October 22, 2020

2020 will be remembered for the storm of the coronavirus and the global pandemic that followed. Supply chains were disrupted, and prices plummeted with large demand uncertainty. That followed with an early planting season in much of the Corn Belt, but seasonal new-crop prices rallied into early July. Then came drought and the derecho across much of Iowa. Prices bottomed in early August before the extent of production loss was known. China strengthened its buying of U.S. ag products to better meet its Phase 1 trade deal obligations and in response to the threat of rising prices.

By mid-October, nearby corn and soybean futures contracts rallied roughly 25% higher than they were trading in early August. Changes in the U.S. balance sheets were triggered from the National Agricultural Statistics Service’s Quarterly Grain Stocks, October Production, and World Agricultural Supply and Demand Estimates reports.

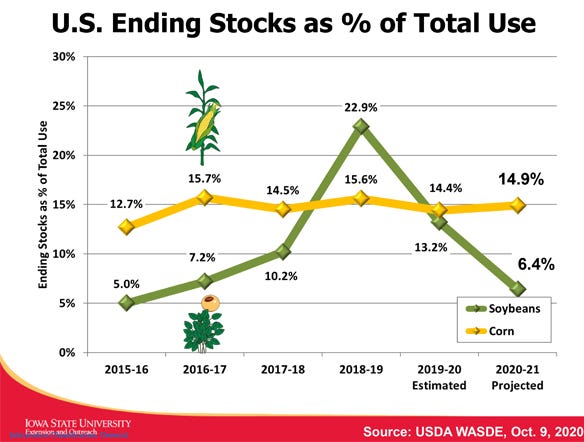

Ending stocks of U.S. corn for the current marketing year are projected at 2.167 billion bushels on Aug. 31, 2021, with an average cash price of $3.60 per bushel. That’s a decrease of more than 600 million bushels and a price increase of 50 cents from the Aug. 1 projections.

A bigger surprise was that U.S. soybean ending stocks are expected at only 290 million bushels. The average cash price is likely to rise to $9.80 per bushel. That’s a decrease of more than 300 million bushels and an increase in the price by $1.45 from Aug. 1 projections.

Harvest basis hasn’t weakened as much as expected as processers and grain shippers have bid up cash prices to obtain adequate supplies. However, futures carry or difference between the nearby futures contract and a deferred contract are relatively small for corn and inverted for soybeans. The ability to store bushels commercially or even on-farm and make it pay is in question without improved deferred futures prices along with a better basis being offered.

Global weather concerns

Dry weather concerns in the Black Sea region and South America have kept strong export demand in place. In August, the U.S. shipped $2.15 billion worth of ag and related products to China, topping the 2012 record for the month by 19%. Soybeans accounted for 41% of all U.S. shipments of farm goods. Exports of U.S. corn to China hit an all-time high for the month at $190 million.

According to the latest U.S. Climate Prediction Center, odds are roughly 85% that the La Niña climate pattern will continue into the winter months. The odds are 60% it may linger into spring. Most climate models call for a moderate to strong event during the peak November to January season, and then weaken during the spring months.

La Niña winters are typically associated with heat and dryness in southern Brazil and across Argentina. The early soybean planting has been delayed, which means the start of Brazilian new-crop soybean exports in early 2021 will be pushed back. This will likely leave the window open a few weeks longer than usual for U.S. shipments of soybeans.

The larger impact from the soybean planting delays in Brazil could be to the safrinha corn crop —planted after soybeans are harvested. Because soybean harvest will likely be delayed, the safrinha corn crop will be planted later, which increases the risk the crop will pollinate and fill after the end of the rainy season. Those risks will be heightened if La Niña conditions strengthen past February.

Winter price outlook

However, some market analysts are concerned the near-term bullishness, especially for soybeans, could be limited as commodity funds now hold record-long futures positions and open interest is large. Be prepared to sell more of your 2020 soybean crop with the inverted futures carry signal along with strengthening basis postharvest. Consider pricing some of your 2021 soybeans as they approach $10 per bushel in the November 2021 soybean futures contract.

Corn futures prices should remain strong with large demand both domestically and for export. However, with corn ending stocks still over 2 billion bushels come next August, the upside futures price potential could be limited. The lack of large futures price carry and strengthening basis postharvest should trigger corn sales. You may want to avoid commercial storage costs where basis improvement could be limited. Consider pricing some 2021 new-crop corn, as December 2021 corn futures trade more than $4 per bushel.

As the old saying goes, “The cure for high prices is high prices.” We’ve learned from the past that it results in lower demand for commodities, with product substitution and an expansion in global planted acres.

Johnson is an Iowa State University Extension farm management specialist. Email [email protected].

About the Author(s)

You May Also Like