Corn prices have rebounded a bit this morning but are still now down about 30¢ in just the past seven sessions. Traders are not only chewing on U.S. trade uncertainties but also more talk about a U.S. crop that's supposedly in very-good condition.

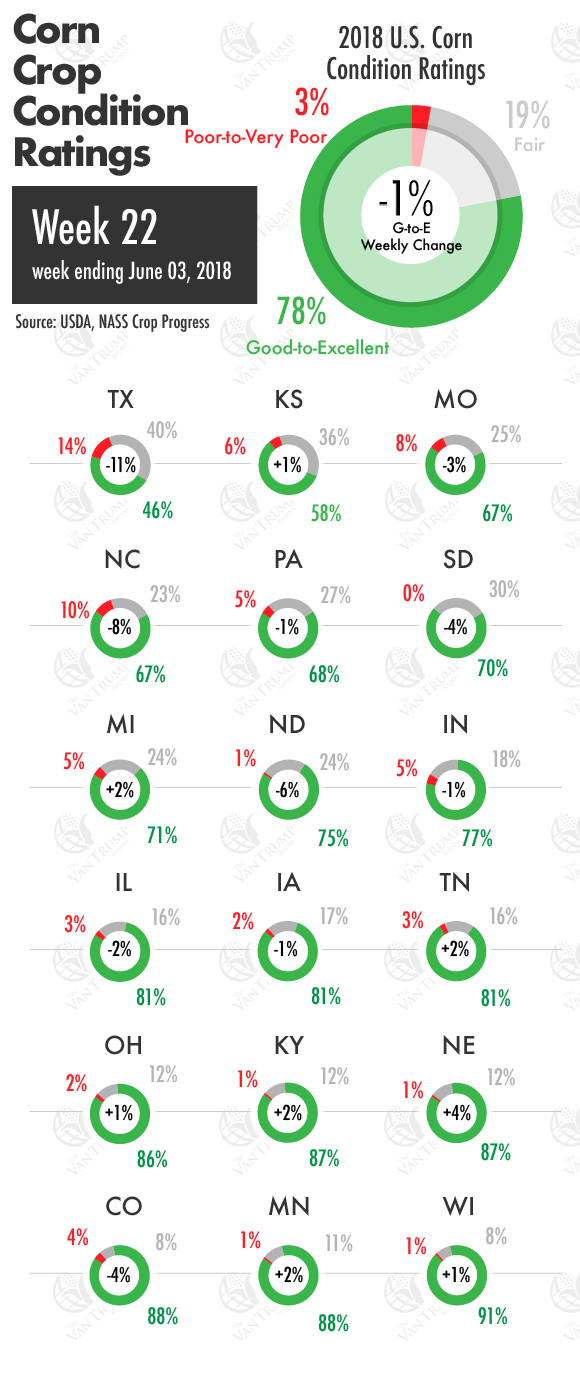

The USDA's most recent data showed 97% of the crop planted vs. the 5-year average of 95%. I suspect, if you wanted to argue planting delays, Michigan and Pennsylvania are probably your only legit arguments or areas of concern. The USDA reported 86% of the U.S. corn crop as emerged vs. 84% last year vs. the 5-year average of 83%.

The bulls are also a bit uncertain about Washington's outlook on ethanol. There's talk that the industry might soon be allowed to count ethanol exports toward federal biofuels usage quotas. This has driven RIN prices to multi-year lows and have many insiders thinking it could ultimately provide the fuel industry with a way around the annual EPA mandate. As a give-and-take, there's talk that Washington will lift restrictions on selling E15 blended gasoline in the summer, which has been long sought by the corn lobby because it should help expand the market.

Well-respected ag Senator Charles Grassley, an Iowa Republican and biofuels advocate, said in a recent statement that allowing exports of biofuels to count toward mandates "exposes the U.S. to trade cases and retaliation from countries like Canada and others." He added that allowing the sale of E15 "isn’t anywhere near enough to offset the impact” of the ethanol export credits. "I’m not convinced this is a win-win."

I suspect this might have spooked some of the bulls, at least until they learn more about the details and how it will impact longer-term demand. As of right now everyone is just guessing.

Weather here in the U.S. doesn't really seem to be causing any wide-spread concerns. There's going to be some extreme heat nearby, but over the next couple of weeks things don't appear all that bad. So, the trade doesn’t want to add much weather risk premium at the moment. At the same time, the bullish technical picture on the charts has been massively beaten up. I suspect there's still some room to the downside nearby. Longer-term, I remain optimistic.

States showing improved crop conditions include: South Carolina +18%; Alabama 8%; Arkansas 6%; Nebraska 4%; Oklahoma 3%; Kentucky, Michigan, Mississippi, Minnesota and Tennessee 2%; Ohio and Wisconsin 1%.

About the Author(s)

You May Also Like