March 19, 2015

With USDA projecting an average corn price of $3.50 to $3.60 and soybeans at $9, these times require risk management survivalist mode.

“Hopefully, these numbers are below what we will actually see,” says Chris Hurt, Purdue University ag economist. “Soybeans at $9 is pretty realistic, but I feel the $3.50 corn is too low. I feel $4 or the low $4 range is more accurate.”

Dan O’Brien, Kansas State University Extension grain marketing economist, says the foreign crop production, U.S. weather during planting, the U.S. dollar and other factors may impact prices at any time.

“There’s a short list of things we’re watching that could affect the markets, either way,” O’Brien says. “One involves Ukraine, which in the top five (countries) sellers of corn. That crop is projected below normal. If they are unable to deliver, that’s a factor that could affect things.”

The projected prices from USDA, as well as the Revenue Protection insurance rates don’t lend much hope to a big marketing year. The RP corn price is $4.15, the average December 2015 futures price during February. The RP soybean price is $9.73, the average November 2015 soybean futures price during February.

“None of those numbers offer a profit. We need to think about a risk management plan that is not a thriving plan, but a surviving plan. Make sure you try to cover your basic costs. Make sure you can farm another year.”

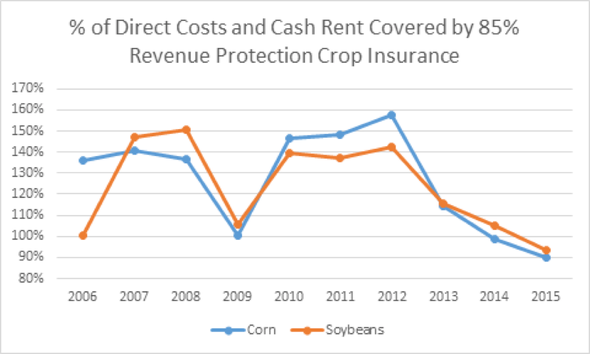

Hurt adds that RP insurance should be viewed as “wreck” coverage, not cost coverage. “Crop insurance doesn’t do a good job of covering cash costs of production (see chart),” he says. “When prices are high, insurance does a good job. But this year is one of the worst in the past 10 years for crop insurance to at least cover cash cost of production. RP is not a strong risk management solution.”

Revenue Protection insurance, even at 85% coverage, doesn’t cover cash costs at the spring price level, according to Chris Hurt, Purdue ag economist. “When crop prices were high, insurance was protecting positive margins above cash costs,” he says. “For 2015, insurance does not even protect cash costs. This makes a much different environment for marketing.” Courtesy: Purdue Extension Ag Economics

Be ready for spring rallies

There’s no guarantee rallies will happen, or they won’t. However, historic patterns show a seasonal trend upward in spring for corn and soybean prices. This could provide a chance to capitalize on market rallies.

“Look for opportunities to get some sales made during the traditional spring pricing window of mid-March through mid-May,” Hurt says. “Try to get 25 to 35% of your expected production marketed in that pricing window.

“Also, some are looking at purchasing out-of-the-money call options in the event we get a price explosion to the upside, caused by a more limited crop due to weather or other situations.”

Hurt says one strategy would be to buy calls to cover about 20% of expected production. In early March, December corn futures were trading at about $4.15. Cost of a $4.60 to $4.70 out-of-the-money December call was about 20 cents per bushel. If the price rallied big time during a weather scare – something not uncommon during this age of volatility – the value of the options would increase, along with the price for corn.

“With the calls in place, they could sell 45% to 55% in the spring pricing window and already have upside price protection in place on the 20%.” Hurt says, adding that this still leaves much of the crop still open for further upside potential.

Hurt sees a better chance for higher corn prices than for soybeans, saying last year’s massive national average corn yield of 171 bushels+ will be hard to live up to in 2015, and acreage will likely be down as well.

“When we look at yield variability, my sense is we have extremely high yield variability in corn,” Hurt says. “Corn is not adapted to take a lot of stress, like at pollination if it’s hot and dry. We could see a yield that is 10 bushels below trend or certainly below last year. That could cause substantial increases in prices.”

O’Brien notes that “glut selling” at the first sign of a rally could cause problems. “The biggest issue to watch for in the cash market is how much corn will need to come out of storage and move into market channels this spring when prices warm up,” he says. “If a person has been following that track, there’s a price risk to that. They could find themselves along with the rest of the herd trying to find a decent price.”

O’Brien says 2014 saw prices begin to drop earlier than usual. “Typically we can expect prices to remain seasonally stronger through mid-June up to July,” he says. “But last year, December 2015 corn futures hit a high of $5.14 on May 9. Then we began a long slide all the way to Oct. 1, to as low as $3.18. That is an issue of concern.

“We hope to maintain stronger new-crop bids through most of planting. If we have a good early planting season and the crop gets off to a good start, we need to be concerned if the price starts to slide too early.”

Should you stretch out sales?

Farmers worried about making substantial sales may consider making small sales over most of the 12-18 month marketing year. “That would at least give you an average price. That’s a simplistic way to go,” O’Brien says. “You would market 7 to 10% per month. With that strategy, you would be about 20 to 30% sold three months in and about 40 to 50% marketed preharvest.”

O’Brien says out-of-the-money options can help capture price spikes after corn or beans have already been contracted at the elevator or other market. “If you see a break in the market, the cost of those options may be cheaper,” he says. “You could take advantage of the lower premium price and capture a surprise increase in prices.”

Rethink all costs

With all the negative aspects of 2015 farming – low crop prices, still high seed, chemical and other input costs and cash rents that don’t pencil out – redefining your cost of production and costs in general may be in order. Hurt encourages farmers to rethink their costs of production and living expenditures.

“Getting realistic is what they have to do,” he says. “Cost doesn’t have much to do with marketing. But we still have record high cost of production. If we can’t get a higher price, we need to get overall costs lower. The margins say someone is going to have to take less.”

Hurt and O’Brien encourage farmers to monitor national and world corn and soybean and other commodity production and usage closely. Many things can impact prices, they say.

“Truck strikes in Brazil and port strikes in the western U.S. have come into play this year,” O’Brien says. “Such things can cause a huge disruption. The increase in value of the U.S. will continue to impact our ability to export grain.

“Also, China’s thirst for non-GMO feed may impact corn acres more than we think. The premium for sorghum being paid by China markets could see more shift in acres in the western Corn Belt.”

Finally, in previous periods of tight margins the government farm program has helped many grain farmers make it through. “The new farm bill is designed to help close the negative margin gap,” Hurt says. “Farmers should carefully study how that can help them survive as they adjust to an era of lower prices.”

About the Author(s)

You May Also Like