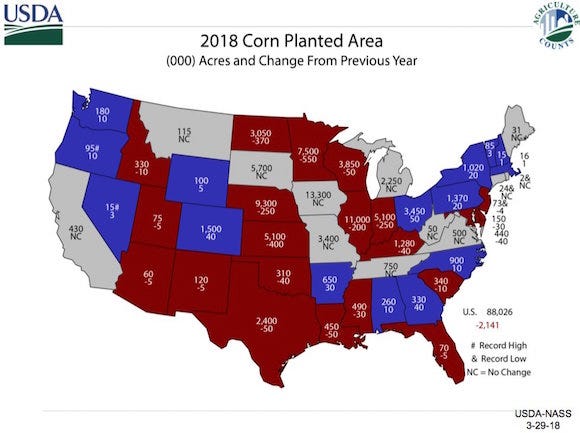

CORN

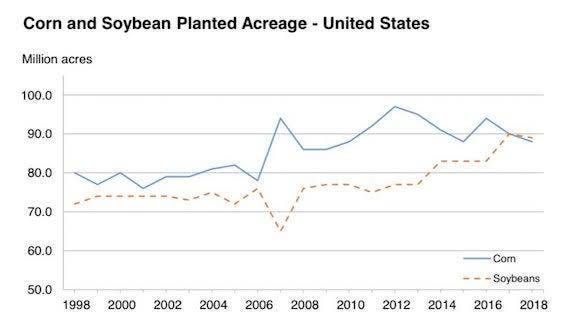

Corn acres reported at just over 88 million vs. the previous estimate of 90 million. March 1 corn stocks reported at a new record of 8.888 billion bushels.

The South American story hasn't changed much as of late. It feels like the Argentine crop has gotten smaller, and could, in fact, fall to sub-30 MMTs on continued lack of rainfall. I'm also still hearing talk that Brazil's second-crop corn acres could disappoint, possibly down -5 to -10 MMTs compared to last year.

Ultimately meaning the USDA's current export estimate for Brazil could be overstated by 3 to 5 MMTs. Meaning perhaps increased export demand for the U.S. I continue to believe strong demand is going to carry this market and help to limit the downside. Weekly ethanol production was a bit lower on the week, but still above 1.0 million barrels per day. Also somewhat bullish is the fact ethanol stocks fell by about -1 million barrels and were down by about -500,000 barrels below last years level.

I have to imagine after we return from the holiday weekend, the trade is going to start paying much more attention to U.S. weather and possibly planting complications. Heavy rains and cool soil temps could provide us with a few bullish headlines...

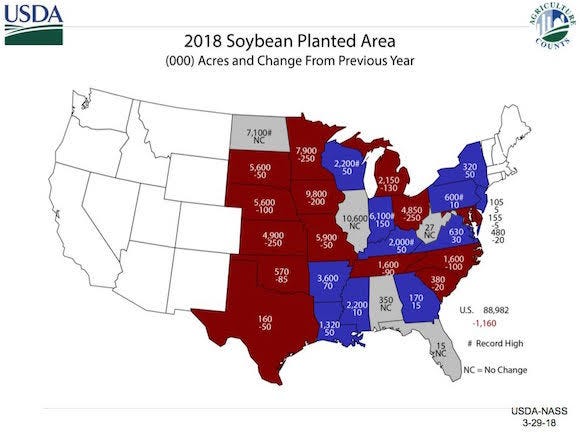

SOYBEANS

Soybean acres reported at just over 88.9 million vs. trade thinking we would be north of 91 million acres. March 1 soybean stocks reported at a new record of 2.107 billion bushels.

As for South America, I continue to hear reports of the Argentine crop getting smaller and the Brazilian crop getting larger. Most inside sources in Brazil see last years production record of 114.6 MMTs as a thing of the past. In return, I continue to hear talk of Brazil exporting an additional +4 to +5 MMTs of soybeans.

I should also note,I'm hearing more talk that workers at Argentine crushing facilities are threatening a labor strike, which could certainly further complicate issues. Get all Van Trump's marketing news here.

About the Author(s)

You May Also Like