Last month I noted that grain markets needed a jolt to upset the status quo. The jolt is here, by way of drought in Argentina. The latest estimates for the Argentina soybean crop are 10-12 mmt lower than USDA projections in December. For perspective, 10-12 mmt less production is about the same as losing 10% of the U.S. soybean crop. I think we agree that losing 10% of the U.S. crop is a significant issue.

Drought in Argentina explains much of the corn and soybean price rally from the start of the year until early March. Higher prices are good because you have unsold bushels from 2017 in storage. In addition, planting season looms and 2018 new crop prices look appealing. Can the rally continue into the April-May-June (AMJ) period?

Price rallies in the spring – old crop and new crop – happen quite often in both corn and soybeans. If you examine cash prices over many years, it is a fact that average prices in the Corn Belt reach their peak in the May/June period. In about three of four years, cash prices in the month of May will be higher than prices during the previous harvest. The odds are in your favor if you decide to hold some bushels for pricing in May and June.

Concerning new crop pricing opportunities, spring and early summer is the “too-too” season. Planting season is an anxious time – the temperature is too hot or too cold; the soil is too wet or too dry; planting progress is too early or too late. Anxiety during the “too-too” season can lead to higher prices and favorable pricing opportunities.

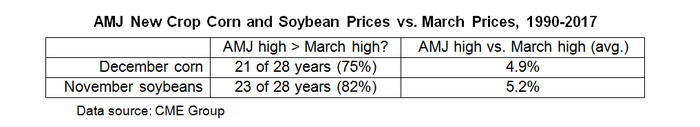

The accompanying table speaks to the power of the too-too season. Corn and soybean prices in early March were 6-7% higher than at the start of the year. History indicates that prices could go even higher. Since 1990, high prices in December corn and November soybeans during AMJ exceeded March highs in 75% and 82% of the years, respectively. The AMJ highs average 5% more than the highs established in March. Like old crop bushels in storage, the odds are in your favor if you decide to defer new crop pricing into May and June.

Now that I have your hopes up, let me throw a little cold water on basis. Basis will continue to frustrate this spring and summer. From the perspective of grain stocks worldwide, the fundamental situation is beginning to turn favorable. World corn stocks will decline this year, as will soybean stocks due to problems in Argentina. However, U.S. stocks of corn and soybeans are high and climbing. The poor basis you are experiencing simply reflects the ease of buying grain in the country.

The drought in Argentina has set the stage for an interesting summer. A crop problem in one major producing country is interesting, but problems in two major producing countries would create fireworks. All eyes are on the U.S. and production possibilities in 2018.

I will not disagree if you decide to wait another month or two to price old and new crop grain.

About the Author(s)

You May Also Like