This month’s USDA corn outlook calls for reduced imports, greater feed/residual use, considerably lower FSI consumption, and larger stocks.

Feed/residual use was increased 150 million bushels to 5.675 billion. This was partially the result of the March 1 corn stocks report indicating disappearance during the December-February quarter rose about four percent relative to a year ago.

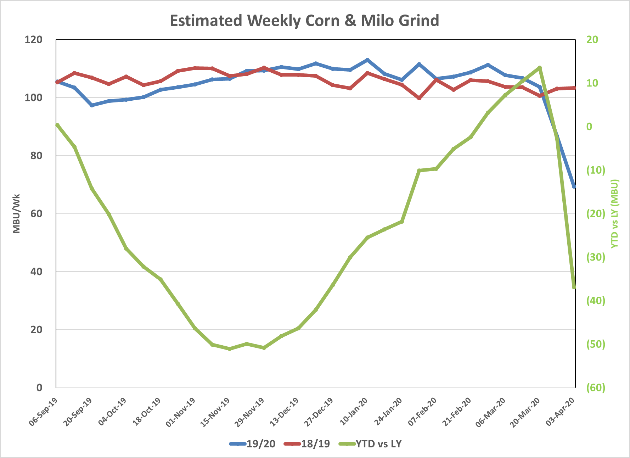

Lower corn use for ethanol also supports larger feed and residual use. Corn used to produce ethanol was lowered 375 million bushels to 5.050 billion based on the latest indications from Energy Information Administration data revealing an unprecedented decline in ethanol production/motor fuel consumption due to the impact of COVID-19.

Demand destruction

Some in the trade were suggesting as demand destruction in the ethanol sector took place, reduced production and consumption of DDGS would impact feed use a little more. This month’s WASDE report revealed a 400 million bu. combined reduction in corn and milo used for ethanol production. Allowing for 40% of DDGs going into the export market, that suggests the feed impact was perhaps 45-50 million bu. understated.

With use declining, ending corn stocks were raised 200 million bushels to 2.092 billion. The season-average marketing weighted corn price received by producers is lowered 20 cents, to $3.60 per bushel.

Export optimism

There may be some optimism on the export front in the future. The latest four-week period has corn sales averaging nearly 56 million bu. per week which is a 2 ½-decade seasonal high. And on a FOB basis, U.S. Gulf corn prices are currently the cheapest among the four major exporters. However, the market is keeping a close eye on the development of Brazil’s safrinha (second corn) crop.

U.S. soybean supply and use changes for 2019/20 included lower exports, seed and residual use, higher crush, and a build in ending stocks. Soybean exports were reduced 50 million due to strong competition from Brazil. Lower seed use reflects plantings for the 2020/21 crop indicated in the March 31 Prospective Plantings report. Residual use is reduced based on indications in the March 31 Grain Stocks report.

Soybean crush is raised on higher soybean meal exports and increased domestic disappearance. Domestic soybean meal use is forecast higher with an expected reduction in the availability of DDGs. With higher crush only partly offsetting lower exports, seed, and residual use, ending stocks were increased by 55 to 480 million bushels.

The season-average soybean price is forecast at $8.65 per bushel, down 5 cents from the March forecast. Also noteworthy in this month’s report is lower global production, exports, and stocks. World production was trimmed 3.7 million tons to 338.1 million as the result of lower expectations for the Argentine and Brazilian crops. The former’s output was lowered 2 million tons to 52 million, reflecting dry conditions in the main growing regions during the latter part of February into early March.

Brazil’s crop is reduced 1.5 million tons to 124.5 million due to dry conditions in Rio Grande do Sul while the crop was in pod-filling and maturation stages.

Global soybean exports are lowered 0.4 million tons to 151.5 million. U.S. and Canadian exports are lowered while Brazil’s shipments are revised up due to a competitive exchange rate and ample exportable supplies.

China’s imports are raised 1 million tons to 89 million, reflecting higher Brazilian shipments. Global soybean ending stocks are 2.0 million tons lower than last month as lower stocks in Brazil are partly offset with higher U.S. and Chinese stocks. The USDA’s 1.775 billion bu. export forecast for the U.S. needs to be closely monitored. Unshipped sales are woefully low and down 314 million bu. (63%) year to year at the same time exports for the remainder of the year are expected to be just 38 million or only 6% less.

The 2019-20 U.S. wheat outlook calls for lower exports, reduced domestic use, and increased ending stocks. The NASS Grain Stocks report from March 31 implied less feed and residual disappearance for both the second and third quarters than previously estimated.

Total 2019/20 feed and residual use is trimmed 15 million bushels to 135 million. Wheat exports are also cut 15 million bushels to 985 million as the pace of shipments slows and the fact U.S. prices have become uncompetitive in many international import markets.

By class, Hard Red Winter and Soft Red Winter are reduced 10 million and 5 million bushels, respectively. The changes result in a 30 million bushel increase in estimated all wheat ending stocks to 970 million. Despite the larger ending stocks, the projected season-average farm price is raised $0.05 per bushel to $4.60 on updated NASS data as well as surging nearby cash and futures prices, partially resulting from the global COVID19 pandemic.

Advance Trading

Contact ATI at

800-664-2321

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

Covid 19About the Author(s)

You May Also Like