Black swans can come in the form of weather events. This August alone has brought three major, unexpected weather events which has turned the soybean outlook from bearish to potentially bullish.

August weather events

The Derecho storm that hit the Midwest early in August flattened corn fields, leaving soybean fields ruffled from the impact of the 100-plus mph wind. Surviving that storm, soybean fields then faced blistering August heat. Much of the Midwest saw two to three weeks of scorching temperatures in the 90’s, just when soybean plants are in the critical pod filling stage.

As if the heat wasn’t bad enough, Mother Nature provided very little rain throughout August, with many Midwestern states reporting total rainfall at half of normal August precipitation.

Now producers sit and watch the weather radar, hoping that remnants of Hurricane Laura will make its way north into the Midwest. If the rain can reach Nebraska, Iowa, Illinois, and Indiana in the coming days, the marketplace will assume that the soybean crop has been “saved.” If the rain doesn’t materialize, then the guessing game of lost yield and lost productions begins.

Prices back to pre-COVID-19 sell off

November 2020 soybean futures are back near the $9.25 price level, not seen since early March. Technically speaking, this is a major resistance area on daily charts. The market is becoming “overbought” and the funds are long approximately 100,000 contracts.

This is a great time to stop and think about your cash marketing needs, and if this might be an opportunity for you to get current with sales. Right now the market has priced in the August heat, and trade is assuming U.S. soybean yield around 52-53 bushels per acre on a national average.

Upside potential

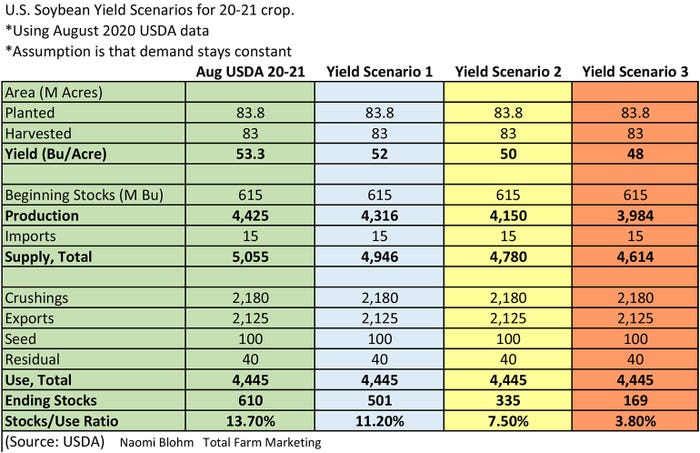

Could U.S. soybean prices trade higher? Yes, if it is perceived that U.S. yield is less than 51 bushels per acre.

I am no agronomist, but I can tell you that this extreme, constant heat that the soybean crop has endured during August has taken a toll. Several farmers say their soybean crop seems to be shutting down. Pods are not filling properly. Pods are aborting. Pods only have one or two beans in them. Yet, in the very next breath, they say, “If we could just get a rain.”

Based on pod counts from extension agents, producers, and crop tours, the U.S. soybean crop had potential. But if those pods aren’t filling properly, that potential is gone. If the rain doesn’t materialize for the Midwest yet this week or early next week, traders will point to likely declining crop conditions in Monday’s Weekly Crop Progress Report.

If nationwide yield is perceived as anything less than 51 bushels per acre, the ending stocks, and stocks to usage ratios get really snug (assuming demand remains constant).

Should prices close above the $9.25 level for November 2020 soybean futures, $9.50 is the next upside target, with $9.75 as an ultimate target, which would be a re-test of the January high.

It’s all up to Mother Nature. Will the Midwest receive this much needed rain in the next week or not?

Scout your fields. Do what-ifs with your grain marketing plan. Be ready for a potential price move higher if it does not rain. And, be ready for a potential price move lower if the rain materializes.

Reach Naomi Blohm: 800-334-9779 Twitter: @naomiblohm and [email protected]

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like