Chinese tariffs on imports of U.S. soybeans knocked prices for a loop. But data on shipments since the trade dispute ratcheted higher in July show the market adjusting to what amounts to the new normal. Both Brazil – and, surprise, the U.S. – sold more soybeans.

To be sure, shipments from the world’s number one and two exporters normally slow during these months. Inventories in Brazil normally are beginning to thin into the start of planting there in mid-September. U.S. shipments typically fall off even more ahead of the fall harvest as buyers wait to scoop up bargains when the cash market is flooded. And without Chinese business, U.S. 2018 crop total exports likely won’t increase much if at all over those sold the previous year.

Still, large leftover supplies of 2017 crop soybeans in the U.S., coupled with dirt-cheap prices crushed by the tariffs, were a fire sale buyers couldn’t refuse, especially those who normally rely on Brazil. Originations out of Brazil for October are trading at a 27% premium to those out of the Gulf, enough to overcome the 25% tariff if the Chinese government allows, an incentive for others to take what China won’t.

While Chinese regulators permitted a trickle of imports from the U.S., public statements by officials pushed the party line hard: China wants its pork industry, already beset by African swine fever, to help slash soybean imports by some 10%, while seeking alternative protein feeds and encouraging domestic production to expand in coming years.

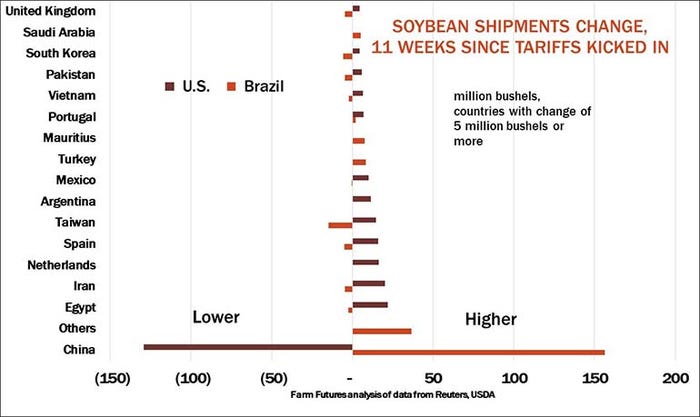

In the here and now, however, Brazil took up the slack of plunging U.S. shipments to the world’s largest importer. In the 11 weeks after the tariffs took hold, U.S. shipments to China fell by 129 million bushels compared to the previous year. Flows out of Brazil during the same period rose by 156 million bushels as buyers there built up inventories at ports by 15% as protection.

Most, but not all other buyers, switched from Brazil to the U.S. For example, Brazilian shipments fell by 14.8 million bushels to Taiwan, which took 14.4 million more bushels from the U.S.

Politics, and not just economics, may also be at work. Turkey, embroiled in its own tariff battles with the U.S., isn’t a huge summer buyer. But it took 8.1 million bushels from Brazil. And the market produced some strange bedfellows. Iran cut purchases from Brazil by 4.5 million bushels, while increasing shipments out of the U.S. from 2.5 million bushels last year to a whopping 22.7 million this year.

Overall, Brazil’s exports rose by 165 million bushels, up 31%. Shipments out of the U.S. edged 24 million bushels, an increase of 8% year-over-year.

About the Author(s)

You May Also Like