With temperatures rising as rapidly as market volatility this summer, corn and soybean farmers are faced with increased uncertainty about the directions to take for future success. Right now, prices remain very profitable – but for how long? How do you ensure success this year -and maybe even next year too?

To be sure, market volatility has made for a wild, inflationary ride. We’ve seen two years of financial upheaval derived from the pandemic, supply chain issues, and the Russian-Ukrainian war – among other issues. None of these things have made decisions easy in farm country.

“Simply put, history only goes so far in defining risks because every boom-and-bust cycle is different,” Farm Futures contributing analyst Bryce Knorr explains, encapsulating the decision-making dilemmas many growers now face.

“When was the last time we had a drought and a war after a pandemic? That's a plaid swan, and this risk limits forecasting reliably -- which isn't all that reliable anyway.”

And with peak pollination season approaching across the country, the urgency of those decisions is only increasing as the outlook remains murky. So where should farmers be setting their sights in terms of new crop and input pricing?

Pricing ‘22 crop

AgMarket.Net co-founder and Illinois farmer Matt Bennett emphasizes flexibility in marketing plans when looking towards pricing 2022 crops. Bennett’s team recommends clients price 50% of anticipated 2022 crops with some sort of sale to lock in higher prices. The next 50% largely depends on an individual producer’s risk tolerance.

AgMarket.Net analysts encouraged clients to lock in about 30% of 2022 crops with physical sales – be that through basis contracts, hedge-to-arrive contracts, or other tools. The other 20% of APH yields can be protected by a floor using a put option or cash sales so that producers can still capitalize on upside price potential.

Weather scares are also high on Bennett’s mind. “If you can’t come up with the bushels because of a drought unfolding, you could be looking at another $1/bushel on this market pretty quick.”

But even if growers are hit by a drought this summer, they will need to insulate the bushels they are able to produce, Bennett cautions.

“I do want protection – when we are this far above the spring insurance price, I think it is smart to at least protect the fact that we have rallied $1.30/bushel above that target,” Bennett reasons. “Quantify a worst-case scenario and stay on your toes just in case this market rips higher.”

Grain marketing consultant and founder of Wright on the Market, Roger Wright, acknowledges that farmers may want to continue waiting for new market tops – which is less guaranteed than ensuring adequate profit margins for 2022.

“Sell corn and soybeans at a price that makes business sense for your operation,” Wright suggests. “When you think prices have peaked, buy a put option. After futures decline, sell the put option and add the put profit to your hedge-to-arrive price. Also, buy puts to capture price gains on rallies after you priced your crop to make the money on the way down you missed on the way up.”

Additional sales strategies

There are opportunities for both growers who may use a brokerage account as well as for those who opt to not use one.

“One does not need a brokerage account to do a great job of marketing their grain, but one must understand how the futures and options markets work to do a great job of marketing their grain” explains Wright. “Invariably, once farmers understand how the futures and options market works, it’s not so scary,” Wright adds. There are other – even simple – ways to optimize grain sales beyond using these marketing tools, Wright points out.

“Talk to every grain merchandiser in your area and ask them what marketing tools they will provide,” Wright emphasizes. “They won’t offer any information about their offerings unless growers ask. Once you start asking, you may be able to negotiate a more favorable sale for your farm.”

How can producers be certain of what a favorable sale may look like for each operation? Agricultural Economic Insights managing partner David Widmar sees opportunities to lock in some decision-making certainty even during these volatile market conditions.

“Know where you stand for 2022 – update your cost and revenue projections frequently,” Widmar recommends, but also keep an eye farther down the road. “Create budget projections for 2023 or update them based on current market conditions if you already have them in place.”

“There are many unknowns for 2022 and 2023, but having up-to-date projections allow you to make faster and more confident decisions,” Widmar explains, noting that there may be fewer unknowns at play than producers realize.

“It can also be surprising how many knowns there are within a budget project, even looking into 2023. Fixed costs and obligations – such as cash rents, debt payments, and family living – can often be forecasted years in advance with a great degree of confidence.”

What about ’23 sales?

With prices so high and the 2022 crop not even harvested, how aggressive should farmers be considering pricing 2023 crops?

The easy answer: it depends on your risk tolerance. But don’t ignore moving price targets. “2023 selling is tricky right now because we don’t know 2022 crop size,” says Wright. “So some waiting is warranted until this fall. But if it makes business sense, there are ways to offset risk.”

As input costs are predicted to rise beyond year-ago levels, it may be worth the while to consider pricing some 2023 sales. Projected ’23 budgets should provide clues to break evens and what can be afforded to pay for inputs.

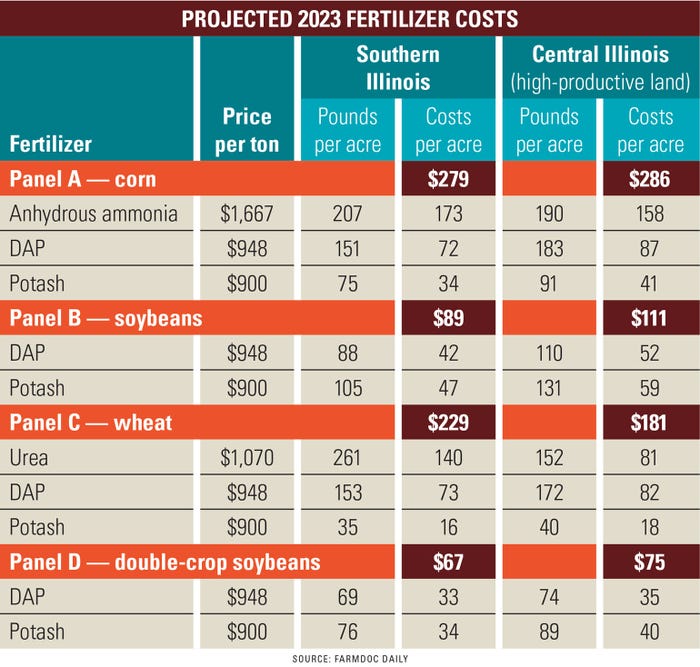

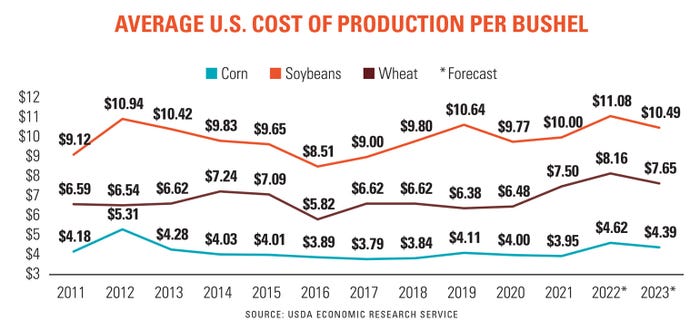

USDA in June updated its cost of production forecasts for 2022 crops and provided its first estimate of the bill for 2023. The government’s numbers for fertilizer may look too low for many growers, so all growers should guestimate their own costs of production and not rely on some sort of average, says Knorr. “The new data said total corn and wheat costs rose 16% for 2022 with soybeans 10% higher. But cheaper fertilizer could offset higher interest rates next year, cutting total costs 2%.

“On a per-bushel basis based on USDA’s expenses and normal trend-line yields, this puts the cost of corn around $4.40 per bushel, with wheat at $7.65 and soybeans $10.50. Futures on 2023 crop production are well above these levels for all three crops, and that translates into triple-digit profit potential.”

“My previous research suggested getting at least a 15% return over all costs before hedging the next year's crop was advantageous over the long term,” Knorr calculates. “Summer markets appear likely to meet that test.” The AgMarket.Net team eyes the 50% benchmark for pre-booked sales ahead of the ‘23 growing season. Bennett’s team has been advising growers to lock in 10% of the ‘23 crop so far through hedges.

For the remaining 40%, Bennett has advised clients to buy $6 puts and sell a $7 call option with a March ‘23 expiration to keep a floor under prices. Keeping an eye on APH crop insurance prices should also be a key focus to in case they rise higher than last year’s values.

Bennett’s team’s preferences are to buy a put option for March 2023 at a strike price within one standard deviation of an expected futures price move to improve the odds of the option expiring at the money.

“It can act as a hedge of crop insurance or simply a hedge for the next six or more months,” Bennett explains. “We are willing to give up some upside to have a floor underneath us.”

Purchasing options on ‘23 futures can be a risky strategy a year ahead of 2023 crops being planted, as the premiums on products that far out are likely too high to ensure an adequate profit margin.

“It's not realistic to trade options a year or more before harvest -- the premiums increase the cost of production too much,” Knorr explains, noting that at-the-money November 2023 put options traded at $1.20/bushel in early June 2022.

“That may not be enough to justify FOMO on a bigger rally next year if supplies stay tight and/or weather doesn't cooperate.”

Small steps matter

Even small steps count towards easing the uncertainty created by volatile markets, reasons Widmar.

“For many of us, our default thinking is to lock-in large chunks of our inputs – such as half or all of our fertilizer,” he explains. “However, like marketing grain, producers can also make small steps.”

Knorr agrees. “Prices are good, so locking in some incremental sales isn't a terrible idea,” he echoes.

“Getting some 2023 crop priced this summer is a start, but also remember there are other pricing windows. The marketing time frame for this crop is 2 years plus. Patience may or may not be profitable, but it's a virtue for a reason.”

Managing next year’s costs

High prices are on everyone’s mind, even though it is not yet clear how 2023 expenses will shake out. Fertilizer prices were trending lower due to seasonal demand ebbs, but inflationary fears are at the forefront of everyone’s decision-making process this year. “We all know that seed could go up, but it will be within a range,” predicts Bennett. “Fertilizer will be more volatile.”

Pricing options for fertilizers are not typically available from ag retailers until after fertilizer producers set their prices. And that does not typically occur until mid-August. But Bennett says that’s no excuse for complacency.

“Keep asking your dealer the questions – when can you lock in 2023 prices?” Even if pricing is not yet available, Bennett points out that, “the worst they can tell you is ‘no.’”

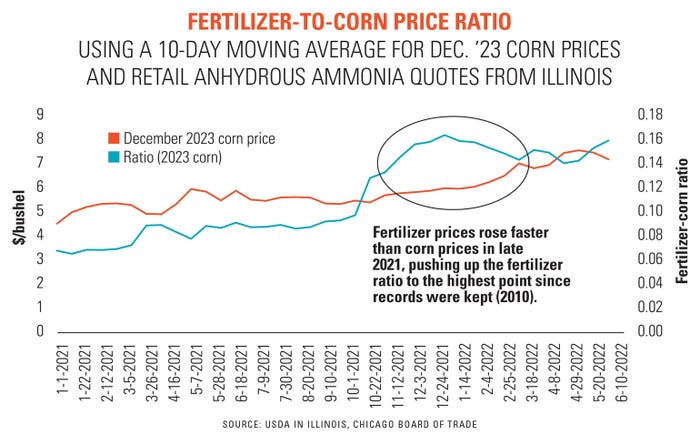

In the meantime, pencil out the ratio of fertilizer to corn prices. “Once you start getting fertilizer prices, you need to start comparing it to the ratio against Dec23 corn futures prices,” Bennett advises. The anhydrous – Dec23 corn price ratio remains elevated near record highs, which means that fertilizer prices continue to take a large bite out of potential 2023 revenues.

The ratio does not indicate how profitable – or unprofitable – planting corn will be, but it does help ease some of the sticker shock of $1,500/ton anhydrous ammonia prices, Widmar observes.

“In a world of diminishing marginal returns and optimizing crop production where marginal revenue equals marginal costs, that ratio would give you some insights into how much fertilizer to apply, in theory” explains Widmar. “A low ratio would mean you’d push for higher yields, while a high ratio means you’d theoretically apply less fertilizer.”

It also does not account for other production costs, which are only increasing amid broad inflationary pressures. “Diesel fuel prices are a big question mark,” worries Bennett, who is already trying to anticipate fall fuel availability. “If a person is able to bulk up on-farm inventory, that is a smart thing to do.

“It’s not for everyone and it’s not fun to fill those bigger tanks right now,” he adds. “It’s a complicated situation but by all means if you’re worried about not having enough fuel, it’s one way to ensure you’re not going to run out.”

But if there is some seasonal fertilizer price relief this summer – or if corn prices continue to climb – those margin prospects could improve and trigger proactive marketing decisions.

“We don’t want to be more aggressive on ‘23 sales unless we can lock in ‘23 prices at a rate that can ensure we can lock in 2023 profit margins,” Bennett concludes.

About the Author(s)

You May Also Like