Tuesday’s USDA reports were largely statistically insignificant—with one very important exception. U.S. soybean carryout declined 10.7% from last month, despite rising global supplies and no recent Chinese purchases and no apparent adjustment by USDA for Phase One.

If you will recall, prior to the U.S.-China trade war, the very strong tendency was for USDA to continually lower U.S. ending stocks projections as the marketing season evolved. And, this pattern was consistently seen in many, many years. It was as if global demand for protein was expanding faster than USDA could keep upwardly adjusting. This is also a good time to point out that China’s total soybean imports rose in 2019, vs 2018, despite African Swine Fever and trade war factors.

Thus, I am really intrigued by USDA lowering carryout projections this month and I ponder the likelihood that we will see further notable cuts in U.S. soybean ending stocks as the marketing year unfolds. I remain very much of the opinion that China will meet their Phase One obligations. For those of you who think it is unreasonable that they can increase their ag purchases from the U.S. by $16 billion, when the baseline measurement is $24 billion, I want you to realize that China imports $125 billion annually of agricultural products. When you consider that the U.S. is asking for China to purchase an additional $16 billion, it is not that big of an ask if you see the $16 billion from the perspective of the entire $124 billion pie, as opposed to the $24 billion U.S.-only pie.

Demand and Coronavirus

As for demand concerns regarding coronavirus, there are still 1,399,999,000 Chinese that have their same appetite as they did before. It is certainly probable that transportation issues in quarantined areas may have resulted in a brief period of demand reduction, but that will be only temporary.

A more likely result of coronavirus will be a political leadership structure that was reminded how loose of a grip they may actually have on power if their population is faced with food shortages. Chinese leadership will exit the coronavirus situation likely to be much more determined to build agricultural stocks that were depleted during the trade war. And, they will be looking at economic stimulus measures to spur their domestic economy as they exit the coronavirus storyline in the weeks ahead. This and the foundational economic reasons for them to seek tariff relief from the U.S. will ensure they will in fact fulfill their Phase One commitments during at least the next two years.

A historical perspective on current soy prices

Below I want to remind you of just how cheap soybeans are.

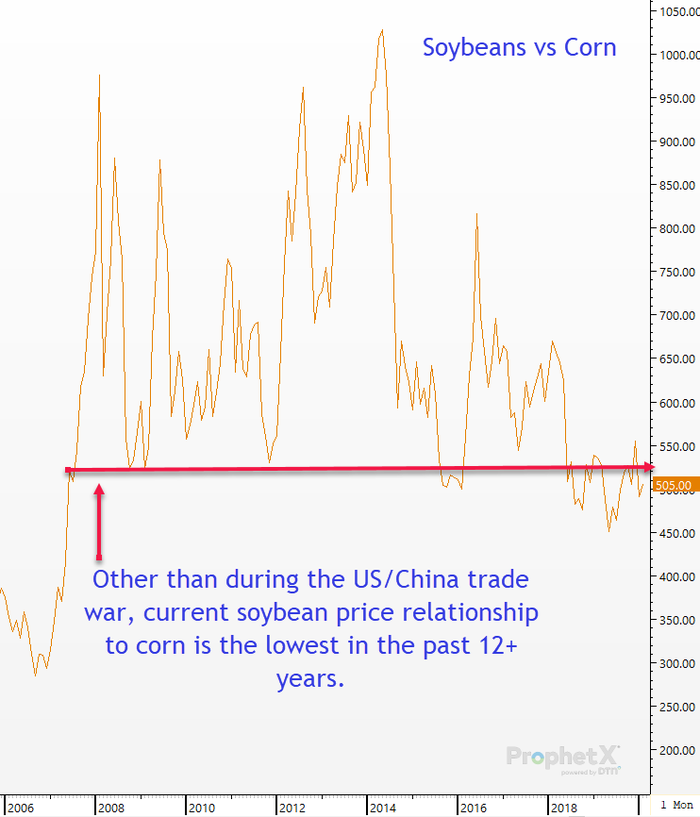

Now that you are reminded of how cheap current prices are, I want to show you a chart of soybeans vs corn. This next chart shows how historically cheap current soybean prices are in relationship to corn. This chart clearly shows that U.S. producers are not being given any historical incentive to plant soybeans. Producers are choosing to plant soybeans out of habit and/or their desire to maintain their crop rotation strategy. Producers are not planting soybeans because of profit incentives.

The charts above should give you pause to being bearish on soybeans. With Tuesday’s USDA report lowering carryout levels by 10.7% from the previous month and the history of USDA routinely lower carryout levels as the marketing year unfolds in years without trade wars, we should expect U.S. soybean carryout levels to decline in future reports. If/when China begins to purchase U.S. ag products and offer signs that traders are forced to reconsider their passive approach to Phase One, soybeans have dramatic price adjustments that will be warranted to move values off the bottom side of historical relationships of the past 12 years. This will cause soybeans to be the upside leader in the weeks/months ahead. It remains very plausible to see soybean prices feeling compelled to do something to entice U.S. producers to more proactively increase acreage in 2020, which implies a price rally. As you can see from the historical relationship to corn in the chart above, a very notable price rally will be needed to accomplish that incentive from the current depressed price levels.

Vegetable oil prices and their historically inelastic demand reactions to price

Lastly, I want to show you how cheap soyoil is.

Global vegetable oil prices had rallied sharply, prior to experiencing a price correction during the past month. The major trend in vegetable oil prices is likely to remain bullish during the next couple of years, as palm tree cycles enter a declining production period. Thus, the recent slide in soybean oil values is likely to be very temporary. It is reasonable to believe that soybean oil charts will unfold trending higher action in the weeks/months ahead and that will lead to prices well above the January highs.

Summary

Don’t be deceived by the markets’ bland reactions to Tuesday’s USDA reports. We are poised for rising price trends and the soy-complex is likely to be the upside leader in the months ahead.

Duane Lowry

Senior Risk Manager and Market Research Director

Silver Creek Commodities

Email= [email protected]

Twitter= @DuaneLowry

Phone/text= 563-419-1300

About the Author(s)

You May Also Like