The entire agricultural market landscape has been under attack and the bearish concerns are compelling. Livestock markets and ethanol futures are probably creating the greatest longer-term concerns, but large acres and rising 20/21 corn ending stocks figures are also compelling arguments for the bears.

Wheat has managed to craft a more bullish narrative. But with wheat prices already quite high in relationship to corn, how much more can wheat rally independently of corn? Therefore, wheat’s ability to sustain further near-term strength may feel the weight of corn, as well as favorable wheat crop prospects at this time.

Grounds for soybean price optimism

Soybeans may have a completely different type of backdrop than corn, wheat, livestock and ethanol markets. Be careful trying to lump all agricultural markets into the same pile of despair.

Soybean price action has shown signs of immunity to much of the bearish aura in place since February and March. Here’s a clear historical timeline as support.

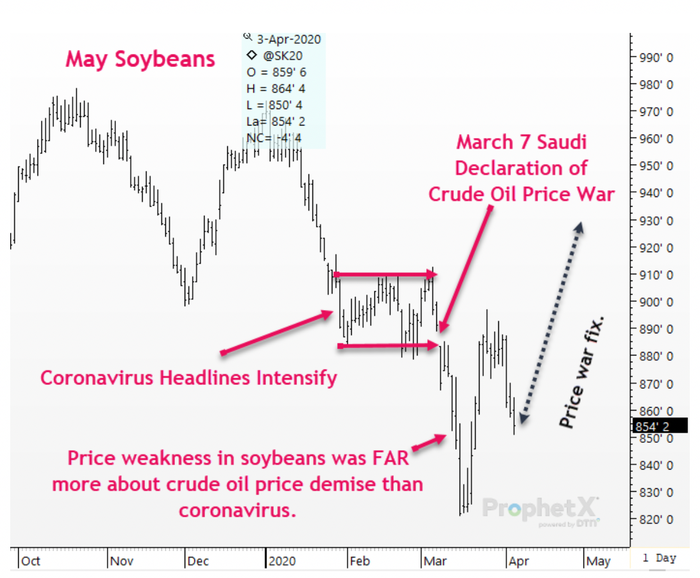

Below is a daily chart of May Soybeans. Notice that during the month of February, when the COVID-19 storyline was intensifying, soybean prices outperformed prevailing bearish sentiment at the time. It wasn’t until crude oil prices collapsed that soybeans also reacted negatively.

The next sign of soybean strength came when prices abruptly managed to reject the 70-cent price slide reaction from crude oil, when soybean just as quickly managed to recover to price levels that existed just before the crude oil price war began.

With that as my basic premise, I think bears are very vulnerable to holding a bearish outlook for the wrong reasons. Fundamentally, something else is at work here.

Chinese soybean demand

In search of what may be behind the clearly different price action in soybeans, vs either corn, ethanol or livestock futures, I am intrigued by the aggressive Chinese soy demand that has been taking place for several months and still continuing. It is true that their purchases have largely been South American, but they have been producing record monthly South American export figures. During Jan/Feb, China’s soybean imports rose more than 14% from year ago levels. Based on trends of the past several months, statisticians have been steadily increasing China’s soybean import projections for both this year and 2021.

Massive printing of currency

The US is leading, but virtually every major economy is also printing money at record levels. This creates an environment that is not bearish commodities. If it is correct that soybeans have good/improving demand as a fundamental backdrop, then soybeans may also soon begin to find an increase in speculative capital that is looking for a commodity-based investment. Soybeans also have a history of being a favorite of speculators when the commodity sector becomes a favorite place for speculative capital. It is very possible that we have conditions where speculative capital will be looking to the commodity sector again.

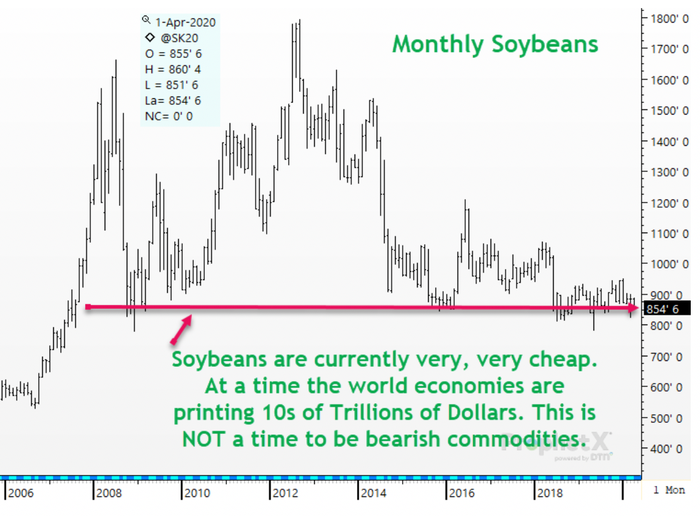

Historical perspective to current soybean prices

Below is a monthly chart of “spot” soybean futures from 2006-present. Do you really want to be short this market?

Trillions and trillions

While the world deals with COVID-19, we know there are disruptions in demand and trade. We know that some will be lost for a longer period of time. However, the leading world economies are printing money into the system at a pace never seen before. COVID-19 is (hopefully) only temporary, but the stimulus money will continue. So, it is a near certainty that inflation is ahead.

This can have a dramatic impact on commodity prices. Be very careful not to lose hope or believe that current problems will last for an extended period of time. Markets and inputs affecting markets can change very quickly.

The soybean market is already historically cheap, and its own fundamental footings have shoots of bullish opportunities. Stay tuned!

Duane Lowry

Senior Risk Manager and Market Research Director

Silver Creek Commodities

Email= [email protected]

Twitter= @DuaneLowry

Phone/text= 563-419-1300

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like