After a tumultuous year of weather and trade uncertainties, grain markets start 2020 looking for clarity. History suggests USDA’s blizzard of Jan. 10 reports could set the tone for prices for the rest of the winter into spring.

Both corn and soybean futures have a tendency to confirm seasonal trends in the wake of the reports. Ability to take out fall highs can set markets on a bullish path that can last well into spring, and sometimes longer. But markets that break through December lows can wind up locked in a bearish trend, struggling just to get back to January levels. Here are keys to watch:

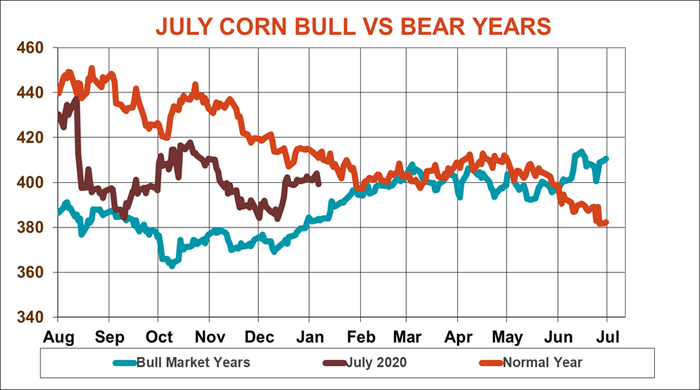

Corn faces biggest. The July futures chart shows a pattern of lower highs in August, October and December, with the market struggling to hold fall lows in December. That doesn’t mean prices can’t break that pattern; since 1974 futures ended January higher 56% of the time.

Cash corn prices also rally more years than they drop by a similar percentage, ending around 14 cents higher one week after the USDA data dump.

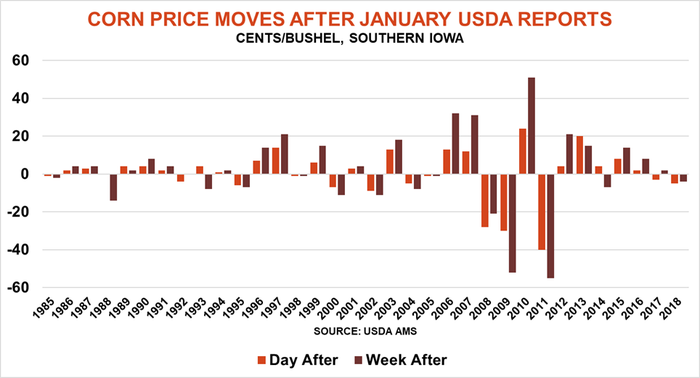

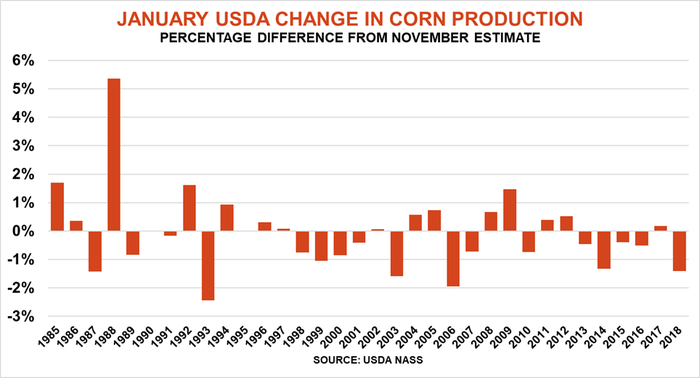

Smaller crop could trigger rally. A reduction in the size of the 2019 corn crop seems like the natural spark for a turn higher, if it comes. Only 48% of North Dakota corn fields were harvested in December with some still standing in other northern states. That increases potential for the final estimate to be lower than USDA’s last number put out in November. Changes in production historically are associated with market moves in the wake of the January reports.

Harvest delays don’t guarantee a cut in production. Statistically speaking, slow harvests are correlated with an increase in the size of the crop in January, compared to USDA’s previous guess. While weather caused delays for the 2019 harvest, big crops also take longer to bring in. Since 1965, USDA cut its estimate of total corn production in January only 44% of the time.

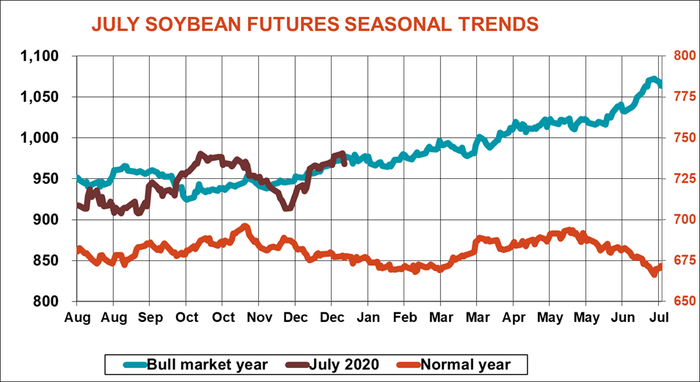

Soybean chart looks promising. Soybeans come into the Jan. 10 reports with a more positive trend on the July chart. Fall highs exceeded those from the summer, and the market nearly made a new top to start 2020 after conclusion of the first phase of a trade deal with China. A move above the October high of $9.855 would set futures on the bullish trend. In bullish years July futures on average keep moving higher into June.

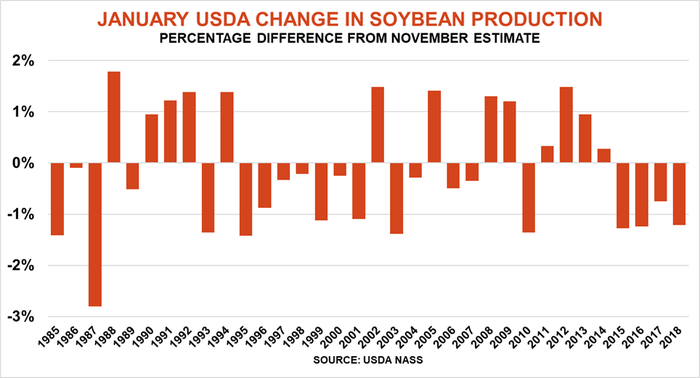

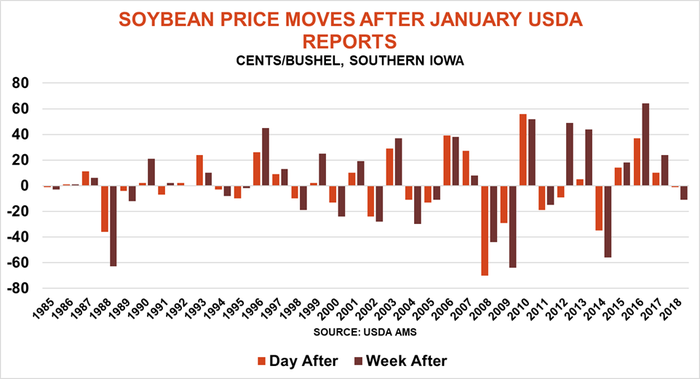

Rally not a sure bet. Historically, bullish soybean years are anything but a sure bet. Both cash and futures post gains around 56% of the time in the week after the report. But futures tend to be choppy in February, even in what turn out to be bullish years. In years with a bearish trend, December highs fall below those from earlier in the fall, sending prices into a grind lower through February and the teeth of the Brazilian harvest.

Surprise less likely. In addition to the onset of the South American harvest, prices tend to be sluggish after the report because it’s harder for the market to be surprised. This year, as is normal, there’s less uncertainty about soybean production because harvest was farther along in November. Still, price moves after the report typically depend on changes in production, and the number of years with smaller crops outnumbers those with increases.

Watch the close. Higher Southern Iowa cash prices on report day are a sign of things to come. In the 17 years since 1985 that soybeans were higher on report day, they were still higher a week later 16 times. For corn, 18 of the 20 years with report day gains also found prices higher a week later. Use this link to check on the Iowa price trend.

About the Author(s)

You May Also Like