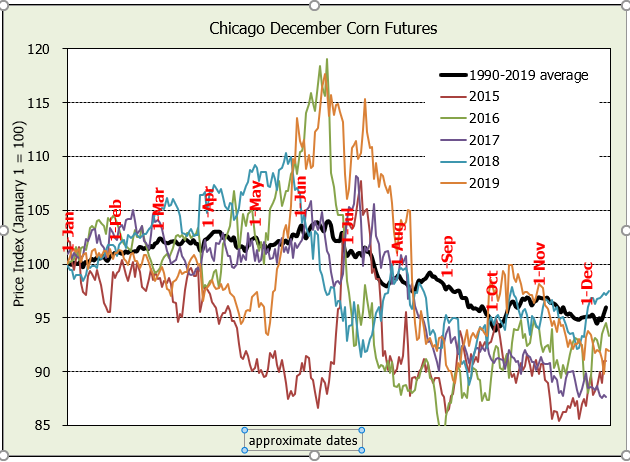

In each of the past six years, the new crop December corn contract has enjoyed a significant price rally in spring or early summer. How likely are we to get another rally this spring?

Allow me to offer a few observations about spring price rallies in December corn futures.

As of mid-February, Dec’20 corn futures have traded in a narrow 15 cent range, from a high of $4.04½ on the first business day of the year, to a low of $3.89½ in early February. Time will tell if this narrow range holds through the end of March.

The AMJ (April-May-June) high in the December new crop contract has exceeded the JFM (Jan-Feb-Mar) high in each of the last six years (2014-19). This is the longest consecutive streak since 1980, the first year I started tracking.

Does the AMJ high always take out the JFM high? Of course not. Since 1990, the AMJ high has exceeded the JFM high in 7 of 10 years (70%). I would like make broad generalizations about years when the AMJ high fails to exceed the JFM high. For example, I note that in 2007, 2010 and 2013 – the most recent years when the AMJ high was less than the JFM high – new crop futures entered the new year at a “high” price (i.e., there was more opportunity to trade lower). However, this does not explain 1997-99, three consecutive years when Dec futures entered the new year at a not-so-high price and proceeded to trade even lower. The late 1990s was a noteworthy bear market in grains – please don’t tell that the current bear is as large and persistent as that bear.

Here is an encouraging note: the AMJ high in the December corn contract has exceeded the JFM low every year since 1980. Will $3.89½ be the AMJ low?

And another encouraging note: the Dec contract high in the first half of the year (Jan-Jun) has occurred in the months of January and February in only 4 of the past 30 years.

Based on the last two nuggets of information, I like to think we have a good chance to trade higher than the $4.04½ mark set at the start of the year.

If you are banking on a spring pricing opportunity in corn, I think we will see it. However, market prices will not move higher in a vacuum – we need a story! Could the story be a repeat of last year’s story – flooding, wet fields and more prevent-plant acres? Will the promise of purchases by China finally start to become a reality? The China/trade angle is critical because the demand side of this market desperately needs some positive news.

Do I need to review the negative stories in the market? More U.S. acres in 2020, good South American crops, coronavirus and ASF (markets hate uncertainty). The most interesting aspect of markets is that the dominant story will quite possibly be something completely different and unexpected.

If you seek an early look at the supply and demand situation for 2020/2021, pay attention to the information released at the USDA Ag Outlook Forum (February 20-21). With their initial ideas on acres and yields in 2020, USDA will give us something to debate in the months ahead, as we wait and hope for another spring price rally.

About the Author(s)

You May Also Like