May 24, 2018

Live cattle futures contracts have been on a roller coaster ride in 2018. In mid-February, the June contract peaked at $118.825 per cwt. It fell rather precipitously through the first week of April to a low at $99.625. The June contract recovered some to $107.625 by May 11. The April contract showed a similar pattern, with prices eroding in late February and March, then rallying to expire at $123.750.

Corresponding cash markets have maintained relative firmness compared to the sharp declines seen in the April and June futures contracts. Evidence of this is seen in 2018 deviations in basis, the difference between the cash price and the futures price, compared to historic basis norms.

Early in the 2018 live cattle futures slump, basis moves held within historical basis norms. However, as the April futures contract downturn accelerated, the futures skid outpaced the cash market dip. Typically, the Iowa-Minnesota cash market trades at a premium to the April live cattle contract on a weekly basis.

From 2012 to 2016, this positive basis averaged $2.08 per cwt over the futures market in March and April. Last year provided some historically strong basis levels in March and April, averaging $7.41 per cwt and ranging from $1.40 to $12.29 per cwt.

In mid-March this year, basis again significantly strengthened against the April contract, with the Iowa-Minnesota cash market selling in several weeks at more than $5 per cwt, and up to $8.89 per cwt, above the April live cattle contract. As the April futures contract neared expiration, cash and futures prices did converge some, but basis was still stronger than in 2017 and the five-year average before that.

Trading price risk for basis risk

Will a super strong basis occur again in 2019? It’s way too early to even guess at that. But this does raise the issue of the importance in accurately predicting basis.

Fed cattle prices can swing dramatically over time. Basis can vary, too. But basis swings are generally much narrower. When cattle feeders sell futures to hedge, they remove their exposure to potentially collapsing futures prices. But the net cash selling price they expect to receive remains subject to errors in projecting what basis will be at the time they lift the hedge.

As June live cattle futures move toward expiration, the basis gap would be expected to close. But basis is attractive enough that it will prompt cattle feeders to move hedged fed cattle to market quickly.

If basis ends up stronger than expected, producers net more than the expected net cash price. If basis ends up weaker than projected, the net cash price from the hedge falls a bit short of the price the hedge was expected to capture at the time the producer sold futures. Thus, how close the actual net cash price comes to the expected price is predicated on the ability to forecast basis.

Hedgers often use historical basis information to predict basis. A five-year average basis is typically long enough to smooth out annual aberrations and short enough to adjust to changes in seasonality and local market conditions. However, expected basis should be adjusted if a change from historical norms is anticipated.

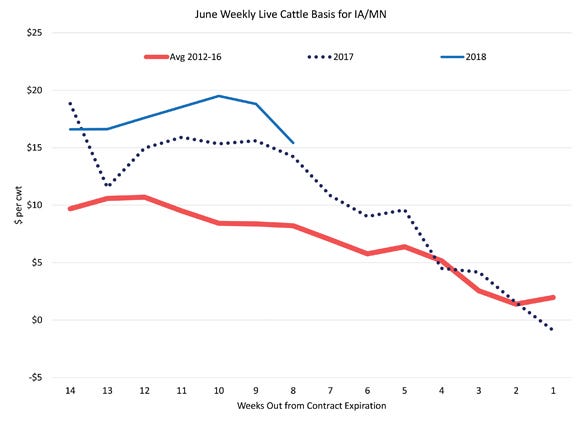

Eleven and 10 weeks before expiration of the June 2018 contract, basis differences were dramatic. During 2012-16, late-April cash prices averaged a $9-per-cwt premium to the June contract, last year a $15.50 per cwt premium, and this year that number was $19 per cwt. For a short hedger, selling May cattle ahead with this kind of basis was a dream.

To illustrate, in the last week in April, some cattle sold in Iowa for over $124 per cwt for delivery in May. In this case, a short hedger missed their predicted net price received, but the basis prediction error was in their favor. That is, net price received was higher than predicted. If a $10 basis was expected using the five-year historical average, then the $19 actual basis resulted in a $9 per cwt higher price than expected.

As June live cattle futures move toward expiration, the basis gap would be expected to close. However, in the first two weeks of May, Iowa-Minnesota cash fed cattle averaged a $17.11 premium over the June live cattle contract, almost $9 per cwt higher than the 2012-16 average basis for those weeks and even $2 per cwt higher than last year’s historically strong basis.

In the next seven weeks, the difference between cash and futures will get smaller, but which will give more — the cash market or the futures?

Probably some of both. Regardless, basis is attractive enough that it will incentivize cattle feeders to move hedged fed cattle to market quickly.

Schulz is the Iowa State University Extension livestock economist.

About the Author(s)

You May Also Like