Typically, my time spent writing this blog will involve explaining our perception of the corn and soybean balance sheets, spotting actionable patterns in the market, or proposing methods to consider for managing farm profitability. But nothing is typical about the market we are currently dealing with and there are other risks to consider beyond prices dropping. These risks could be far worse than a drop in price and they involve the market going higher.

The word on the street is that a large market participant lost $90 million this week due to their exposure in the spread between May and July corn. Let’s walk through this together.

Imagine for a second you are short May corn futures, which a commercial entity is required by law to be, if they are holding physical bushels. Now imagine that short position represents 225 million bushels, or 45,000 contracts. If the commercial is going to maintain physical ownership of those bushels past the expiration of the May contract, the short position needs to move to July. In a well-supplied environment, the commercial entity will generally take advantage of carry in the market and exit the short May position while simultaneously selling the July contract at a higher price. Carrying product in this environment pays handsomely.

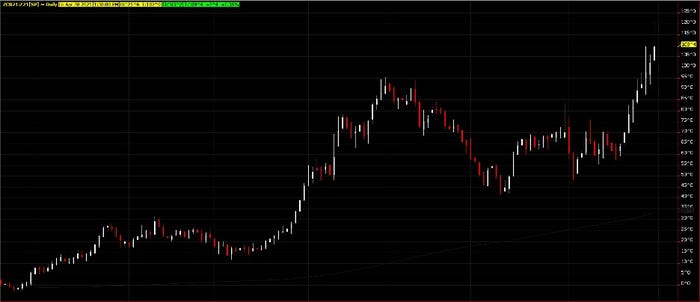

We are not in a well-supplied environment and things didn’t work out as planned. On the day May options expired, May corn futures settled 23 cents above July futures; first notice day was a week away. Now moving your short position to July at a 23-cent inverse is not an easy pill to swallow, but in the next few sessions the spread ran another 40 cents higher before the roll was done. Ouch!

While the talk on the street will always be about the biggest example of what happened, I’m a believer that if I see one cockroach, there are more lurking. My point in saying this is that you need to be aware of the counter-party risk involved in selling and delivering grain. Is your local co-op or grain elevator another smaller example of what we just walked through?

Spread risk isn’t just on the commercial side, though. You may or may not be familiar with a product called accumulators. Generally speaking, the product will allow producers to slowly accumulate sales at a price above the market when the product is agreed upon. The “catch” is that if the market goes down after agreeing, prices might reach your “knockout” in which case you will no longer accumulate any more sales above the market.

There’s another “catch,” and this one is the one that really hurts. Accumulators have another feature; if futures values are above a certain price level on a certain day, the producer owes double the amount of agreed upon bushels. Let’s imagine together again and say that during the summer of 2020, in the low-price environment, a producer used an accumulator product based on July ’21 futures to accumulate sales above the market, thinking that an extra 15 cents could make all the difference in the world to their farm’s profitability. “If I could get $4 for corn, I can turn a profit this year.”

Fast forward to now and the producer doesn’t have those bushels. Oops!

Now the producer must deliver bushels they don’t have. The elevator manager is really nice though and will let the producer “roll” the sale of those bushels to another delivery period. “If the bushels aren’t there to deliver against July, you can just roll the sale to new crop.”

Great idea! But wait, when can those sales get rolled to new crop? Those doubled up bushels aren’t officially doubled up until July option expiration. Could the producer without the bushels to deliver get burned in the same fashion as the large commercial entity we walked though earlier? The answer is very much so a resounding YES

At some point along the way that producer felt like they were taking advantage of ever-increasing prices and sold the rest of their old crop thinking the market would stop going higher. Who knows at what point the producer realized they didn’t have the bushels to deliver against their July accumulator, but since fall the July ’21 contract has gained as much as $1.20 on Dec ’21.

This is very important, and you need to understand this. Until June 25th, when July options expire, the producer is at the mercy of the July/Dec corn spread. When the sale is rolled from July to December, the amount he spread is trading at is taken off the December sale price. Let’s say the accumulator “double-up” was at $4. If that July sale is rolled to December at today’s settlement of $1.095 over, the December sale is now $2.905. What if July continues to gain on December over the next two months? What if July went $2 over December and it turns into a $2 December sale? What if it’s worse? What if the producer has no idea this exposure even exists…?

As always, feel free to contact me directly at 815-665-0463 or anyone on the AgMarket.Net team at 844-4AGMRKT. We’re here to help.

Reach Brian Splitt at 847-946-2080 or [email protected]

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading infromation and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like