Think differentIllinois grower/grain market analyst Jason Moss is always looking for marketing opportunities. He strives to make early marketing decisions based on early USDA and foreign-crop reports. Unlike recent years, where 25¢ price shifts were the normal, he pays more attention to 5¢ market moves, knowing that profit margins will likely be tighter than ever.

January 30, 2014

Considering where corn was not that long ago, Jason Moss frowns at prices on the futures market and at his local elevator. And he’s thankful he got about 40% of his expected crop booked early at near $5.50 per bushel when demand was still high, supply was low and markets were hot.

Moss, a Quincy, Ill., grower/grain market analyst, is among few who are very excited about corn or soybean prices in early 2014. Gone are $7 corn and $15 beans. Taking time to revisit pricing programs offered by your local elevator, ethanol plant or other grain user may yield a positive return.

“If you can get some priced, you might want to take advantage of the market,” says Perry Broders, a grain merchandiser for AGP in Lincoln, Neb. “With the large corn carryover, if we have any sign of decent crop, there will definitely be pressure on the cash price.”

Kyle Lehman, grain merchandiser for Farmers Cooperative Co. in Ames, Iowa, adds that farmers will likely look closer at marketing tools available from grain handling co-ops and private companies. “We offer various types of contracts on our website and at regional offices,” he says. “We give farmers a market rundown and list marketing possibilities they may consider, such at hedge-to-arrive, basis, minimum price or other contracts they may consider.”

Moss is looking at potential marketing opportunities for his 2,000 acres of corn in west-central Illinois. He was 100% corn in 2013 and plans on continuous corn again this year. “I’m 40% sold already,” he says, adding that he figured pricing at near $6 would generate a solid profit, even if price one-two years ahead.

“In August 2012, I used December 2014 corn futures to market about 20% of my ’14 crop. I marketed another 20% in May of 2013. The contracts are at $5.80-$6.10.”

He admits that profit from the remaining portion of his unsold crop won’t be as easy. “In the past two years we’ve debated on 25¢ moves in the market,” he says. “Now we fighting for nickel moves.”

Moss’ second role is that of a market analyst for Brock Associates. He often offers farmers the same advice he uses to make sales. And with about 60% of his anticipated crop still unsold, he is looking for upward price shifts to market more.

“Based on cost of production numbers, selling corn anywhere in the upper half of the $4s should be profitable with an average yield,” he says. “We can’t just wait on $5 corn again.

Minimum price contract

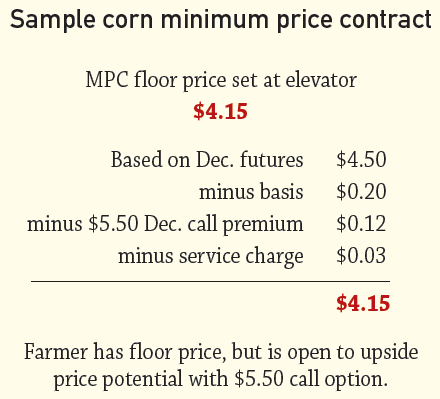

Most simple elevator contracting programs operate similarly to the Minimum Price Contract (MPC). Lehman says the Farmers Cooperative MPC enables a farmer to set floor price, but permits participation in a rally through a call option. The delivery period, quantity and minimum price are established in the contract. The minimum price is simply determined by taking the cash or forward contract price and subtracting the premium and service charge. The title to the grain passes to the buyer upon delivery.

As an example, a grower wants a floor price, but also the opportunity to capitalize on price increases should planting problems or a drought scare occur. He could set MPC floor, based on CBOT December 2014 corn futures at, say, $4.50 and a 20-cents-under basis, putting the MPC at $4.30, or the current local bid.

In addition, he would buy a December call with about a $5.50 strike price for a cost of about 12 cents per bushel (based on late December 2013 options premiums). The MPC is then about $4.15 ($4.30 minus the 12-cent options premium and about a 3 cents elevator service charge. (Remember, these are price examples and will vary depending on current price ranges.)

There is a floor price of about $4.15. But the farmer can also benefit from price rallies.

Farmer advantages

Lehman says that the MPC eliminates the risk of price decline for both basis and futures, while not restricting upside futures potential. Also, the minimum price is guaranteed and paid in full upon delivery. No up-front charges, fees or margin money are required, and it may cost less than commercial storage rates.

Broders says that MPCs or other elevator contracts can be just as efficient for soybeans. “We have guys doing straight cash contracts, basis contracts or futures contracts,” he says. “A fair number of guys have priced 10% of their soybean production at near $11. We expect to see more of these moves using a variety of contracts.”

Moss says even with pressure from the 2013 crop, price rallies can’t be ruled out. “The large 2013 crop is dog wagging the ‘14s tail,” Moss says. “For sales on the first 20% of the crop, I wouldn’t be overly selective.

“Everyone wants corn to start with a $5 corn and $12 on the beans. It’s way to early to rule those out. So I don’t think there’s reason to move on more than 20% in the near term.

“I frame my marketing decisions on what’s the most objective percent I would like sold when early crop reports come in. I wouldn’t choose to market a lot of corn or beans right now, but I wouldn’t want to be 0% sold.”

About the Author(s)

You May Also Like