Over the past few years the market has provided carry, an incentive to store corn and beans (see Ryan Griess’s blog from last week). Most recently we have seen the market disincentivize storing the crop, by removing the carry premium to further out months. What is the market telling you to do now?

The decision maker

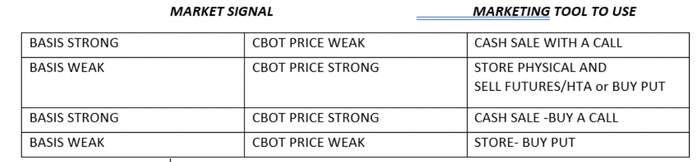

In marketing 101 classes, I use a slide that talks about basis. Basis is the decision maker on making cash sales. If basis is strong, it tells you to sell physical ownership. If basis is weak, it indicates the market does not want your product and will pay you to hold it until a future date.

An example I like to use to illustrate basis and its signals follows:

If it is close to dinner time, you are generally more willing to pay up for a good steak dinner. You are likely to pay a higher price because you are hungry for that fantastic meal. Like your level of hunger just in front of dinner, end users of grains are more likely to “pay up” when they are wanting ownership of physical product. If it is harvest time, and everyone is harvesting away on a nice crop, the end user is likely not as hungry for physical ownership, therefore having a wider basis and more incentive to store the physical for a later cash sale.

Corn basis, in many areas of the Midwest, the past 3-4 months has been giving you the signal to sell physical ownership. Many times basis will be relatively strong when Chicago Board price is not as attractive, making it something you don’t want to do or can’t make yourself do.

Call option limits risk

Many will ignore this market signal in hope of a price rally somewhere down the road. This is where it is important to understand using a call option to retain paper ownership, while limiting risk.

Once you have made a cash sale, you can buy a call option to “re-own” bushels in case of a market movement higher. This gives you a minimum price contract in case the market continues to move lower. Your minimum price floor is established by making the cash sale and subtracting the cost of the call option.

Currently the market has been providing a second signal to move your physical ownership. Basis has been trying to convince you to move physical and has not had success. In the merchandising world, if basis doesn’t convince you to move the physical, then the “spreads” attempt to make you move physical ownership. Currently, when you look at the difference between the months on the Chicago Board of Trade, they are signaling to you to bring the corn now, not later.

Market prices as of 3/6/20 for CBOT corn (as an example of a flat market- no incentive to carry):

March 3.77

May 3.75

July 3.78

September 3.76

The above prices from Friday 3/6/20 mid-session illustrate a signal to move physical. You have basis in many areas telling you they want the corn as well as Board price not giving incentive to hold the corn.

Two signs to move physical ownership

I have always been a student of the market telling me what to do. I also am of the school to recognize basis is an indicator of what the price can possibly do. Once the basis has attempted to get the physical ownership to move, then the spreads have attempted to get the physical to move, price may follow. You should stay optimistic about higher price once a sale has been made.

There are many fundamental reasons why that can happen. If you follow market signals, stay disciplined in your approach by owning a percentage with calls, you can root for that higher price and feel good if the market rallies. Besides, you are likely needing to get to work on further out sales if the market does rally.

To sum it up: listen to the market, stay balanced in your approach so you aren’t mourning when prices move lower, and you won’t be disappointed if you make a sale and prices rally.

Advance Trading

Contact ATI at

800-664-2321

www.advance-trading.com/disclaimer

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like