The month of June historically holds increased volatility and though this year’s volatility has been considerably subdued over the last two months compared to year’s past, one still needs to pay attention to the coming reports later this week and later this month. (All Times are Eastern)

First, the continuation of the Crop Progress and Conditions that are posted every Monday at 3 p.m. will continually be influenced by weather. This obvious variable is always changing. Later this week we will have the USDA WASDE Report (World Agricultural Supply Demand Estimates) released June 11th at 11 a.m. CDT.

At the end of June, which some view as one of the most important report days of the year, the Planted Acreage Data and the Quarterly Stocks Update are released.

What the balance sheets say

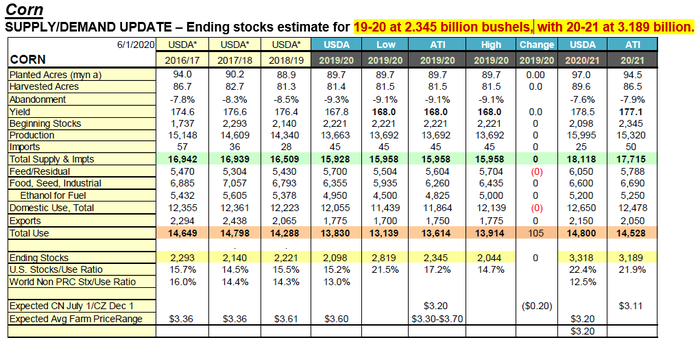

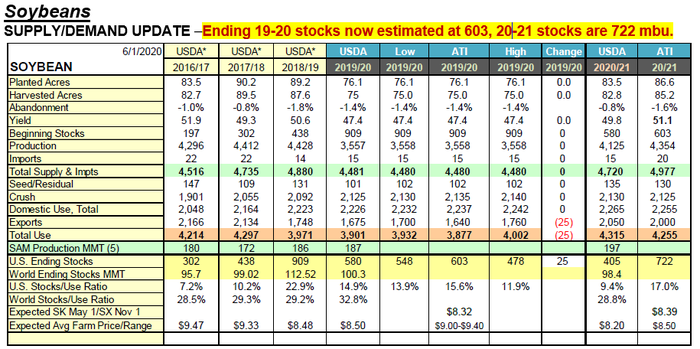

Let us review the Balance Sheets supplied by the ATI Research Department for both Corn and Soybeans posted as of Monday June 1st. Our Research Department Updates these balance sheets every Monday evening for our customer base.

Note that these weekly updates are continually changing through the course of the season due to the numerous variables and as market factors dictate.

The Corn Supply Demand Balance Sheet essentially speaks for itself --too much old crop corn in the 2019/2020 old crop pipeline, with potential to have an even more over-supplied market going forward in the new crop 2020/2021.

If an eventual 3.0 to 3.4-billion-bushel carryout is realized, the current unsavory Dec20 market price of $3.45 futures may look great compared to sub $3 per bu. futures price potentials. But only time will tell.

The Soybean Supply Demand Balance Sheet does have a bit of a story, at least one that is potentially better than corn. Much depends upon China’s continued purchases of U.S. product vs. Brazil.

U.S. beans have recently become competitive once again with more sales to China from our shores. However, there are many who believe that China as a whole will not be able to fulfill their agreed to obligations mentioned in Phase 1 of the trade agreement, and this will need to be watched closely.

The number of dollars that China would have to spend going forward do not appear to be plausible; in the last Financial Quarter they would need to double the largest exports on record for the same time period which previously was $12.4 billion in 2013. Basically, $28.5 billion would need to be spent, a total that former USDA Chief Economist Joe Glauber states, “There’s absolutely zero chance” and “They’re just so far behind”. We are only about 38% of the pace set in the trade deal. What this means for tensions between our two nations remains to be determined.

As with all numbers, forecasts, estimates, and opinions, they are subject to change based upon what is witnessed going forward.

Be prepared, avoid prediction, and utilize protection that allows flexibility in your operation. There are several chapters yet to be written in the already very long and what feels like an arduous book called “The year that was 2020.”

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like