Adverse August weather in the Midwest appears to have taken a toll on 2020 production, potentially cutting as much as a billion bushels off this year’s corn and soybean crops.

While the true toll from drought and the Aug. 10 derecho windstorm may not be known for months, USDA could make significant cuts in its next monthly estimates Sept. 11. Preliminary August weather data, as well as plunging crop conditions, point to crops smaller than the bin busters forecast by the agency last month.

Lower production should support basis in the cash market this fall. But with large supplies still left over from the 2019 harvest, it may be too late in the growing season to produce major rallies, leaving the fate of prices dependent on how demand develops in coming months.

USDA Aug. 12 put the corn crop at 15.278 billion bushels, estimating farmers would bring in 4.425 billion bushels of soybeans. Those guesses were made from grower surveys before hurricane-force winds flattened fields. The September estimates will feature the first data from actual field samples, as well as an update on possible acreage losses from growers affected by the windstorm.

Here’s what the evidence says now about production as fall begins.

For corn, weekly crop ratings are off 6% over the past month. USDA’s August yield came in at 181.2 bushels per acre nationwide. The drop in conditions suggests yields could be as low as 172.9 bpa. Vegetation Health Index maps prepared by satellites also are down, but not by as much, with the current reading from this metric translating to a yield of 175.8 bpa, a measure likely to decline further.

It’s always hard to tell how much sharp declines in ratings reflect lost acreage or lower yields. But assuming no change in harvested acres, a yield of 172.9 bpa would generate a crop of 14.522 billion bushels, some 725 million less that USDA printed for August.

Not all that loss would trickle down to ending stocks, the bottom line of supply and demand estimates. Projected carryout a year from now would still likely be well above 2 billion bushels. Under current market dynamics, nearby futures over the next 12 months might average $3.70 bushel, giving producers a shot at selling $4 corn on the board at some point. December futures hit $3.6425 on this week’s rally before backing off; the July 2021 contract topped at $3.8325.

Soybeans could yield even bigger surprises. Nationwide ratings are down 4% over the past month. USDA’s August yield came in at a whopping 53.4 bpa, but the condition slippage points to a yield around 51.7 bpa. And other tools are lower yet.

August weather in key Midwest growing states historically has proven crucial for soybean yields. Average temperatures were only slightly warmer than normal, but rainfall fell 25% short of average overall. A weather model that includes July conditions, too, puts the yield down to 50 bpa. The Vegetation Health Index for soybeans last week was at 50.7 bpa, with a mash-up of various factors a tenth of a bushel lower than that. With steady acreage, that would generate a crop of 4.19 billion bushels, 235 million less than USDA’s August number.

Even if demand drops due to higher prices and lower supplies, projected soybean carryout on Aug. 31, 2021 could slip below 500 million bushels. Strong Chinese buying, and perhaps a weather threat in South America, could produce rallies from $10 to $10.75 potentially. November futures peaked this week at $9.6675.

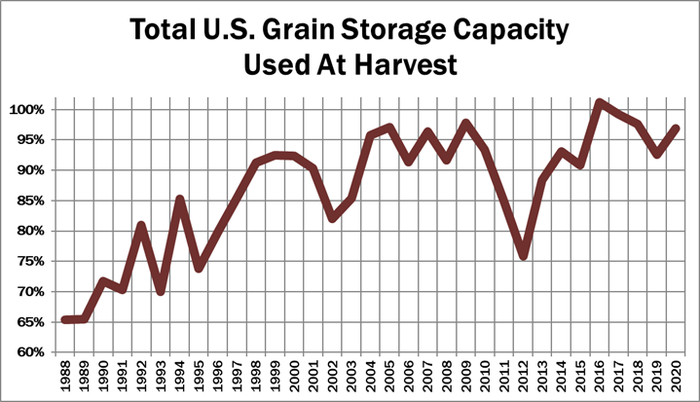

These lower production estimates, if realized, should help alleviate some of the storage shortages that loomed just a month ago. Now production of fall crops, added to existing inventories looks like it could fill 97% of the nation’s storage capacity, depending on how many bins were destroyed by the derecho. That would be tighter than occurred after last year’s floods, but would be the lowest percentage of capacity used otherwise since 2015.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like