As Southwest grain farmers finish the 2021 harvest and start planning for next planting season, they will weigh the current good market opportunities against the high and rising cost of inputs.

“We’re looking at much higher input costs than we saw a year ago,” says Texas A&M AgriLife Extension Economist Mark Welch, College Station.

Despite those increased production costs, “returns look better than during planning stages last year,” Welch says.

He says wheat at $8 a bushel and corn at $5.80 show profit potential with decent yields. “The situation changes with lower prices,” he adds.

“If current prices are something producers can count on or protect, they can pencil in a profit.”

Uncertain Markets

He sees a lot of uncertainty in markets. “We’re just wrapping up the crop year, and it’s difficult to get a firm grip on where we are and where we are headed. The U.S. winter wheat crop was better than we thought. The corn crop, if yield numbers hold as they were over the last month or two, gets bigger and bigger.”

He says spring and summer drought caused concern early, but overall yields now look pretty good. “Also, decent weather indicates the South American crop has good potential. Weigh those factors against things we just don’t know.”

A big unknown is how much input costs will rise. “Fertilizer and other input costs (pesticides and herbicides) and availability for 2022 planting pose serious questions. How will producers weigh that into acreage decisions?”

Strong markets also figure into planting decisions. “Last year, we had great prices across the board for corn, cotton, wheat, grain sorghum, and soybeans. The market is telling us we need more acres in all of those. Higher production costs will play a role in what folks will plant.”

Resource Allocation

Welch insists that incentives exist to produce for profitable yields. But allocating resources efficiently will be key, he adds. “It’s econ 101 — how to allocate scarce resources. Producers have a lot of needs and a lot of wants. How will they respond to their options? I see challenges but some opportunities in planning for next year.”

Options for Profit

The big question, Welch says, is how to balance good prices against rising input costs. “How do we make higher prices work against higher input costs?

“Producers must be as efficient as possible. Soil test, watch fertilizer rates and placement, calibrate equipment, use proper timing on every production practice — planting, fertility, and spraying. Manage every input dollar spent to get the biggest bang for every buck. But be careful not to cut too much on input production and risk yield consequences.”

Test Management Skills

Welch says 2022 will be a year to evaluate management skills. “Manage inputs and fine tune those decisions.”

He says managing marketing decisions will be crucial to overcoming high production costs. “Fertilizer prices are higher because grain prices are higher,” he says.

Producers will need to find ways to make current prices work to their benefit for 2022. “We may not see those high prices next fall,” he warns. “We want to avoid locking in high input costs only to see lower market prices at harvest. We’ve seen that before.”

Manage Market Risks

He recommends producers, as much as possible, lock in or get a floor under prices on a portion of expected production to protect bottom line profits, assuming normal yields. At current price levels, the budgets work, he says.

The challenge is to make it work at harvest. “We have tools that help establish price floors. Protecting against downside prices makes sense, especially considering producers are making a much higher investment in 2022. It’s a whole different ball game with price and input this year. And we don’t get a guarantee on prices. Keeping costs in balance will be a key.”

Welch says picking one commodity over another could be an issue for some producers. Is corn better than soybeans? Is wheat better than cotton? Is grain sorghum a better option than soybeans?

In his best economist attitude Welch answers: “It depends.”

He says markets are in a “state of flux.” And, based on data out of the University of Illinois comparing corn and soybeans, corn shows better profit potential, even with higher fertilizer prices. “Economists do not expect a major acreage shift in the corn belt.”

Best Commodity

Texas and the Southwest will look a bit different, but Welch advises producers to consider “what do you do well?”

He says current budget estimates do not differ enough between corn, wheat, soybeans, and grain sorghum to make one stand out starkly from another. Experience should be a factor, he says. Producers who have a history of good corn yields and little with soybeans or cotton, might not want to wade into unknown waters in a year with uncertainty and high costs.

“Fine tuning and honing management on what worked well in the past might be the best option,” Welch says. “Push production, but in a cost-efficient manner.”

Rotation still makes sense, long-term, he adds. “Herbicide cost and availability may affect crop choices.

But this year should not be a sea change situation.”

Oklahoma

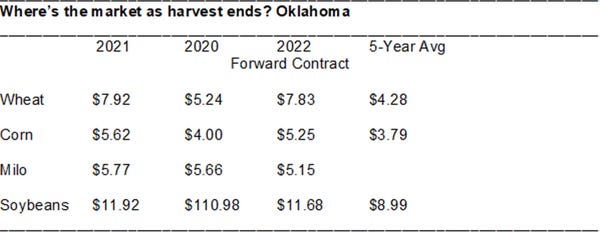

Kim Anderson, Oklahoma State University economist, echos Welch's assessment, stating that managing costs will be a key to grain profits in 2022. He offers the chart below comparing the four main grain crops for the Southwest.

Anderson expects market strength to continue into 2022.

He says wheat looks strong through August/September 2022.

“Corn also looks good, but the Argentine and Brazilian corn harvest occurs before the U.S, which could negatively affect prices. High fertilizer price support price strength.”

He says Brazil and China control soybean prices. “Soybean prices need to remain relatively high to insure planted acres.”

Anderson sees no new challenges. “Manage input costs to generate profit,” he says. “Penciling out commodity budgets for land allocation will be critical.”

Manage Risks

Welch says risk management and marketing tools work for all grain crops. “Protect the price; keep an eye on inputs and pricing opportunities. If you see a profit, take a bit of it. If it goes up, that’s good news.”

He says Extension offers numerous tools and programs to help producers develop marketing and risk management strategies.

“Certainly, input costs will be much higher for 2022,” Welch says. “But so are market prices. My concern is we get all these high-priced inputs locked in then the price drops by harvest. Managing for next year needs to be focused first on production and input efficiency. Then, use price risk management tools that prevent these high prices from slipping away.

“Yes, 2022 comes with some challenges, but gosh we see some opportunities, too.”

Oklahoma

About the Author(s)

You May Also Like