Peak corn export season is leveling off in the U.S., following an unusually strong early 2020/21 corn export season which will likely see corn exports record a new all-time high this marketing year. As of press time, the U.S. had already shipped 73% of USDA’s 2020/21 projected 2.775-billion-bushel corn export target, with record-setting shipping paces likely to continue through August 31.

Monthly export data released by the U.S. Department of Commerce and USDA’s Foreign Agricultural Service (FAS) saw monthly corn exports reach the highest volume (372.8 million bushels) and value ($2.4 billion) in March 2021. But China isn’t the only international buyer in line for U.S. corn as 2021/22 lurks around the corner.

To be sure, Chinese buying paces have played a significant role in rising corn export demand as China seeks additional feed supplies for its growing livestock herds and poultry flocks. At nearly 580 million bushels, 2020/21 marketing year to date U.S. corn exports to China are 77 times higher than the same period a year ago.

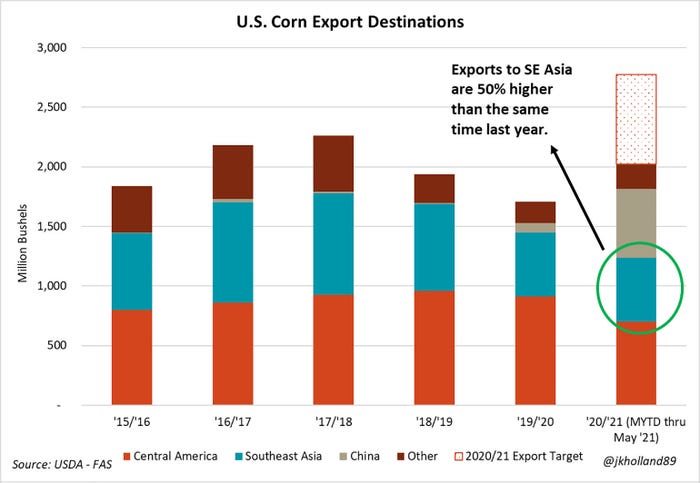

But year to date U.S. corn exports to all countries besides China are 21% higher than a year ago. Southeast Asian countries excluding China are primarily responsible for the uptick, as corn shipping volumes to those countries are 50% higher than the same time a year ago as Southeast Asian buyers increase demand for livestock feed and stockpiling capacity in the post-pandemic era.

New data expected this Tuesday will show if April 2021 U.S. corn export loading paces matched those of March. Weekly export data from USDA-FAS suggests the April 2021 tally will likely fall short of March’s haul by around 28 million bushels but it is hardly cause for a negative price correction.

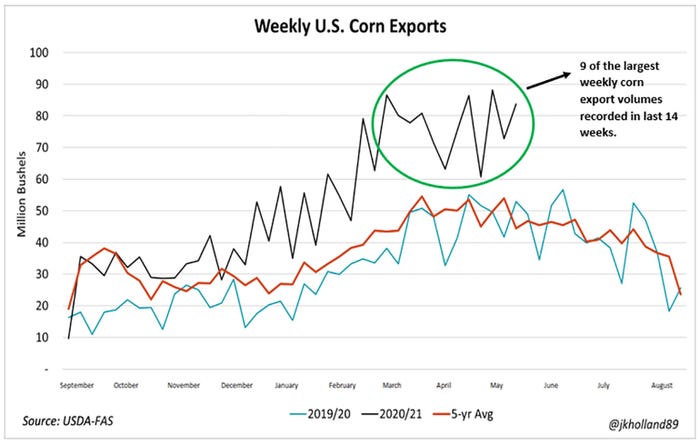

Nine of the largest weekly loading volumes for corn exports have been recorded in the past 14 weeks. USDA expects U.S. corn exports in fiscal year 2021 to rise nearly 23% from 2020 to $17.2 billion on the record shipping paces and rising corn prices. Corn exports are expected to account for 12% of U.S. agricultural exports in FY 2021 as international buyers seek increasingly scarce feedstuffs for the growing livestock herd.

China’s wheat harvest

Chinese demand for corn continues to pave the way for high export paces. Nearly 29% of marketing year to date U.S. corn shipments (579 million bushels) have been sent to China with a quarter left in the 2020/21 marketing year.

But those shipments could slow in the coming days as China finishes its record-setting wheat harvest. On government guidance and scarce soymeal and corn supplies, Chinese livestock and poultry feeders have largely reduced corn and soy rations in favor of cheaper wheat, sorghum, and barely since the year’s beginning. But not before importing a staggering 1.0 billion bushels of corn – over half of which has been sourced from the U.S. so far this year.

That’s not entirely bad news for farmers with corn still left in the bin to sell. Exporters had only shipped 64% of projected annual corn exports by the same time last year, just as Chinese feed demand began intensifying. And as ethanol production emerges from the pandemic, cash offerings for corn will likely remain at a premium during summer while exporters vie for bushels against a large livestock inventory, food processors, and ethanol producers.

The global supply dilemma

High usage rates will set the pace for corn prices headed into to the 2021/22 marketing year, especially if supplies end up any smaller than USDA’s May 2021 estimate of 15 billion bushels. At this point, it is too early to determine final 2021 yields but expect any excess bushels to go straight into the export market, though the weekend’s hot streak and drought conditions in the Upper Midwest and Northern Plains does not bode well for favorable trendline yields in 2021.

USDA’s forecast for 2021/22 corn demand currently uses exports as a secondary “residual” measure. This means that if the current crop comes up short, export paces are projected to shrink. USDA's current 2021/22 export target of 2.45 billion bushels is about 300 million bushels lower than last year's estimate, reflecting tight supplies for another marketing year.

As the Brazilian crop comes to market, overall corn export volumes from the U.S. could see somewhat of a slowdown. But Brazil’s corn crop has been slashed by 315 million bushels (7%) since its growing season began last fall and its domestic usage rates for corn have increased 3% on corn ethanol expansion projects over the past year.

China is not traditionally a large buyer of Brazilian corn. Japan, Vietnam, South Korea, Egypt, and Spain tend to jockey for Brazil’s safrinha corn crop. Those international customers are no strangers to U.S. corn exporters and could increase non-seasonal shipments later this fall if Brazil’s exportable supplies shrink further or are snapped up faster than expected.

China began ramping up its corn buying from the U.S. just after this time last year. With a smaller Brazilian export crop expected, U.S. supplies could be tapped to satiate the world’s growing livestock feed demand. Shrinking Brazilian exportable corn supplies could offset China’s record wheat harvest as U.S. corn export paces soar to new heights, providing a solid foundation for corn prices ahead of this fall’s harvest.

About the Author(s)

You May Also Like