Export inspections for the week ending November 7 had more of the same themes running through the sector in recent months, according to Farm Futures senior grain market analyst Bryce Knorr.

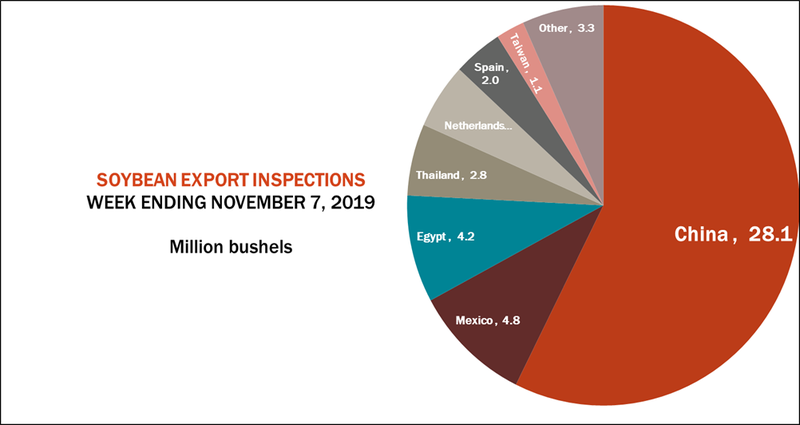

“Soybean inspections slipped a little but remain well above the rate forecast by USDA thanks to good movement to China, which accounted for 57% of total inspections with 28.1 million bushels,” he says. “The big question for the soybean market is how long this strength will last. China, or other countries, must continue to buy from the U.S. longer than normal, instead of shifting to South American origins.”

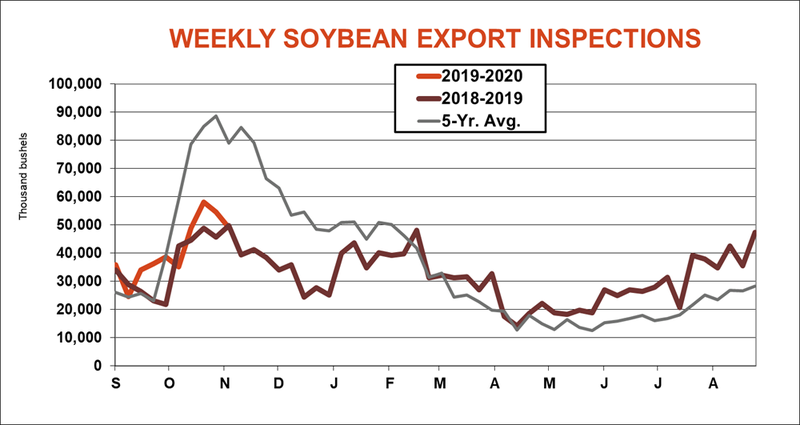

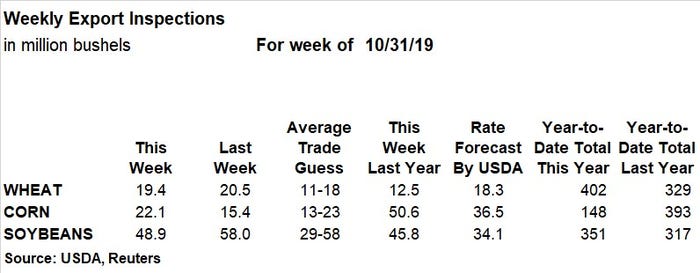

Total soybean export inspections reached 48.9 million bushels last week, which was moderately below the prior week’s tally of 58.0 million bushels but still on the high end of trade estimates that ranged between 29 million and 58 million bushels. The weekly rate needed to match USDA forecasts fell again, to 34.1 million bushels. Year-to-date totals of 351 million bushels so far in the 2019/20 marketing year are still trending 10.7% higher than a year ago.

Aside from China’s 28.1 million bushels, other leading destinations for U.S. soybean export inspections last week included Mexico (4.8 million), Egypt (4.2 million) and Thailand (2.8 million).

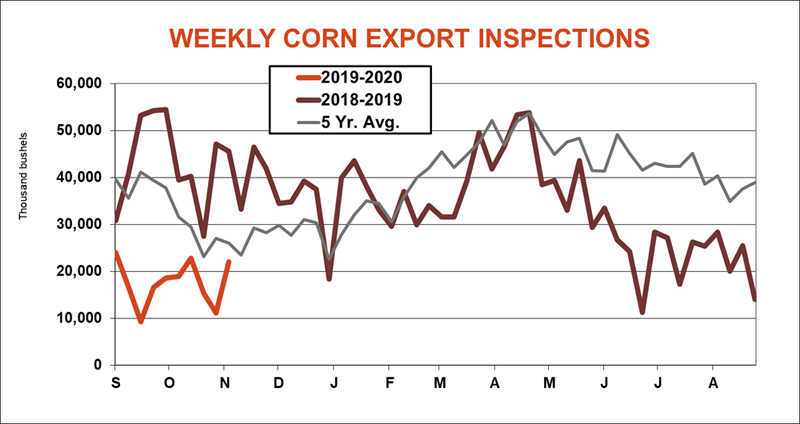

Corn export inspections still failed to impress last week, with 22.1 million bushels, although totals still moved moderately higher than the prior week’s tally of 15.4 million bushels and stayed on the high end of trade estimates that ranged between 13 million and 23 million bushels. The weekly rate needed to match USDA forecasts moved up to 36.5 million bushels. Cumulative totals in 2019/20 are only at 148 million bushels, falling further behind last year’s pace of 393 million bushels.

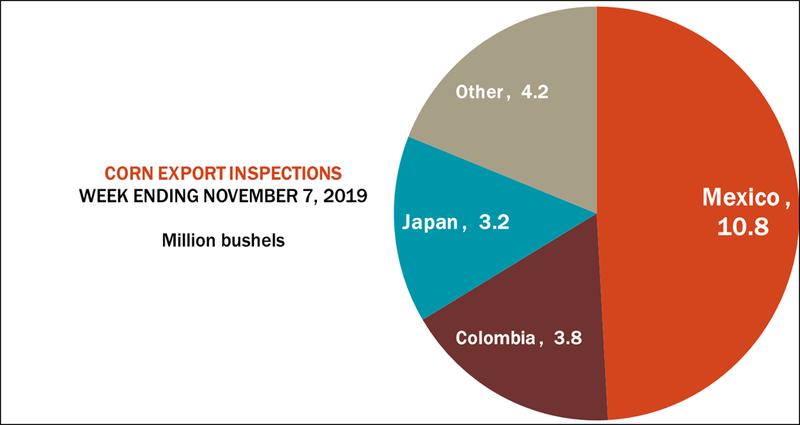

“Corn inspections improved, but that was the only bright spot,” Knorr says. “Total shipments last week are still way behind the rate needed to catch up to USDA’s forecast for the marketing year. Mexico continues to dominate the trade, but some regular Asian customers, including Taiwan and South Korea, are booking supplies from South America and the Black Sea instead.”

Mexico’s 10.8 million bushels led all destinations for corn export inspections last week, accounting for nearly half of the total. Other top destinations included Colombia (3.8 million) and Japan (3.2 million).

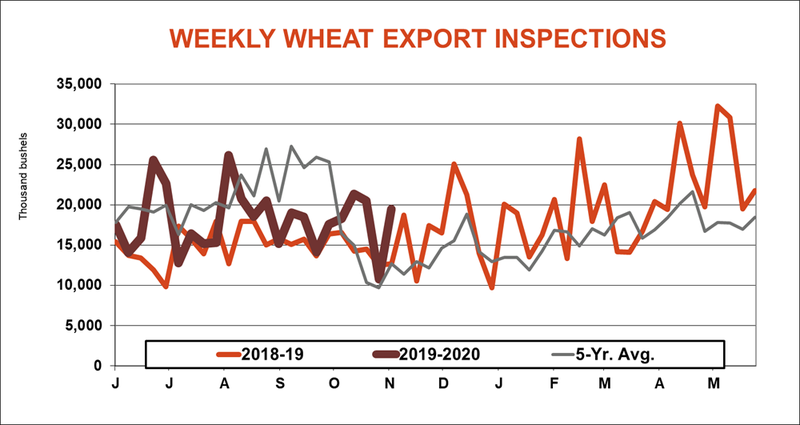

Wheat export inspections declined slightly week over week, moving from 20.5 million bushels down to 19.4 million bushels. Last week’s total surpassed the average trade guess of 11 million to 18 million bushels, however, with the weekly rate needed to match USDA forecasts declining slightly, to 18.3 million bushels. Cumulative totals for 2019/20 are trending 22.2% higher than a year ago, at 402 million bushels.

“Wheat inspections slipped slightly but remain good, beating the rate needed to reach USDA’s forecast for the 2019 marketing year,” Knorr says. “U.S. wheat continues to move to numerous destinations around the world, making up for the relatively small size of most deals. None of our customers are shipping out more than one cargo a week, so wheat looks a lot like Walmart these days – succeeding on overall volume.”

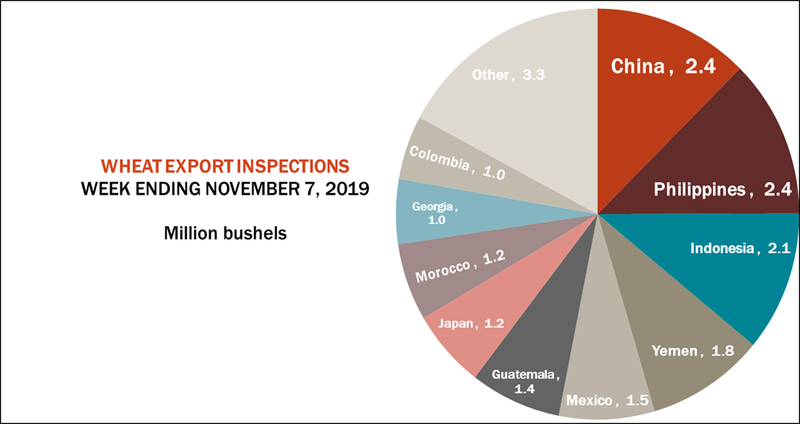

China and the Philippines topped all destinations for wheat export inspections last week, with 2.4 million bushels each. Eight other countries took at least 1.0 million bushels, too.

Read more about:

ExportsAbout the Author(s)

You May Also Like