USDA’s surprising planting intentions released March 31 captured plenty of headlines – not to mention limit up moves in corn and soybean futures -- overshadowing quarterly grain stocks out the same day. But old crop inventories halfway through the marketing year underscored questions about how much will be left over before the 2021 harvest begins, increasing uncertainty over the impact of the acreage shock.

Numerical noise

These quarterly inventories always contain numerical noise. They’re based on surveys of farmers and commercial merchants, so statistical error is virtually built into the numbers. But the latest report included revisions to the previous tally of Dec. 1 stocks.

Updated data apparently caused the changes, highlighting the difficulty of gathering information during a pandemic. These aren’t the only USDA numbers seeing revisions; export inspections over the winter also included at times significant changes to previous reports. Collecting data is hard enough in normal times, but the task becomes exponentially more challenging when employees miss work or facilities close altogether.

So, USDA started the day by revising its Dec. 1 estimates, knocking 30 million bushels off its previous corn number while adding 14 million bushels to soybeans.

Usually this type of error gets adjusted in USDA’s murky “residual use” category. This bucket likely will see changes when USDA updates its supply and demand estimates April 9.

For corn, residual use also includes grain fed to livestock. The amount of corn taken by exporters, seed companies and industrial users, like ethanol plants, is fairly well known. So the rest of the corn that “disappears” from quarter to quarter is assumed to have walked off the farm.

USDA last month estimated this number at 5.65 billion bushels. But after strong first quarter feeding, the total for the first half of the marketing year likely already amounts to 77% of USDA’s forecast for the entire crop year. Normally, about 68% of what’s fed is done in the first two quarters. This suggests USDA’s forecast is too low unless higher prices are effective in rationing demand.

Exports question mark

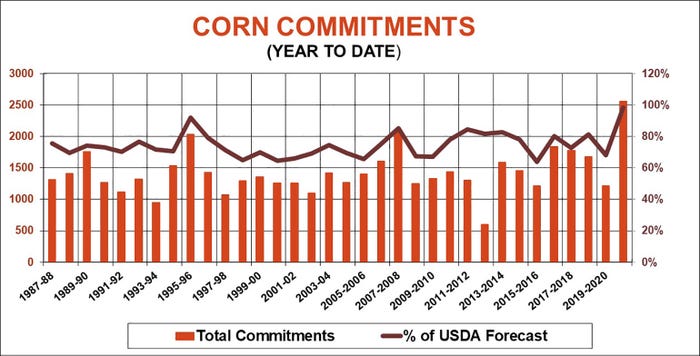

Exports are another question mark. Shipments to date have been a little slow because exporters were racing to move a mountain of soybeans. But the total of corn shipments coupled with outstanding sales is running at a record pace, amounting to 99% of the government forecast for the entire marketing year. China, normally only a small buyer at best, accounts for 35% of total exports, pushing aside Mexico as the leading destination for U.S. corn. So, without a lot of cancellations, total exports could be even greater than the record USDA forecasts. Ethanol demand could be more than estimated too.

Residual usage for soybeans is also uncertain. However, at current rates for exports and crush, it appears residual usage would have to be negative to keep stocks from tightening too much. While negative use sounds like an oxymoron, it has happened before. This year it could also be a tip off that the 2020 crop was bigger than estimated in January.

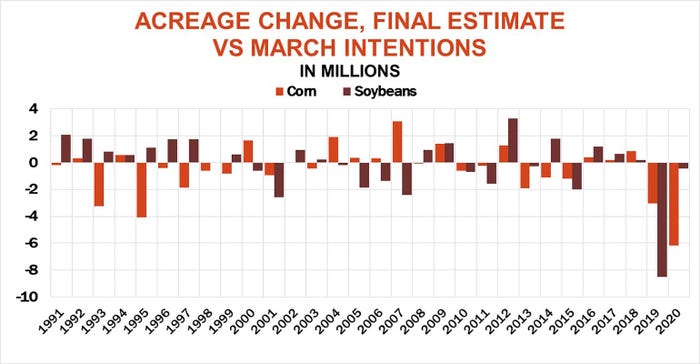

USDA’s next monthly supply and demand report will deal only with old crop. But traders likely will continue to focus on planting intentions, especially for soybeans. USDA put soybean intentions at 87.6 million, 4.4 million less than the number in the trade. Corn intentions also fell a million bushels or more short of expected at 91.1 million.

December corn gained 35 cents in the wake of the report, while November soybeans jumped 77 cents. That’s a start, but history says it’s not enough to get back all the acres that didn’t show up in USDA’s estimates, especially for soybeans.

One reason? Price gains alone in April and May aren’t the only factor influencing acreage gains. The pace of planting is more important for both corn and soybeans. The faster farmers plant crops, the more likely they are to keep going and add acres.

The historically slow year of 2019 – compounded by the China trade war -- caused both corn and soybean acres to plummet. Last year the pandemic derailed what first looked like a surge in corn ground.

Still, if farmers match their record corn pace, getting 96% of that ground planted by the third week of May, it increases chances they wind up putting in the 92 million acres USDA first forecast for 2021 last winter. If farmers match their average rate of 80%, futures must rally another 40 cents a bushel could add back the “lost” ground.

The bar is higher for soybeans. With the rally to date, farmers would have to plant around 79% of their acres by the fourth week in May, 21% more than average. With only average planting speed, futures must rally another $1.12 a bushel to convince farmers to get total soybean acres to 90 million.

In addition to weather, inputs could be another limiting factor influence acreage gains. Even if seed is available, fertilizer may not be in some locations due to tight supplies and weather disruptions.

All the unknowns should keep the market simmering this spring, and perhaps longer.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like