First, let’s stipulate that most of Farm Futures readers are men, and that most of them grew up in the 1950s and 1960s. Those who don’t meet these qualifications may need a refresher about Mad Magazine.

As Mad readers will remember, Alfred E. Neuman’s motto was “What, Me Worry?” Believe it or not, there’s a fighting chance corn growers may be able to say the same thing about their 2020 prospects.

Despite all the doom and gloom hovering over agriculture, and perhaps the planet right now, reports of your demise are greatly exaggerated.

Mark Twain said something like that more than 120 years ago. It may be just as true today. Your cost of production, crop insurance plan and Farm Program choices matter. But those with on-farm storage, a good banker, the ability to trade and gumption to look for the best cash market may wind up doing all right with only modest rallies.

Simply put, the outlook for corn put out by USDA today is so bad, it’s not bad. Safety net programs and market mechanics could help offset supply and demand fundamentals that are the worst in 35 years.

Each farm is different, which is why it’s essential to crunch all the numbers and scenarios to reflect the facts on the ground of your individual operation, not some blanket, one-size-fits-all recommendation. But while traders see only a burial shroud, many growers may be protected by a security blanket.

Here are factors to consider when mapping out your strategy for the next year or more.

Farm program benefits. Farmers enrolled three of every four corn acres in Price Loss Coverage under the 2018 Farm Bill, with that choice locked in for 2019 and 2020. The effective reference price of $3.70 for corn should easily trigger a payoff if yields hold up and farmers harvest the record 16-billion-bushel crop forecast by USDA today. USDA put the average price for the 2020 at $3.20, which seems overly optimistic given current conditions, with $3 a more likely minimum.

To be sure, growers won’t actually get that $3.70 price from USDA. Planted acres could top the 95 million base enrolled to date, and the large gap between a farm’s real production and at its program yields will further dilute the payment, which is made on only 85% of base acres. Sequestration due to the staggering federal budget debt could erode the support more. Nonetheless, PLC could come to the rescue of many farms, enough so that payment limits may also be in play. So if you haven’t already, see if updating PLC yields makes sense. The deadline for doing this is Sept. 30, and it’s the decision of the landowner, not the farmer if the ground is rented. So you may have some explaining to do.

Crop insurance. Revenue Protection remains the most popular choice for corn growers, selected on 85% of policies for 2020. Current summary of business data indicates the median coverage is around the 75% level. But with the spring price at $3.88, December futures must average below $3 in October for a 75% policy to pay off as long as yields are normal. That could happen; otherwise unless higher levels of insurance were taken the protection mostly amounts to coverage against either bad yields or sharply rising prices if hedges are put on at lower price levels.

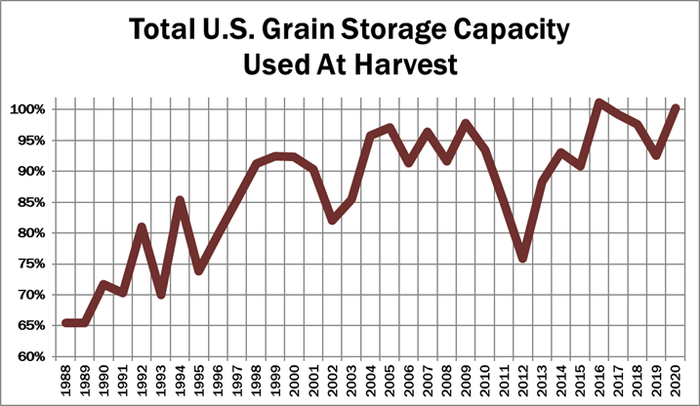

Basis. A record crop on top of Sept. 1 old crop supplies topping 2 billion bushels could easily swamp storage capacity in the U.S., even if growers and merchandisers find the financing to add bins. Not surprisingly, new crop bids are generally soft, though some locations are still stronger than harvest levels seen from 2016 to 2018.

Weak nearby basis is one mechanism the market uses to put corn in storage at harvest. The other tool is carry. The spread, or difference, between December futures and contracts for delivery in the following spring and summer provides additional incentive for storage if potential for appreciation – nearby basis improvement plus carry – is enough to pay for the cost of storage.

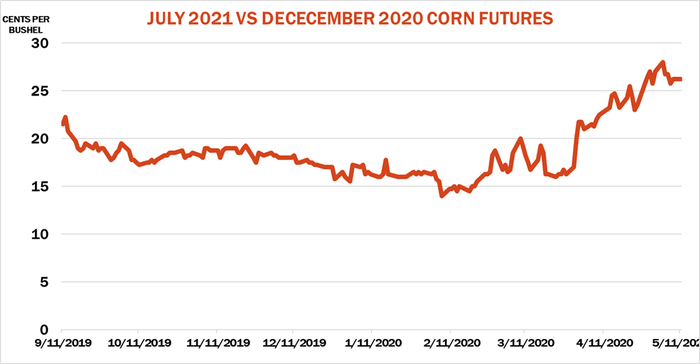

Carry this year could be a wild card. The CBOT increased maximum storage fees at deliverable locations from five to eight cents a bushel after last year’s harvest. But low production and adequate storage held back 2019 harvest carry to less than three cents a month. July 2021 futures started the week at 26.25-cent premium to December 2020; the question for traders is whether higher storage costs will swell carry, adding additional incentive for hedgers.

Storage. If supplies remain burdensome, grain held in on-farm bins could be a money maker for growers who can hedge rallies, roll those positions to deferred 2021 futures and wait for the cash market to narrow its difference to futures. While new steel may not cash flow, depreciated facilities could net 15 cents a bushel or more depending on carry, opportunity costs and basis improvement.

A good banker is needed – one who understands your plan. Patience – and operating capital will be needed to seed it through.

Money will be needed for cash flow because any 2020 farm program payments won’t be received until October 2021. Cash grain also would be held off the market until reasonable basis targets are achieved, which could take well into spring of 2021.

Fortunately, in theory at least, money is cheap right now and likely to stay cheap. Interest rates on CCC loans are as low as they can get, unless the Federal Reserve decides to pursue negative rates, something that isn’t likely right now. Other financing can’t match the government, but should be affordable too, for those who qualify.

Knowledge of the markets and the ability to hedge is essential. Basis or hedge to arrive contracts, or long or short futures, likely will be needed. Call options to protect against a big rally, however unexpected, may also be needed to offset lower PLC payments, especially for those who sell off the combine or face hedge losses.

Gumption will pay off. The ability to scout out new markets could be crucial, especially if the ethanol industry recovers slowly. Any problems with repairs on the Illinois River this summer – not to mention the COVID-19 pandemic -- could also disrupt who wants corn and when they want it

Think about targets. Finally, determine at what level it makes sense to start pre-harvest hedges, if and when the market can sustain something of a rally. December futures might need only a modest bounce to be profitable, when storage returns and safety net supports are included.

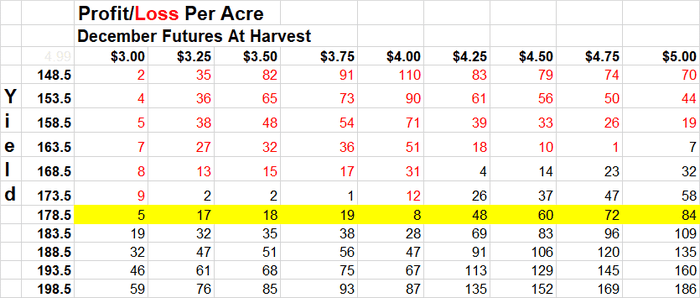

This table shows the impact of varying yields and harvest prices on profit/loss per acre for an average farm with a cost of production of $3.52 a bushel with trend yields that hedges $3.50 December futures. While this cost is below USDA’s last estimate, it reflects real-world machinery expenses that inflate the government’s estimate. It assumes ability to store the crop on farm in depreciated bins, selling carry at harvest. The government’s projected yield with normal 2020 weather is 178.5 bushels per acre, high-lighted in yellow.

Record 2020 corn production and large leftover supplies of 2019 crops could tax U.S. grain storage capacity this fall, weakening basis and increasing carries in the futures market.

A large corn crop could put expanded storage costs in CBOT futures contracts into play this fall.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like