August 22, 2018

By Lee Schulz

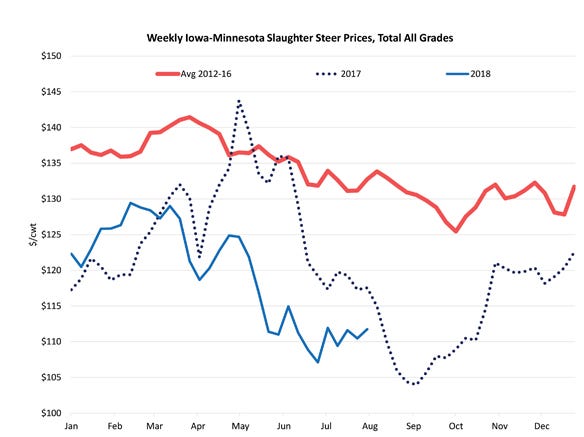

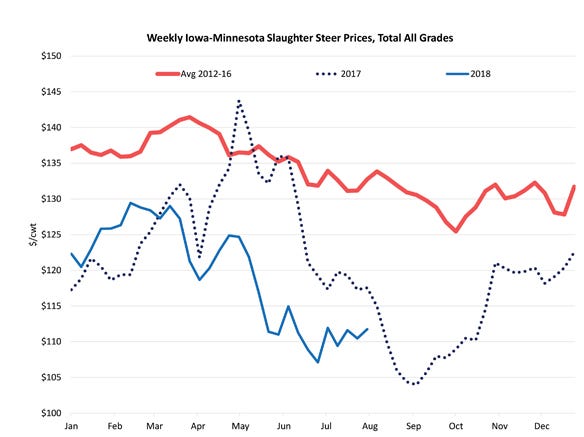

Fed cattle prices started 2018 strong and remained above year-earlier levels into March, with Iowa-Minnesota prices averaging $126 per cwt and $5 per cwt higher than the same period in 2017. Since March, fed steer prices have consistently held below year-earlier levels, averaging $117 per cwt during April through June, $15 per cwt lower than during 2017’s second quarter. July fed cattle prices averaged $111 per cwt, down $8 per cwt from July 2017. Note that March through mid-June 2017 fed cattle prices were very strong, so measuring from a higher base exaggerates some of the year-to-year decline.

Source: USDA Agricultural Marketing Service

Ample factors contribute to lower fed cattle prices. One of them is more beef. Beef production closely follows trends in cattle slaughter, which has been above last year in five of the first six months of 2018. Through June, monthly slaughter has averaged 3% higher than year-ago levels. Heavier weights have pushed beef production up even more than slaughter volume, as beef production rose almost 4% compared to the first half of 2017.

Sticky downward prices create drag

Retail beef prices have not dropped enough to spur the added consumption needed to hold higher prices with more beef on the market. Data provided by USDA show that in the first half of 2018, all fresh retail beef prices were less than 1% lower than in the first half of 2017. Per capita consumption only rose 0.5% over this period.

Further reductions in retail beef prices seem likely. Lower retail prices that boost sales volume can help support fed cattle prices. Meantime, robust economic growth, rising incomes and wealth, and one of the lowest unemployment rates on record could help spur beef demand.

Strong exports help — at least so far

Exports have been a bright spot for beef demand this year. According to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF), January through June 2018 beef muscle-cut export volume was up 14%, and value was up 23% compared to the first half of last year. Beef variety meat exports make an important contribution to cattle carcass value as well. Those exports are down 4% by volume but still up 2% by value. USMEF calculations indicate beef export value has averaged about $317 per head of a slaughter steer this year.

One unknown hanging over the beef market is the impact of higher tariffs on beef muscle-cut and offal exports. Second-half 2018 impacts will be felt even more strongly, as tariffs on many products exported to China and Canada rose in early July. Last year, 11% of U.S. beef production was exported to all destinations. The largest U.S. beef customer in 2017 was Japan (29%) followed by South Korea (17%), Mexico (15%), Hong Kong (12%) and Canada (11%). Year-to-date 2018 beef exports to South Korea are up a whopping 39% by volume and 55% by value, surely buttressed by the successfully revised Korea-U.S. Free Trade Agreement (KORUS).

USDA surveys producers for 2 July cattle reports

USDA’s midyear cattle report provides the first estimate of the nation’s 2018 calf crop plus some clues on how rapidly the U.S. cattle herd is increasing. Roughly three-quarters of the calf crop already hit the ground this spring. The rest will be born this fall. The July survey asks producers to report the calf crop for the entire 2018 year. Their responses suggest the 2018 calf crop will be 1.9% larger than in 2017. The rise in the calf crop implies that cattle slaughter should continue to climb for at least the next 18 to 24 months, but the rate of increase will likely slow.

July’s Cattle on Feed report confirmed that the on-feed inventory continues to be larger than a year ago. Feedlots with capacity of more than 1,000 head held 4.3% more cattle than on July 1, 2017. June marketings rose 0.9% versus a year earlier, while net placements (placements minus other disappearance) climbed 1.2% compared to June 2017. Differences in regional supplies are readily apparent, with feedlot inventories in Iowa, Nebraska and South Dakota sustaining robust levels since the beginning of the year. Marketings in July and August remain key and will be critical for cattle prices this fall.

Despite reported larger auction and direct trade volumes, the modest rise in June feedlot placements reflects lower placements concentrated in the heavier weight categories, partially offsetting larger placement volumes in lightweight categories. Placements of feeders under 600 pounds were up 6.7% year-over-year, and placements at 600 to 699 pounds were up 9.5%. Placements of 700- to 799-pound cattle were down 10.5%. Placements above 800 pounds were up only 2.0% in June. Smaller heavyweight placements in March through June suggest tighter fed cattle supplies heading into late summer and fall, setting the stage for a possible price rebound from summer lows into the fall months.

Cow herd growth could be slowing

An important note regarding the Cattle on Feed report is that the number of heifers on feed was as expected — larger. The breakout of heifers and steers on feed is reported quarterly and goes back to 1996 in its current format. The number of heifers on feed on July 1 was up almost 8% over July 1, 2017. This was the second-largest July number of heifers on feed, behind only July 2001. Heifers not going into cow herds have boosted feeder cattle supply but don’t appear to have had a noticeable impact on calf and feeder markets.

Even more than fed cattle, prices for steer calves started 2018 much stronger than in 2017, primarily because prices in 2017 were surprisingly weak. Prices for 500- to 600-pound steer calves in Iowa averaged $185 per cwt during the January through March quarter — $27 per cwt higher than a year earlier — before declining slightly during the second quarter to average $177 per cwt, only $4 per cwt lower than during April through June 2017

Producers probably have yet to decide how many heifers from this year’s calf crop to retain for breeding. But more heifers from 2017’s calf crop are ending up in the “other heifer” category in USDA’s midyear cattle report, i.e., heifers not intended for replacement, and they are making their way through feedlots and slaughter channels. That trend is likely to continue next year. Other heifers climbed 2.7%, and congruently, heifers for beef cow replacement fell 2.1%.

The July 1 inventory of steers and heifers outside of feedlots — those not included in the monthly Cattle on Feed report or in smaller feedlots — is estimated to have grown by 0.5% from the previous year. This is the largest number since 2010, but it could have been larger. The relatively meager year-over-year rise underscores the lighter-weight placements that have already been seen in the Cattle on Feed reports as of late. Many of these animals are already in the feedlot supply chain as of July 1.

Summary

The expansionary phase of the cattle cycle in the U.S. is slowly coming to an end. Even so, Jan. 1, 2019 may still show an annual increase in all cattle and calves. The Jan. 1, 2018 inventory was 94.4 million head, about the same number as in 2009. The resulting beef production in 2009 was 25.9 billion pounds. In 2018, with about the same number of cattle, beef production forecasts are around 27.3 billion pounds. Cattle inventory cycles are seemingly getting shorter and flatter because we are getting more beef from about the same number of cattle.

Schulz is the Iowa State University Extension livestock economist. Contact him at [email protected].

You May Also Like