Traditionally, we call the next few month’s ‘Silly Season’ but after the past year it feels like we are already well into it.

Volatile market moves can be the norm when the U.S. crop goes in the ground and develops, and with the tight stocks situation, there is little room for a production hiccup this year, in the U.S. or abroad. A slew of reports this month could very well set the stage for the months ahead. Tomorrow (March 9) USDA releases its WASDE report; Then, on March 31st, the Quarterly Grain Stocks report and the Prospective Plantings report.

Highest pre-plant pricing opportunity in years

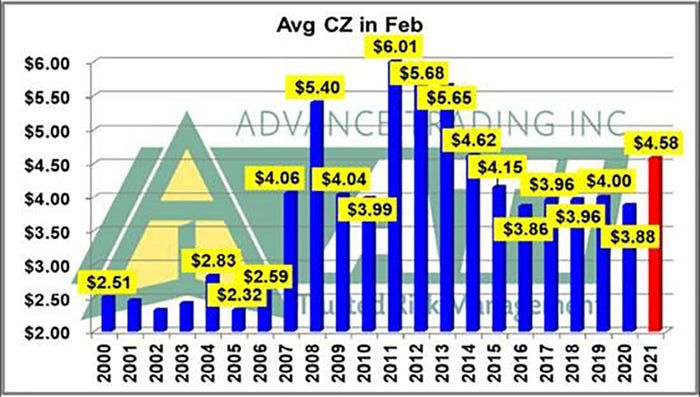

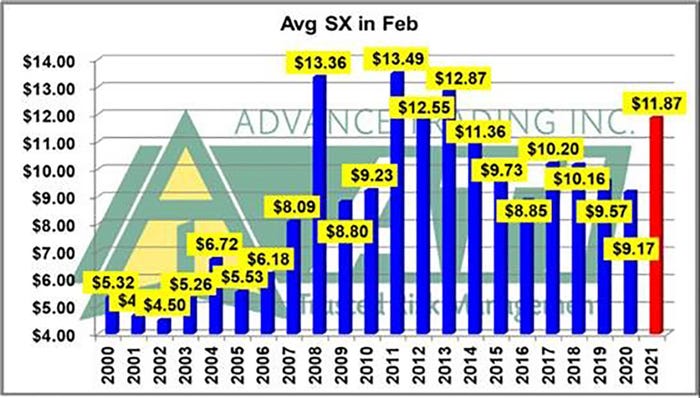

It is no secret that the market is offering higher pre-plant pricing opportunities than we have seen in some time. You can see in the graphic below the February pre-plant insurance prices for 2021 CBOT December Corn Futures and November Soybean Futures are well above recent years.

These prices will incentivize you, as well as your neighbor, to try and produce as many bushels as you can, pulling more marginal acres into production. What gets planted on these ‘fringe’ acres could come down to insurance guarantees. It is important you are defending your planting decisions by managing the price gap between your insured coverage and the current market.

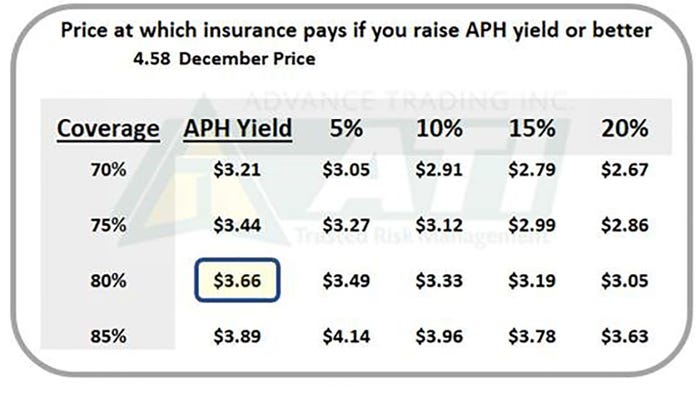

At $4.58, the insured corn price is 70 cents above last year. In the figure below, you can see that if you raise APH yields and have an 80% coverage level, the market would have to fall below $3.66 for you to receive an indemnity, more than $1 below where December Corn futures trade as of this writing.

Taking it a step further, if you exceed your APH, the market will have to fall further to receive an indemnity. Don’t take this wrong, crop insurance is a necessary and fantastic tool that provides a backbone to any great marketing plan, but it is important we understand the holes of using crop insurance alone to manage price risk.

The Best Offense is a Good Defense!

Football coach Bear Bryant’s famous words, “Defense wins championships” fits farm finances as well as the gridiron. Instead of trying to time the market to close this Marketing GAP, set up a good defense for the marketing decisions you make. Timing the market often leaves you with too many sold bushels when prices rally (see last fall) or too many unsold bushels when the market unexpectedly collapses (see the last 5 years).

If we use tools that allow you to proactively defend your balance sheet as well as the forward sales you make, you can place your operation in the driver’s seat to manage potential volatile market moves ahead. This is where the beauty of using options really shines.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like