Timing, they say, is everything. And nobody does a better job of illustrating this than my friends May Sellers and Hank Holder.

It’s late April, and your mind is focused on planting the 2015 crop of corn and soybeans. But I want you to think about last year’s crop. Like May and Hank, you probably still hold a healthy chunk of your 2014 harvest in storage on your farm. The question for everyone with grain in storage is, “When should I sell?” Let me introduce May and Hank, and let’s see if they can help us answer the question.

May Sellers has on-farm storage. Every year she holds her corn and soybeans in the bin to sell in late spring. Her price is the cash price in the last week of May, less storage costs. Like May, Hank Holder also holds his corn and soybeans in the bin after harvest. But Hank is a perennial bull, always convinced that prices are about to surge higher. Because he only has enough storage for one crop, each year he is forced to sell last years’ crop right before harvest, to make room for the new crop. Hank’s price is the following harvest price, less storage costs.

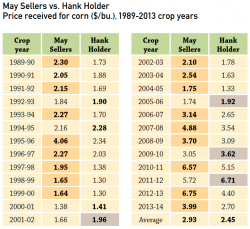

It should be clear that May and Hank are doing the exact same thing at harvest – they store their harvest in on-farm storage. The difference is when they choose to sell. May sells in late spring, a time when cash corn and soybean prices are, on average, at a seasonal high. Hanks waits too long – 19 weeks and an entire growing season – and that decision has cost him nearly 50 cents per bushel over the past 25 years (see accompanying table).

May’s price for corn is better than Hank’s in 18 of 25 years (72%). Even more compelling is her margin of victory. In 17 of these 18 years, her price was greater than Hank’s by 10% or more (see years highlighted in yellow). Hank has his moments, and his price was better than May’s in 7 years (28%). In 4 of these 7 years, his margin of victory over May was 10% or more (see years highlighted in pink).

Are you thinking that Hank’s luck improves with soybeans? Think again. May’s price for beats Hank by an even wider margin in soybeans, and more often.

If you hold grain into the summer months hoping for a weather driven rally in prices, may I suggest selling your grain earlier and selectively re-owing the sale with the purchase of call options. But, you say, options cost money! Hank Holder makes a persuasive case that, more often than not, grain in the bin also costs money.

Now about your 2014 crop in storage. Timing is everything. Will you be May or Hank this year?

About the Author(s)

You May Also Like