The March 2021 WASDE report is not expected to see a significant change in U.S. ending grain stocks when USDA releases updated number tomorrow, but that doesn’t mean there won’t be any excitement.

Granted, more market action is likely later this month when USDA releases updated Grain Stock estimates and 2021 acreage intentions. And if USDA decides to drastically alter demand targets tomorrow, markets could go on a wild ride especially in the absence of any substantial market news over the past couple weeks.

So, with the expectations of a quiet report in mind, I am using this month’s WASDE preview not to just look at what tomorrow’s report may have in store, but also the larger questions on every marketer’s mind about where these markets are heading.

Have we over-exported soybeans?

U.S. soy producers were direct beneficiaries of Brazilian farmers over-selling 2019/20 soybeans into the global market, namely to China. Chinese buying paces intensified mid-summer 2020 and have remained relatively steady since.

But signs of a slowdown in Chinese buying paces are apparent and inevitable. China cancelled 2.3 million bushels of 2020/21 soybean export sales last week, the highest in the current marketing year. And soybean loading paces to China over the past three weeks averaged a meager 11.6 million bushels. Prior to that, marketing year to date soybean exports to China averaged 55.3 million bushels a week.

And in the U.S., soybeans are becoming increasingly more difficult to find. As of February 25, 84% of 2020/21 soybeans earmarked for export had already been shipped out of U.S. ports – with half of the 2020/21 marketing year left. Dairy farmers are already running into trouble booking summer shipments of soybean meal as processors’ forecasts remain murky amid potential supply scarcities.

The February cold snap may have helped temporarily ease processing rates, but there is still a long time left until that new crop is harvested. Four of the five highest monthly soybean crush volumes have been recorded between October 2020 to January 2021. If soybean demand rationing is as necessary as market analysts are calling for, it’s going to need to start happening soon before major shifts in U.S. livestock management begin to show.

Ethanol recovery?

Ethanol recovery was on the upswing to start the 2020/21 marketing year. Monthly corn consumption for ethanol averaged 432.6 million bushels in the last three months of 2020, notching some of the highest output volumes since the pandemic began a year ago.

But ethanol production has had a rough start to 2021. January 2021 corn consumption for ethanol fell to 415.8 million bushels as cold weather and rising COVID-19 cases reduced consumer mobility. Last month’s cold snap in the Southern Plains sent natural gas prices sky rocketing – if ethanol plants had any access to natural gas supplies at all. Ethanol production ground to a halt, tumbling to pandemic lows as plants idled to save costs and refinery activity slowed in the cold temperatures.

It was not a great obstacle on the road to recovery for the ethanol industry. But the year is still young. Vaccination rates are climbing, and consumers are becoming more willing to travel. It may take a few more months for ethanol production to return to pre-pandemic levels but rising basis prices on corn bids at ethanol plants across the country suggest the industry is ready to be back to normal at the first sign of economic recovery.

South American 2020/21 Corn and Soybean Production |

million bushels |

Argentina |

Corn |

Soybeans |

Brazil |

Corn |

Soybeans |

Source: USDA Office of the Chief Economist, Reuters |

South American crop damage – how bad is it?

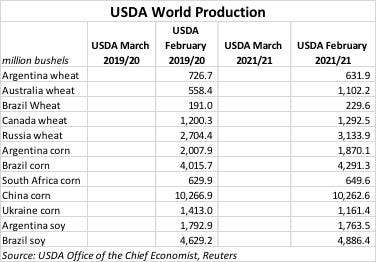

The most bullish price action potential in today’s report will largely lie in USDA’s estimates for South American production. Tarso Veloso with AgResource reported last week that 25% of Brazilian soybeans have been harvested as of last week, down from 46% a year ago. Rain delays are making soybean harvest – and safrinha corn planting – increasingly difficult as progress moves outside the optimal production windows for both crops.

Planting progress on the safrinha crop has now moved past the point of optimal yield projections. “Farmers are planting now knowing that yields are not going to be optimal,” Veloso said in a webinar hosted by the CME Group last week. Only 32% of Brazil’s corn crop was planted as of last week, compared to 65% a year ago. “And the planting window is closing,” Veloso cautioned. Brazil’s safrinha corn crop, typically the second corn crop grown in Brazil’s growing season, is largely sold into export channels. But tightening U.S. and South American corn supplies are limiting the amount of corn available to international buyers.

Veloso reported increasing quality discounts on Brazilian cash soybean sales as the rain delays continue. AgResource’s latest estimate of 4.776 billion bushels of soybeans for Brazil’s 2020/21 crop is quite a bit lower than USDA’s estimate last month.

A USDA attaché already forecasted a half-a-million-tonne drop in Argentina’s 2020/21 soybean production. The latest estimate places the Argentine crop at 1.745 billion bushels after hot and dry weather conditions stressed the crop following January rains.

Market analysts expect higher chances of cuts to the Argentine corn and soybean crops amid the current flash drought that is expected to persist in the region over the next 10 days. Veloso forecasts that a 196.9 million – 275.6-million-bushel drop in USDA’s forecasts for South American production tomorrow could take May 2021 Chicago corn futures prices past the $6/bushel mark.

“There is no room for error,” Veloso warned. “Brazil doesn’t have any more corn to export. [There is] no cushion in the global market right now for a Brazilian crop shortfall.”

World 2020/21 Ending Stocks |

million bushels |

Corn |

Soybeans |

Wheat |

Source: USDA Office of the Chief Economist, Reuters |

Chinese corn imports?

What last week’s weekly export report from USDA lacked in new corn export sales, it more than made up for in corn export shipping paces. Corn export loading volumes for the week ending came in at 79.1 million bushels. It was the highest volume of the 2020/21 marketing year and based on this analyst’s export database reaching back to 1998/99, it was the highest weekly corn export volume on record.

Marketing year to date corn shipments from the U.S. to Japan and South Korea are up 44% and 1171%, respectively, from the same time a year ago. Despite a slow start to 2020/21, Mexican corn buying paces are beginning to intensify as well.

Of course, Chinese demand is the key culprit here. U.S. and world corn stocks could see a reduction due in large part to China’s rapid export purchases of U.S. corn.

USDA currently has 1.725 billion bushels of 2020/21 earmarked for export. But with half of the marketing year remaining, the U.S. has already exported 1.030 billion, or 60%, of those bushels. There are another 1.297 billion bushels of corn export sales on the books for 2020/21, of which 35% are reserved for China and another 18% are on hold for unknown buyers.

The question for tomorrow becomes: will USDA revise China’s 2020/21 corn imports higher? Current WASDE estimates stand at 944.9 million bushels. China has already bought and shipped 278.1 million bushels of U.S. corn in 2020/21 and has another 459.3 million bushels on the books to be delivered later this year for a total of 737.4 million bushels.

But China has also booked corn purchases from Ukraine (63.0M bu.) and Brazil (6.5M bu.) this year, with more sales scheduled for delivery in the second half of 2020/21. China is notorious for its vague stock and production estimates, which makes calculating import demand a tricky feat for USDA. Recent policy memos suggest China will be increasing focus on food security in the years to come, which is likely to boost domestic production as well as imports.

So, any significant change to China’s corn flows – as well as changes to Brazil’s crops – could be cause for bullish price action in tomorrow’s report.

Will wheat export flows see a shakeup?

Wheat markets have seen substantial appreciation over the past few months due in large part to export restrictions in Russia. Shipping paces boomed in Russia leading up to the fixed tariff of approx. $1.66/bushel enforced on March 1. Preliminary export data suggests Russian shipping paces are slowing in the aftermath of the newly enforced export tax.

USDA could pare down Russia’s export estimate for 2020/21 in tomorrow’s report. A rising dollar and easing Chinese demand for U.S. wheat over the last several weeks does not bode well for U.S. wheat exports either.

But U.S. wheat export volumes historically trend higher from March through June. Russia’s export tax and Ukraine’s annual export quota (now at 78.3% of 2020/21 capacity, which ends June 30) are likely to limit exportable supplies from the Black Sea region until the 2021 crop can be harvested this summer. Barring any significant appreciation in the dollar, USDA is likely to keep its 985-million-bushel 2020/21 export target unchanged in the months to come.

About the Author(s)

You May Also Like