February 15, 2012

You know that feeling of being thrown onto a piece of equipment that you haven’t operated for a year? It feels a bit awkward until you get reacquainted. Well, many farmers often feel that way every year when faced with crop insurance and risk management decisions. The strategies may have been familiar once, but now is a good time to review crop insurance values (especially as the March 15 deadline looms) and the wisdom of making pre-harvest sales against insured bushels.

A common question we hear is, “Why do I need to market grain on my insured bushels when I have a government guarantee of X gross dollars?” If you're looking to take advantage of seasonal highs and forward market a percentage of the crop before harvest, one practice is to use a Revenue Protection (RP) product because it protects against a revenue loss caused by price decrease, low yields or a combination of both.

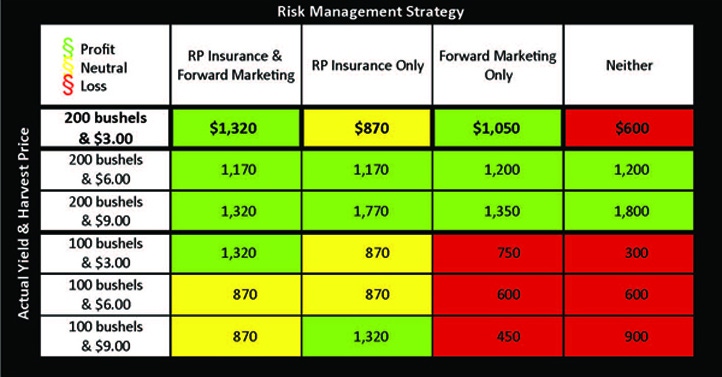

Check the chart to view the scenarios for a farmer who either buys or passes up crop insurance, uses forward marketing or both. If he chooses to forward market his grain, we’ll assume he sells 75% of his grain at the projected price on Feb. 29and the remaining 25% at the harvest price. Otherwise, we assume 100% of his grain will be sold at the harvest price on Oct. 31. He can also choose whether or not to purchase RP insurance.

There are pros and cons for each of the four risk-management strategies:

RP Insurance & Forward Marketing:

Pro – Most consistent in profitability and protects you from a major loss

Con – If prices rally at harvest, you miss out on extreme profits

RP Insurance Only:

Pro – Protects you from significant loss and allows you to capture harvest rallies

Con – Allows for just an average return and the risk of pricing grain during harvest lows

Forward Marketing Only:

Pro – No crop insurance expense and you enhance price from forward marketing

Con – Losses can be extensive if you have low yields

Neither:

Pro – Best chance of hitting the home run

Con – Highest risk strategy with the largest potential loss

Obviously, most farmers would select both insurance and forward marketing to achieve the best probability of profit.But that one con – the chance of missing out on extreme profits during a harvest rally – still causes some to avoid this strategy.

In historical terms, though, the chances of an extreme harvest rally aren’t promising. In 10 of the past 15 years, the price of the December corn futures contract has been higher in February than October. The average February price of those 10 years has been $3.12. The average price during the month of October of those 10 years has been $2.60. This equates to a significant difference of 52¢/bu.

As you’re making decisions over the next month, remember that crop insurance, like any insurance, is a risk-management tool. Its premise is not only about protecting you in bad years, but also providing you with the ability and confidence to make marketing decisions that can yield more profit in good years. That’s why it’s time to get re-familiarized with this tool in order to make the right choices for your operation.

About the Author(s)

You May Also Like