December 3, 2014

Rabobank published a global outlook for ag commodities, including corn and soybeans, in 2015, focusing on demand, supply and prices. Lower prices levels should encourage consumption growth, say market researchers. According to the report, key variables to watch include: U.S. dollar strength, uncertain Chinese demand growth, slowing biofuel demand and oil price weakness.

Stefan Vogel, global head of Rabobank Agri Commodities Markets Research, said, “2015 will be another interesting year for agri commodities. Macro drivers remain very much in play and price swings from supply and demand shocks are still likely, given that the stocks for most commodities are not yet at levels necessary to provide an adequate buffer.”

The pace of world economic growth has been disappointing during 2014, particularly in the Eurozone where counter sanctions from Russia have hindered economic recovery. Rabobank says that the UK and the U.S. are the bright spots for 2015, but their pace of expansion will be tempered by slow growth elsewhere. Significantly, in 2015 Rabobank expects a downward revision of China’s 7.5% annual growth rate.

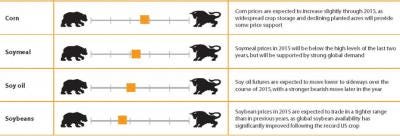

Click for larger image.

Rabobank says farmer selling and planting decisions, global demand and weather-related production risks remain key drivers through 2015. Assuming normal growing conditions, moderate increases in demand will allow stocks to build for most commodities through 2015.

However, the projected lower price levels through 2015 also provide a great incentive for consumption to exceed the forecast levels. In particular, China’s import demand will continue to be one of the most important variables for many agri commodity markets.

On the supply side, weather-related production abnormalities will impact agri commodity prices. The weather in 2014 was somewhat of an anomaly for agri commodity production, with favorable to ideal growing-season conditions experienced across most regions driving bumper crops across commodities. The only exception was persistent drought conditions across central and southeast Brazil and the east coast of Australia. Despite the higher beginning stocks in 2015, weather threats, including risk of a weak-to-moderate El Nino, could cause prices to diverge from our base case.

You May Also Like