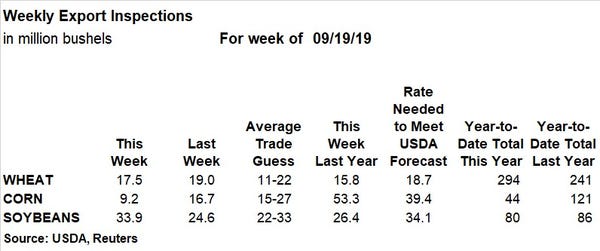

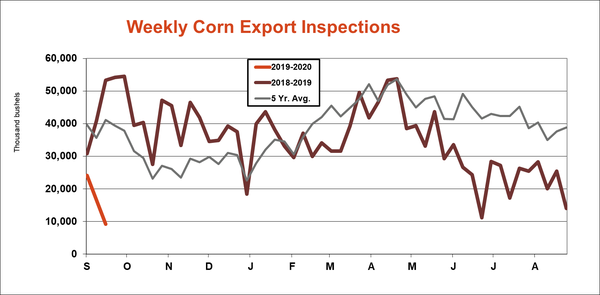

With another round of weekly export inspections in the books, some demand concerns are starting to materialize after posting a meager 9.2 million bushels for the week ending September 19 – the lowest weekly tally in four years.

“While harvest delays might account for a little of the slow start to the marketing year, a greater factor is availability of cheaper Brazilian corn,” says Farm Futures senior grain market analyst Bryce Knorr. “The weak tone is one reason why I expect USDA to lower its forecast of 2018 crop sales after getting a look at Sept. 1 grain stocks data next week.”

Last week’s corn export inspection total fell by nearly half from the prior week’s tally of 16.7 million bushels, while also spilling below trade estimates that ranged between 15 million and 27 million bushels. The weekly rate needed to match USDA forecasts moved up to 39.4 million bushels, while cumulative year-to-date 2019/20 totals are just at 44 million bushels, versus a pace of 121 million bushels a year ago.

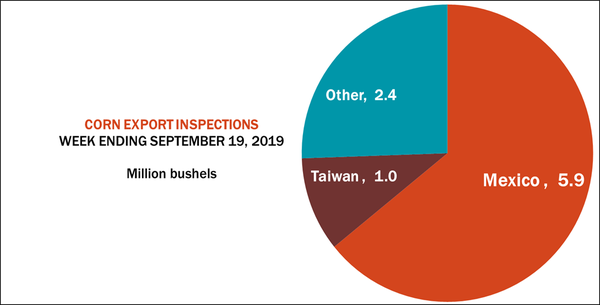

Mexico accounted for more than half of last week’s corn export inspections total, with 5.9 million bushels. Taiwan picked up another 1.0 million bushels, with other destinations accounting for the remaining 2.4 million bushels.

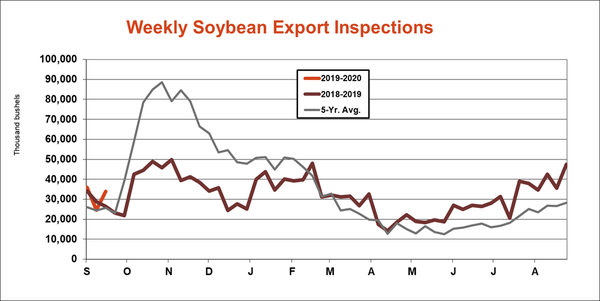

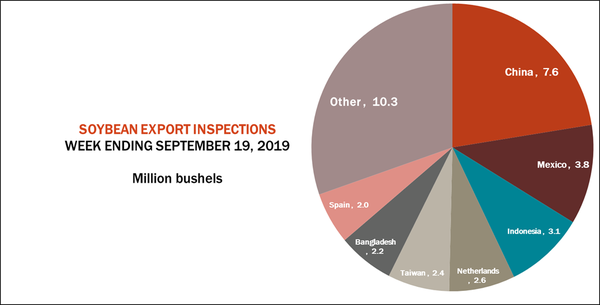

Soybean export inspections fared better last week, moderately surpassing the prior week’s tally of 24.6 million bushels after reaching 33.9 million bushels for the week ending September 19. That was also slightly ahead of the average trade guess, which ranged between 22 million and 33 million bushels. Year-to-date totals for 2019/20 are almost in line with last year’s pace of 86 million bushels after reaching 80 million bushels.

“News that Chinese buyers booked another 22 million bushels today is welcome,” Knorr says. “But Chinese purchases must pick up a lot when trade negotiations restart in Washington next month. And even if they do, it will be difficult for total exports to improve much this year unless production suffers in Brazil. Rains are starting to return to key growing regions there, though forecasts still don’t show widespread coverage yet.”

China led all destinations for U.S. soybean export inspections last week, with 7.6 million bushels. Other top destinations included Mexico (3.8 million), Indonesia (3.1 million), the Netherlands (2.6 million), Taiwan (2.4 million) and Bangladesh (2.2 million).

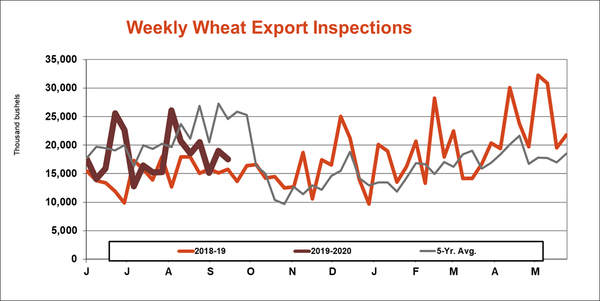

Wheat export inspections fell slightly week-over-week, moving from 19.0 million bushels down to 17.5 million bushels – also landing in the middle of trade estimates that ranged between 11 million and 22 million bushels. The weekly rate needed to match USDA forecasts inched forward to 18.7 million bushels, but 2019/20 marketing year-to-date totals have remained 22% higher than a year ago after reaching 294 million bushels.

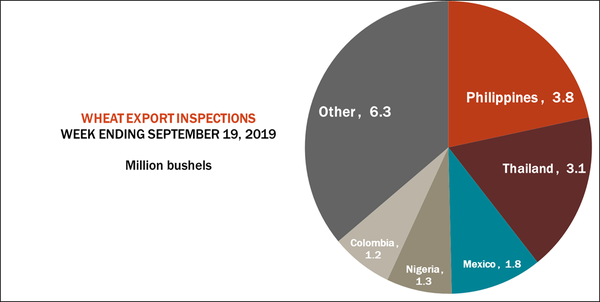

“Wheat inspections continue to be good, but not great,” Knorr says. “End users are just taking delivery on a hand-to-mouth basis because they do not fear shortages. There were 16 different destinations for U.S. wheat last week, but only Thailand and the Philippines took more than one cargo, with most buyers shipping out less than 1 million bushels.”

The Philippines led all destinations for U.S. wheat export inspections last week, with 3.8 million bushels. Other leading destinations included Thailand (3.1 million), Mexico (1.8 million), Nigeria (1.3 million) and Colombia (1.2 million).

About the Author(s)

You May Also Like