This market business is a sinister business that thrives on deceptions. Whether these are orchestrated deceptions or internal deceptions that we bring upon ourselves, I will let you come to your own conclusions. When viewed through the lens of 2020 hindsight, deceptions emerge. The problem is that most are unwilling to offer an honest assessment of what was thought in real-time. Rather, we tend to forget the impact on us of the emotions we were actually experiencing at that time. For that reason, we all miss opportunities to learn and grow from our experiences. And, this is true about not just markets, but life in general. With that spirit, I offer some perspectives on this week’s coronavirus storyline and the associated emotions.

After several weeks of very narrow trading ranges, we did end up with the mini-flush event in corn. In the case of soybeans, this week’s downside probe was nothing more than a head-fake trade. Because of this viewpoint, I am not concerned about this week’s weakness becoming a protracted decline. Current weakness is only temporary, it will not be the dominant theme of the next several weeks.

Quite the contrary, we are rapidly completing whatever bearish pressures will be associated with the liquidation of the March contracts. It is interesting to note that in Monday’s trade, the day’s low for corn and soybeans were both established just minutes into the 8:30 opening. I see no short or longer-term technical needs for spending any material amount of time down here.

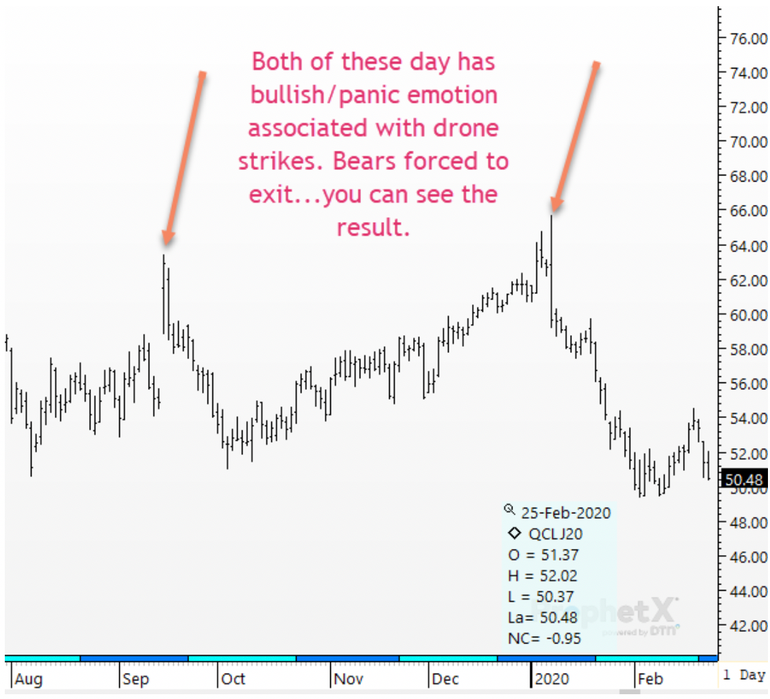

The emotional panic atmosphere experienced Monday, especially when combined with other elements that are trying to force liquidation - rolling or pricing of basis contracts and general activity associated with 1st-Notice Day antics - these circumstances tend to create major market turns. Below I will draw your attention to two recent events in crude oil. I can assure you that it would not take long to find multiple such events in the not too distant past for grains as well.

I have been in this business 40+ years and there is no doubt in my mind that this type of set-up has been occurring much more frequently in the past several years than in the first two thirds of my experience window. It is almost as if this type of action accompanies nearly every major top/bottom and as if it has become a frequent part of today's markets' playbooks.

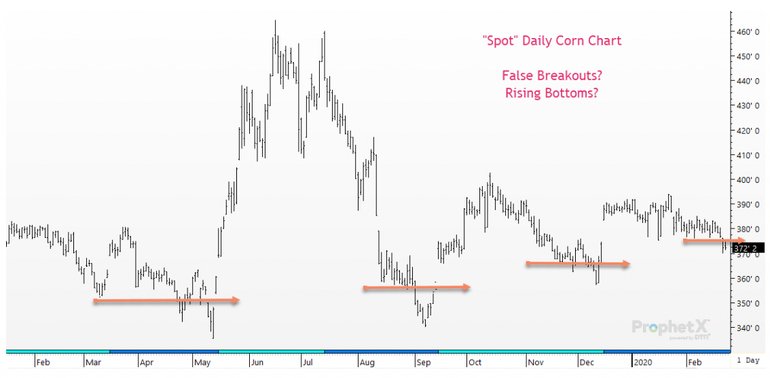

Now, I want to address the head-fake portion of my above discussion. Below is a “spot” daily corn chart. Here we find three distinct head-fake moves that preceded notable price swings. I suggest to you that this week’s panic phase is likely to prove to be the fourth distinct head-fake move to unfold on this chart.

Final Thoughts

I will conclude with some simple summaries:

Markets don't work in a manner that everyone is correct all the time.

Markets don't trend in a manner that everyone has the correct position.

Right now, the entire grain trade is extremely discouraged, bearish, without hope and either short or have already made up their mind that they will be short on a small rally. Some arrived at this state of mind during the past several months and some just arrived there this week, or had their previous bearish fears cemented this week. Either way, these factors should cause us to give pause to embracing the current sentiment and atmosphere.

Duane Lowry

Senior Risk Manager and Market Research Director

Silver Creek Commodities

Email= [email protected]

Twitter= @DuaneLowry

Phone/text= 563-419-1300

About the Author(s)

You May Also Like