Your marketing choices at harvest are simple: sell at harvest, store for sale later in the year, or store grain and sell the carry with a forward contract or futures/HTA sale. Options strategies can add a lot of bells and whistles to these choices. But strip away the fluff and you are left with these three choices. The current situation of basis, carrying charges and price levels (high or low) guide us in this choice. There are years when the choice is a no-brainer. As I consider the current soybean market, this is not one of those years.

Let’s start with basis. I have more than 30 years of data for one location in southwestern Minnesota, and the harvest basis for soybeans at 20 cents under the November is easily the best on record. It might get better. The word from the country is that producers are in a good cash position and there is plenty of available space on farms. Elevators will need to work hard to get that grain out of storage. If futures prices remain in a narrow trading range or, worse yet, trend lower, a stronger basis is needed to pry away the grain.

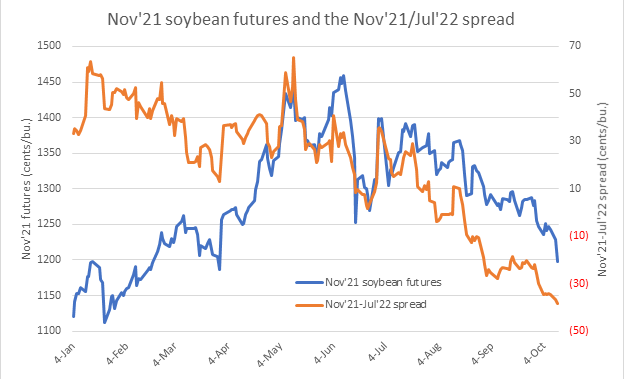

How about carrying charges? The carry from November to July is greater than 35 cents. While this looks like an impressive carry, interest costs on $12 soybeans add up quickly, even with low interest rates. But they are large enough to consider hedging in the March, May or July contract, if for no other reason to buy time for a better basis and to defer income into 2022. (And speaking of deferring income, I’ve heard of producers selling grain at harvest and asking for delayed payment into 2023. That’s a strong cash position.)

Data from CME Group closing prices

A strong and possibly rising basis in the months ahead is a cash price plus. However, cash prices are made up of basis and the futures price, and futures is the larger and more important piece of the equation. Are you anticipating a repeat of last year’s price action, when the November contract topped $14.50/bu.? I’ll never say never, but that sort of move needs a serious crop problem in the U.S. or South America. It is always possible - but is it probable?

And concerning the health of the soybean market and price direction, take another look at the accompanying chart. The Nov’21/Jul’22 spread was trading as high as a 65-cent inverse in mid-May. Just five months later and the spread is showing a 37-cent carry. A $1/bu. move - from a 65-cent inverse to a 37-cent carry - is not the sign of a fundamentally strong market.

Your post-harvest choices are few and the answer is far from clear. This is a year to diversify your pricing actions. Sell some bushels at harvest and take advantage of a strong basis. Sell March, May or July futures against grain in storage to make a modest carry and stronger basis work in your favor. And yes, hold some unpriced soybeans and hope for the best.

Ed Usset will be speaking at the Farm Futures Business Summit about grain marketing. The event is set for Jan. 20-21 in Coralville, Iowa.

About the Author(s)

You May Also Like