Ending stocks for 2020/21 U.S. wheat supplies are not near as tight as those of corn and soybeans. With 143 days of carryout predicted for wheat by June, domestic wheat stocks will likely remain much more liquid than those of corn (37 days) and soybeans (10 days).

Global wheat stocks are also sitting pretty at just shy of 4 months of carryout expected at the end of 2020/21. Winter wheat crops in Russia, Ukraine, and the European Union are largely rated in good to excellent condition with MARS, the EU’s crop monitoring service, suggesting a 3.5% in yields over the five-year average. Russia and the EU are the world’s largest wheat exporters, with Ukraine following up in the sixth place slot.

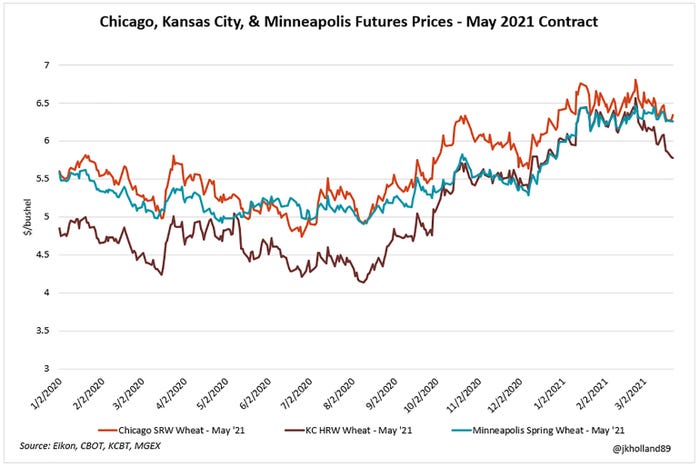

While Chicago soft winter wheat prices have appreciated by nearly a third since late June 2020, the nearby May 2021 contract currently trading at $6.26/bushel has shed over $0.54/bushel since late February 2021 as weather concerns about crop conditions in the Black Sea region eased.

Of course, the Russian wheat export tax will likely continue to benefit U.S. wheat exporters until this large crop comes online this summer, especially as a smaller 2020 wheat crop keeps European Union export capacity limited. But keep an eye out – in mid-March, the Russian government hinted that it would end the wheat export tax if domestic food markets were able to stabilize.

U.S. farmers stand to benefit from shrinking Russian exports as smaller buyers seek readily available American stocks. But should the Russian government lift the export tax before June or the dollar strengthens, the window of opportunity for U.S. wheat exporters could close rapidly.

Weather watch

Weather and crop condition reports will play a significant factor in price volatility over the next couple months. Damage from the February 2021 cold snap will not likely be quantified until combines start rolling.

As of press time, NOAA’s 30-day forecast suggested a 50% probability of above average temperatures across the Plains during the key jointing phase this spring. A late spring frost would increase the chances of higher yield damage, though the likelihood of lower temperatures is expected to decrease as the snow cover melts.

Winter wheat crops in Kansas, Texas, and Colorado saw condition ratings improve after heavy snow and rainfall during March replenished depleted soil moisture levels. Prices for the nearby May 2021 Kansas City hard red winter wheat futures contract slid nearly 13%, or $0.835/bushel, to $5.725/bushel at last glance as crop ratings improve while the winter wheat plants emerge from dormancy into the jointing stage.

But as of press time, USDA’s World Agricultural Outlook Board reported 26% of winter wheat, 78% of spring wheat, and 90% of durum wheat production regions were in areas experiencing drought conditions.

Adequate rainfall will likely be more crucial to 2021 wheat yields than chances of a late spring frost. As the 2020/21 La Niña weather pattern begins to weaken, the drought-plagued West and High Plains could see some relief.

China, white wheat, & spring wheat acreage

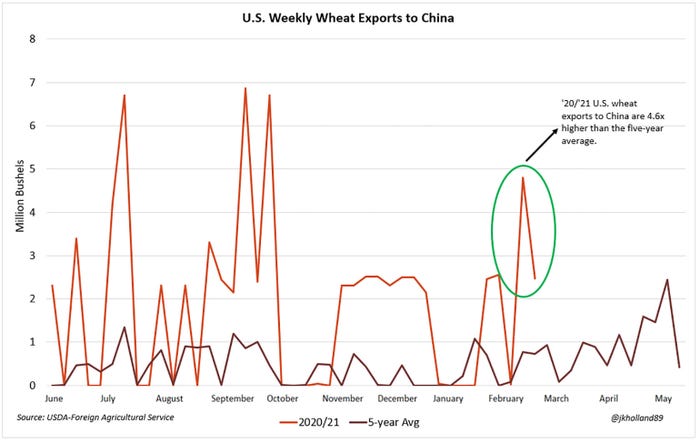

U.S. white wheat shipments to China in the 2020/21 marketing year to date are second only to the Philippines, which is traditionally the largest buyer of U.S. white wheat, amid geopolitical tensions between China and white wheat powerhouse Australia. In fact, U.S. white wheat shipments in 2020/21 are expected to top 245 million bushels – the highest volume since 1994.

And despite a recent round of profit taking bringing nearby futures prices down from a high of $6.465/bushel in late February, Minneapolis spring wheat futures remain $1.345/bushel, or 27%, higher than last summer’s harvest lows at $6.2525/bushel.

But even with the rapid export rates to China, corn and soybeans are likely to beat out spring wheat acres this year. While supplies will remain adequate in the short run, if the winterkill damage to hard red winter wheat yields and the drop in spring wheat acreage is significant enough, U.S. wheat prices could see more bullish activity by late 2021 if domestic supplies tighten.

About the Author(s)

You May Also Like