December 7, 2011

Beginning with the 2012 crop year, farmers purchasing crop insurance for corn and soybeans in 14 Midwestern states will have the option to use the Trend-Adjusted Actual Production History (TA-APH) Yield Endorsement. The TA-APH yield endorsement allows farmers to increase yields used in calculating crop insurance guarantees. The product concept submission to RMA was sponsored by the Illinois Corn Marketing Board, and developed in conjunction with faculty from the University of Illinois.

Rationale

Actual production history (APH) yields are used in the calculation of yield and revenue guarantees in the COMBO product. In the simplest case, the APH yield is based on a history of yields from the insured unit. To be based totally on historical yields, at least four years of yields must be provided. Up to 10 years of yields are used in the APH yield. When more than 10 yields exist from a farm, the most recent 10 are used in calculating the APH yield.

In crops with increasing yields over time, the APH yield lags the true “expected,” or most likely yield, for the coming insurance year. For example, consider a trend increase of 2 bu./year for corn, which has been the general rate increase of corn yields over much of Illinois. In other words, corn yields are increasing by a rate of 2 bu./year on average. If a farm has 10 years of continuous yields, the average of those 10 years will lag the expected yield by 11 bu. ((10 years of continuous yields / 2 + 0.5) x 2-bu. trend).

Because APH yields lag expected yields, guarantees will also lag. The TA-APH endorsement corrects this issue by allowing a trend adjustment to be added to the APH yield. The resulting TA-APH yield then is used in calculating guarantees.

Approach

Each county and crop has a TA-APH trend rate. This rate is estimated using National Agricultural Statistical Service (NASS) county yields, with controls include for weather and spatial considerations. These TA-APH rates are county specific and are published by the Risk Management Agency (RMA). Each insured unit in a county will use the same TA-APH rate. The table in the appendix shows corn and soybean TA-APH rates for Illinois.

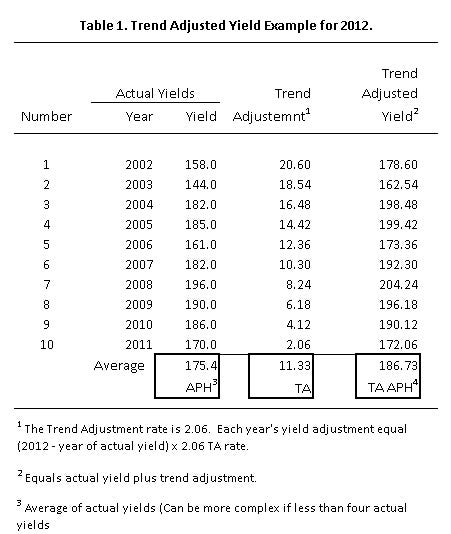

Table 1 shows an example of the 2012 TA-APH yield calculation for a McLean County farm having 10 consecutive yields from 2002 through 2011. The 2002 yield is 158 bu./acre, the 2003 yield is 144 bu., the 2004 yield is 182 bu., and so on. This APH yield for this yield history is 175.4 bu.

Corn in McLean County has yield trend of 2.06 bu./year. Under the Trend-Adjusted APH, each yield will be adjusted by 2.06 bu. times the number of years from the current insurance year. The further the year is from the 2012 current year, the higher is the trend adjustment. For the 2011 yield, the trend adjustment is 2.06. In 2011, the actual yield is 170 bu., and the TA-APH yield is 172.1 bu. (172.06 = 170 bu. + 2.06 trend adjustment). The trend adjustment for the 2010 yield is 4.12 bu., or the 2.06 trend times two years from 2012. The actual yield in 2010 is 186 bu. and the TA-APH yield is 190.1 bu. (186 bu. plus 4.01 trend adjustment). The above process is continued for each year in the past, and then the adjusted yields averaged to arrive at the Trend-Adjusted APH.

In the example shown in Table 1, the TA APH yield is 186.73 bu., 11.33 bu. above the 175.4-bu. APH yield.

Eligibility

To be eligible for the APH yield, a farmer must:

1. Be located in a county where the TA-APH endorsement is offered

2. Have at least one actual yield in the last four years.

An actual yield is based on yields from a farm, not simply transitional yield (T-yield) which is a plugged value when actual yields do not exist, or other changes occur in the insured unit.

Other details include:

The decision to use the TA-APH endorsement must be made by the sales closing date of March 15.

The TA-APH yield endorsement will be made on a crop/county basis. A farmer could choose to insure corn with the TA-APH yield endorsement and not use it for soybeans.

The TA-APH endorsement is a continuous policy. The TA-APH yield will continue as long as the farmer does not change the election or RMA does not end the endorsement. If a farmer switches companies, the endorsement will have to be re-elected.

There must be four yields in the last twelve years for the full trend adjustment to be received. The percent of trend adjustment by actual yields are:

100% adjustment for four or more yields in last 12 years

75% adjustment for three years in last 12 years

50% adjustments for two years in last 12 years

25% adjustment for one year in last 12 years

Total premiums (the farmer-paid portion and risk subsidy) will be the same for the same guarantee level for policies with and without the TA-APH yield. Take a 160-bu. APH yield and a 170-bu. TA-APH yield, and a projected price of $6/bu. An 85% revenue protection (RP) policy without the TA-APH will have a guarantee of $816/acre (160 APH yield x $6 projected price x 85% coverage level) and an 80% RP with the TA endorsement will also have an $816 guarantee (170-bu. TA-APH yield x $6 projected price x 80% coverage level). Because these two policies have the same guarantee, the two policies will have the same total premium. The farmer would pay less for the TA-APH policy because subsidy levels are higher for lower coverage levels.

In general, non-actual yields are not eligible for a trend adjustment. You will need to discuss details with your crop insurance agents to identify cases eligible for the Trend Adjustment.

Summary

The vast majority of corn and soybean farmers will find the TA-APH yield endorsement an attractive option. The TA endorsement causes the yield used in guarantee calculation to more accurately reflect actual production. In addition, the TA-APH yield endorsement eliminates penalties for long yield histories, as yields in the past are updated to reflect current yields.

You May Also Like