There’s an old saying, “Bears get Thanksgiving and Bulls get Christmas” in the industry. With the volatility we have seen in 2022, I'm not confident the bulls can count on a Christmas run, but the odds are high how market volatility seen over the past year will continue. That’s why it’s also important to remember this saying too – “The market doesn’t owe you a profit.”

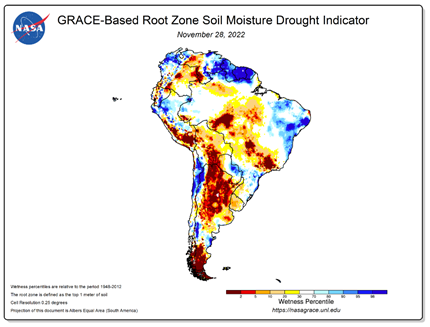

The driving force behind this week's soybean volatility is South American weather. Hot, dry weather has the trade debating how much production loss is happening in Argentina. Soymeal futures have surged to contract highs this week because of threatening dryness concerns.

USDA currently estimates the Argentina soybean crop at 49 million metric tons. Private estimates out of Argentina put the crop size as low as 42 million metric tons due to drought. To put this in perspective, the last major drought which impacted Argentina was back in the 2017/18 production year (when production fell to 37.8 million metric tons). If Argentina's output falls to these levels, we anticipate an increase in U.S. soymeal exports as Argentina is a significant player in the world's soy meal market. The country made up approximately 40% of world trade in the past few years.

It's not all bullish news coming out of South America as the weather in Brazil generally has been considered friendly. There’s talk their crop could be a record. The current crop, the estimate from the USDA, is 152 million metric tons. If the crop is this big, the odds are high US exports are overstated by a minimum of 25 to 50 million bushels. This estimate could be understated if China chooses to cancel some other purchases, switch them to South America and especially them to a a Brazilian order origin (like they are known to do).

Remember, we are still in a trade war with China. The trade war encompassed the United States placing duties on China’s exports to the U.S. and China placing a tariff on our exports to them. Recently, President Biden ramped up the trade war by blocking the sale of advanced computer chip technology to Chinese companies. We have not seen China retaliate due to this action but I believe they will.

When the trade war began in 2018, China shunned U.S. soybean purchases to retaliate against the the U.S., and they may do so again in 2022/23 if they believe Brazil can meet their import needs. I know they have been buying beans recently. Yet, these purchases could be hedging their supply needs until they see the Brazil crop is made; then, we get the dreaded “China Cancels” in the headlines.

The question is, will the potential increase in meal demand from international buyers due to Argentina’s drought offset the lack of Chinese exports? If this doesn't happen, The U.S. carryout will increase, likely driving prices lower.

Like the beans, the corn market is getting mixed signals out of South America. The drought in Argentina has traders thinking production could fall by 52 million metric tonnes. USDA currently estimates the crop at 55 million metric tons. In late November, The Rosario Grain Exchange reported the crop could fall as low as 41.9 million metric tons if the drought extends into next year. If this were to happen, we would look for the U.S. to pick up on the lost Argentina corn exports. Offsetting this potently bullish news is how China is importing Brazilian corn for the first time ever. It is reported four vessels have already left Brazilian ports for China carrying 280,000 tons of corn. Five more shipments are expected to leave any day now. Estimates are that up to 1,000,000 metric tons of corn could be on its way from Brazil to China.

China is importing Brazilian corn due to the lack of ability of corn out of Ukraine. The grain corridor out of Ukraine is open, but the backlog of ships is hampering the ability to move grain out of the country efficiently. Current estimates are over 90 ships are waiting to be inspected and the backlog is estimated at two-plus weeks.

The other thing the trade needs to consider is if Ukraine is able to exports what the world thinks it can.

Up to 60% of the corn crop is still in the field. So, that that field losses will be high. Then on top of this, Putin has gone to war with the Ukrainian people and is destroying their infrastructure. Without infrastructure and road/power, it will be hard to hit Ukraine's export objectives.

If the bearish scenarios mentioned above come to fruition, price action will potentially be negative for some time. To mitigate this downward price risk for unsold bushels, consider buying puts to protect unsold inventory. Also, we are recommending starting to look at ways to protect next year’s crop as well.

Because, it’s good to remember: the market doesn't owe you a profit.

If you have questions or want specific hedge ideas, don't hesitate to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

Reach Jim at 815-665-0461, [email protected] or on Twitter: @jpmccormick3.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like