices surging to higher levels than what we’ve seen in quite some time. Looking back on previous marketing years, with the intent of gleaning some valuable lessons, can be very beneficial in your marketing approach going forward.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like