Despite record crops and an overwhelming bearish sentiment, corn and soybean prices enjoyed a robust post-harvest rally. In southern Minnesota, for example, $2.65/bu. cash corn in early October reached $3.70/bu. before the new year, while Dec’15 new crop futures rebounded from $3.67/bu. to $4.29/bu. At harvest, cash soybeans valued at $8.50/bu. touched $10/bu. before the holidays, while Nov’15 new crop futures rebounded from $9.32/bu. to $10.29/bu.

Price rallies of $1/bu. or more in 10 weeks are uncommon and good news for producers. The bad news is, since then, prices have settled back to lower levels. In hindsight, those mid-December prices are looking pretty good. Will we get a second chance to price corn and soybeans at the higher prices last seen 3 months ago? Let’s focus on new crop-opportunities.

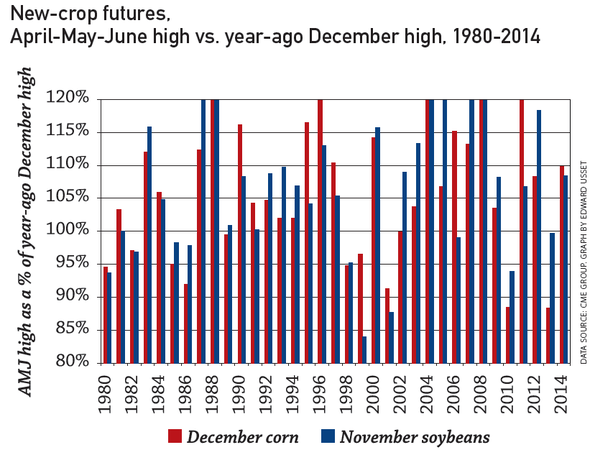

The history over the past 35 years is encouraging (see graph). Since 1980, the median high of April-May-June (AMJ) new crop futures is 104% (in corn) to 105% (soybeans) of the previous December high. Median – shown for soybeans as a red line on the chart – simply means that half the years were above 105% of the December high, and half below. I think it sounds reasonably encouraging to have a 50/50 shot at $11.00/bu. Nov’15 soybeans (105% of the $10.29 December high) and $4.60/bu. corn (104% of the $4.29 December high).

All figures based on closing prices. For scale purposes, the top end was cut off at 120%, a figure exceeded in five corn years and six soybean years.

Even more encouraging are the odds of returning to the December highs in new crop futures ($4.29/bu. in Dec’15 corn and $10.29/bu. in Nov’15 soybeans). Since 1980, about 70% of the years have given us a chance to price new crop futures during the AMJ period at or above the December highs. There have been just a handful of years when sellers did not have a chance to sell new crop futures at 95% of the December highs. Many of these bad years were either plagued by a sharp drop in exports (not the issue this year), or particularly high prices in the fall (hopefully not our perspective this year).

What will make prices rise in the April-May-June period? Spring is what I call the “too-too” season in corn and soybeans (see “Hail the Too-Too Season). Spring is planting season, and the market gets pretty uptight when planting is disrupted. Sometimes temperatures are too hot, sometimes too cold. Other years the soil is too wet, and some years too dry. Sometimes our concern is planting progress, which may be too early this year, or too late the next year. The too-too season is a nervous time for markets, and often results in higher prices.

The bears have the floor but remain patient. I'm betting on the too-too season to deliver a second chance to price new- and old-crop corn and soybeans this spring.

About the Author(s)

You May Also Like