Corn prices fell slightly last Friday despite a friendly USDA Supply and Demand report.

Ending 20-21 U.S. corn stocks were reduced 150 million to 1.352 billion bu. due to increased use forecasts in all three demand categories:

Feed/residual use was up 50 mbu.;

Ethanol grind raised 25 higher and

Exports were 75 million larger versus last month.

The net was a slightly larger reduction in ending stocks versus the average trade estimate, which had pegged carry-out at 1.379 billion.

Despite a somewhat friendly report on paper, May corn closed 2 ½ cents lower on the day of the report at $5.77 ¼.

The export estimate rose from 2.6 bbu in March to 2.675 this month but remains below several trade estimates which are in the 2.85 to 2.9 (or higher) range.

USDA’s China forecast

The trade is having difficulty reconciling the USDA export forecast for Chinese corn imports of 24 million metric tonnes (945 mbu) and the fact that year-to-date “known” purchases from the U.S. are on the order of 920 million bushels. And separately, Ukraine exports to China in the 20-21 crop year are likely approaching 200 mbu. So, it would appear there is room for another 200-225 boost in the export forecast in the coming months.

The increase in both feed/residual and food/seed/industrial consumption were perhaps a surprise to the trade, but the former was justified by the March 1 corn stocks total, according to USDA, as that came in some 70 million bushels BELOW trade average. As a result, feed/residual use was bumped 50 million to 5.7 billion. The stocks report, along with disappearance during the 1st quarter, puts feed/residual use for the first half of the year 80-90 mbu higher than the 19-20 pace.

Corn vs. wheat feeding

Market concern for corn demand for the remainder of the year centers around increased wheat feeding during the summer months. For comparison, the implied balance of the year corn feed number using the USDA forecast is about 300 mbu BELOW last year so it would appear the potential for greater wheat feeding has been pretty well factored in.

As for ethanol, a strong performance for the sector during the month of March based on weekly data provided by the Department of Energy encouraged a boost in the ethanol grind forecast by 25 million bushels, to 4.975 billion. This is now about 120 mbu higher than last year’s use as the U.S. continues to recover from the demand dampening effects of COVID-19.

All in all, the latest USDA carry-out estimate of 1.352 bbu still has room for further downside of around 225-250 mbu which would put 20-21 stocks at 1.1 bbu. Yet there is still a fair amount of uncertainty in my opinion in the weeks ahead regarding the size of the Brazilian corn crop which could have a bearing on U.S. exports in July and August and more so during the first half of the 21-22 marketing year (the USDA left its forecast at 109; the trade is leaning some 4 million or so million tonnes smaller).

Soybeans stocks unchanged

U.S. soybean carry-out in the April S&D report did not change (ending stocks remained at 120 mbu; trade, 118) but the USDA did tweak crush (down 10 on easing domestic meal demand), reduced residual use by 17 as a result of higher than expected March 1 stocks, and added 30 to its export forecast. However, the negatives came from a 2 MMT larger Brazil crop (though Argentina/Paraguay were together), down 1 and while China’s imports were unchanged at 100 MMT, crush was scaled back by 2, to 96.0.

Acreage decisions loom large

The potential impact of the amount of U.S. corn acres planted, growing season development, and potential yield, will loom large in the weeks ahead. At the same time, there is an acute battle for soybean acres as the latter’s balance sheet is the tightest ever heading into new crop.

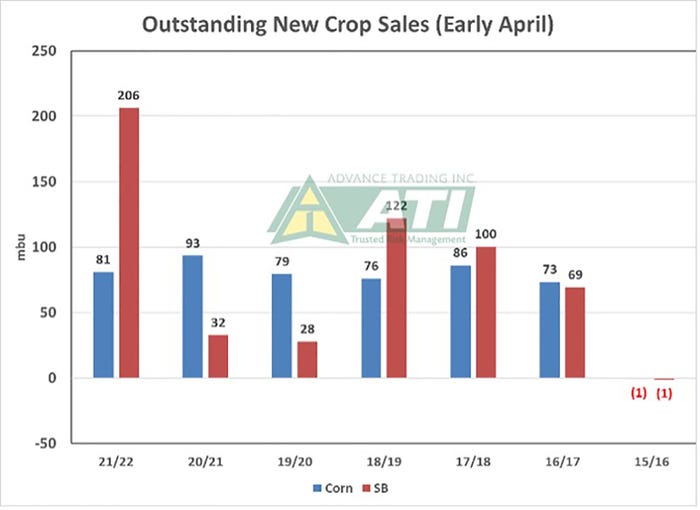

Also, global stocks-to-use ratios of both corn and soybeans have been trending downward in recent years and in the case of corn, this year’s projected 10.2% world stocks-to-use ratio is the 4th lowest of the past 50 years and soybeans, at 21.7%, is at a 21-year low. Thus, trend line corn yields are almost essential in the U.S. this summer. Further, new crop buying of U.S. soybeans is off to an impressive start (China), suggesting that barring a major outbreak of ASF in that country, the world’s largest soybean importer will be back in the U.S. market this fall in a fairly big way. China demand is uncertain; a 6 MMT increase in South American soybean production this year (providing current estimates hold) and a very tight U.S. new crop soybean balance sheet likely means continued volatility as well.

Advance Trading

Contact ATI at

800-664-2321

Information provided may include opinions of the author and is subject to the following disclosures: The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like