So, you did not sell the highs; now what do you do? That is the question that many producers are asking themselves. If you are asking yourself this question, it might be a good time to take a break from watching every weather model run and remind yourself where we are and where prices have come from.

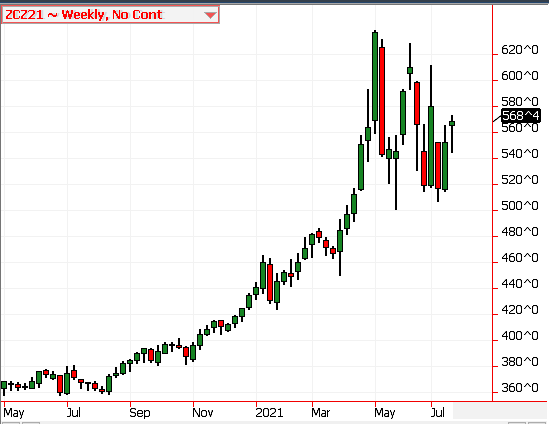

This week last summer, the December 21 corn futures settled at $3.66 ½ cents, and many in the industry were concerned when they might have the opportunity to sell grain above breakeven levels. Well, fast forward a year later, and we are now looking at profitability levels that seemed unthinkable a year ago, even after coming off the summer highs.

With this in mind, we would recommend making sales on moves back toward the summer's highs. In full disclosure, our advice has been to be 50% sold (our average is around $5.00) of expected bushels with calls bought against it (so our net should be higher than $5.00). AND we still have 50% of our crop to market into spring acreage battles.

Zooming in on the market's recent trading ranges, the market has moved into a sideways pattern caped at what looks like the summer high of $6.38, with support at the summer low of $5. 00 ¼. If weather is conducive for a near-trend yield, then we would expect the market to remain in a sideways pattern through the fall. To take advantage of this, you might consider selling a straddle.

We recommend considering selling the Dec '21 Corn 550 straddle. The entry target would be to collect roughly 88 cents on the trade. When you sell a straddle, you sell both the put and a call at the same strike and are collecting the premium. (There is margin call risk when you sell a straddle. ) Selling the Dec '21 Corn 550 straddle for 88 cents gives you a $6.38 upside breakeven ($5.50 plus the 88 cents collected), while the downside breakeven would be $4.62 ($5.50 minus the 88 cents collected).

At expiration, the closer to $5.50, the better the profit potential of this trade. On option expiration day, our profit for the trade would be the 88 cents we collected minus the difference between $5.50 and the futures price on the expiration day. For example, at $5.75, the gross profit is $0.88-$0.25, or $0.63. At $5.00, the profit is $0.88-$0.50, or $0.33.

The risk of losing money on the position will be if the December futures are above $6.38 or below $4.62 at option expiration on November 26. If the market happens to be above the upper breakeven point, you would be net short Dec '20 Corn at $6.38, which you could use as a sale for the current marketing year. Which also happened to be right at this summer's contract high. If the market has broken below the lower breakeven level, you would be net long December corn at $4.62.

We view this as an acceptable place to risk reownership since this price level is 37 ½ cents below the current summer low. We believe that the US balance sheet will tighten as the US adjusts for the lost Brazil production even if we manage to produce a trend yield crop, making this an excellent place to own grain. Read last week's blog posting to read more about how slight adjustments in yield can significantly impact this supply. (Insert a link to last week’s blog)

As always, feel free to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT. We are here to help.

About the Author(s)

You May Also Like