Will history repeat?

In 1989 Ferruzzi, a large Italian-based Soy processor who also owned and traded futures at the CBOT through a U.S. company they owned (Central Soya), attempted to demand soybean delivery to cover user needs overseas. The futures were trading well below cash (a lot like this year) so it made sense to take delivery of what was cheaper. U.S. ending stocks were only estimated at 135 mb (million bushels) while this year is tighter at 120. They were long 23 mb or about 18% of the stocks; taking delivery could force the futures to trade to a more normal premium than futures usually have to cash markets.

The end result would be a significant move higher, and to what level?

Spec shorts would need to buy back positions in order to liquidate positions and with cash markets so strong, the farmer nor the commercial firm would sell to them at a discount (a lot like this year). The only other way out would be to buy cash inventory and deliver. But obviously with cash so strong that would never work (a lot like this year).

Do we have your attention?

The Big Differences

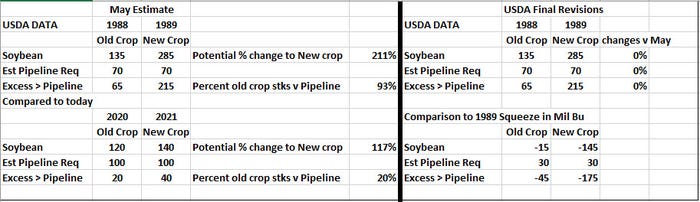

In 1989, there was still about 65 mb over the estimated inventory needed to run the soybean pipeline. This year there are only 20 -- and if you use actual weekly demand statistics, it is likely there would be fewer bushels (or none at all) than the amount USDA is forecasting.

Another significant difference is that the market was trending down in 1989 because the potential growing new crop looked huge and stocks were expected to grow from 135 mb to 285 mb. This year expectations are for stocks to only grow to 140 mb using current acreage and yield projections. This year the market is not trending down as any event that would cause yield to fall below trend could make the tightest stocks situation in history get even worse!

Looking at the facts, the market is in a significantly more precarious situation than it was in 1989.

Which way prices?

Going into May delivery this year, futures bottomed 04/13/21 at $1378 and by 05/12/21 traded to $1677. Theoretically there will be fewer beans in the U.S. pipeline available for delivery on July 1 than there was May 1.

As of this writing, there are 302,031 long futures contracts or 1.5 billion bushels compared to the 10.003 mb that are currently available in a deliverable warehouse. So the risk of being short this year is probably higher than any other year that I have traded (over 40 years).

Unthinkable

Actually, the risk of being short futures is about unthinkable. I would suspect that the CME has already talked to commercial traders asking them to move their business to a different month in order to drive the volume out of July. This week, ADM Decatur switched all old crop bids to November futures. This will avoid them holding short hedges and getting tangled up in any old crop situation that might not look orderly.

The Exchange created the delivery process in order to assure the Ag Industry futures would be a reliable tool and would trade in line with cash values. The process works as we saw the $3.00 rally in May futures put the futures right in line with the cash market. The exchange and the CFTC is also committed to maintain an “orderly” market. So it would not be unusual for the exchange to ask participants to either move positions to another month or to prove economic reason to remain in the July futures. Either way, as long as cash is trading largely above futures as we get to 1st notice day, the trader who is short will have a more challenging time to buy his way out than the trader who is long needing to sell. It will be interesting to see.

(Editor’s note: In 1989 CBOT implemented an order an emergency liquidation order on its soon-to-expire July contract; Ferruzzi sued CBOT, denying it was attempting to corner the world soybean market. Eventually most suits were dismissed and Ferruzzi went bankrupt.)

About the Author(s)

You May Also Like