Tariff trouble, weather and upcoming USDA reports left markets drifting this week. Funds were cautious overall around the Labor Day holiday, selling more on the week.

Here’s what funds were up to through Tuesday, Sept. 4, when the CFTC collected data for its latest Commitment of Traders.

![]()

Broad but thin

Big speculators sold most crop and livestock contracts last week – hogs and cattle were the exception. In total hedge funds added 27,152 contracts to their net short position. Investors using index futures to gain exposure to commodities were small sellers, trimming their net long position by 4,311 lots.

Small change

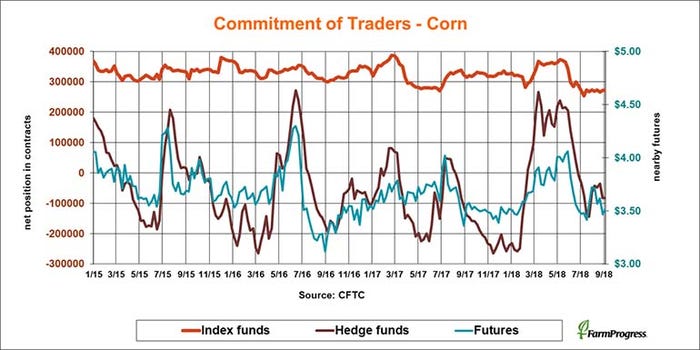

Big speculators sold corn last week, but only a little, adding just 385 contracts to their modest bearish bet.

Downtime

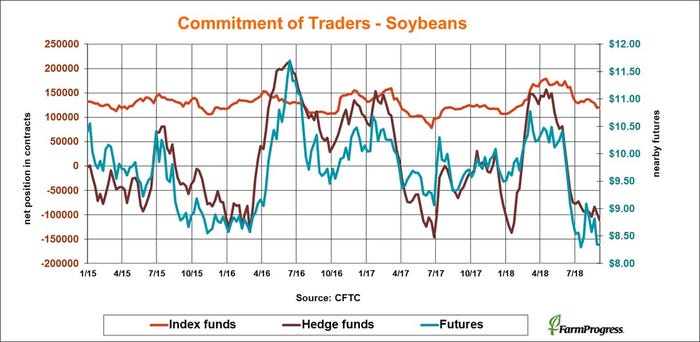

Big speculators sold soybeans again last week, adding 14,148 contracts to their net short position to push the bearish bet to its widest level since January.

Back-peddling

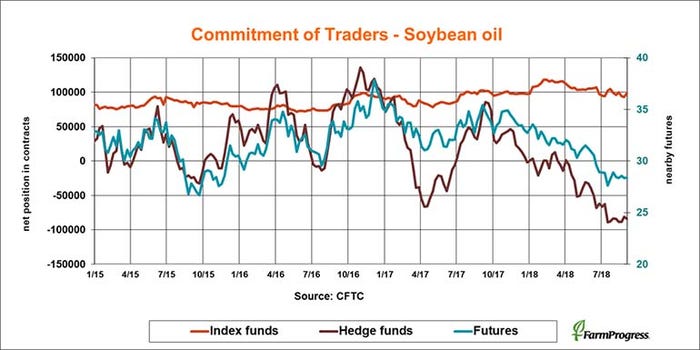

Big speculators continued to consolidate their near-record short position in soybean oil last week, selling another 3,138 contracts. Index traders were buying, adding a net 6,083 contracts.

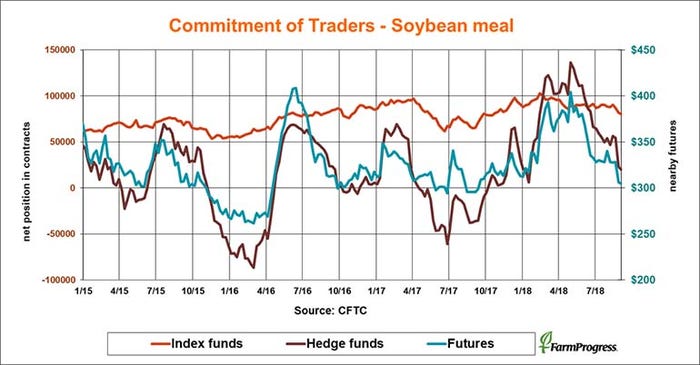

Almost gone

Big speculators continue to liquidate their net long position in soybean meal, helping pressure prices lower. The hedge funds sold a net 3,204 lots and index traders also sold.

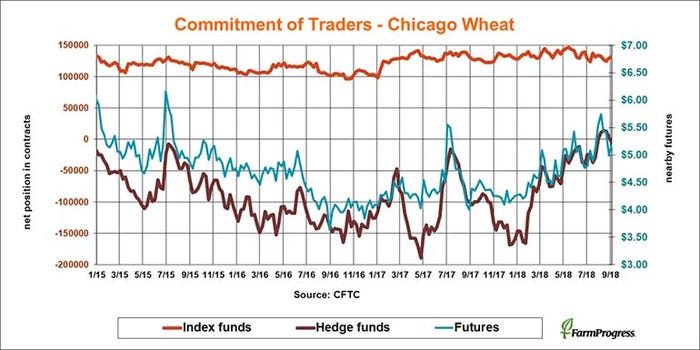

Short again

Big speculators were long soft red winter wheat for only five weeks at the end of summer. That bullish bet ended this week as funds sold 9,362 contracts to slip back to a net short position.

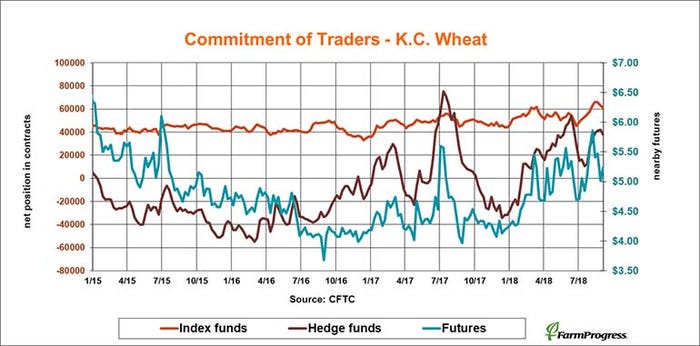

Rebound falters

Big speculators bought hard red winter wheat for six weeks, a string that ended this week as both hedge and index funds turned light sellers, trimming their net long positions.

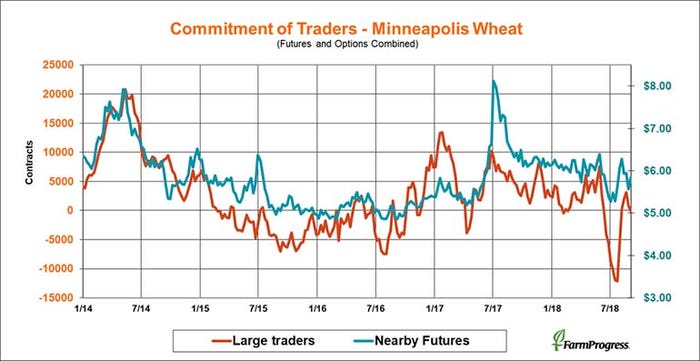

Return to red

Large spring wheat traders ended their move to be long wheat in the last week, selling 872 contracts to turn back to a small net short position.

Stormy weather

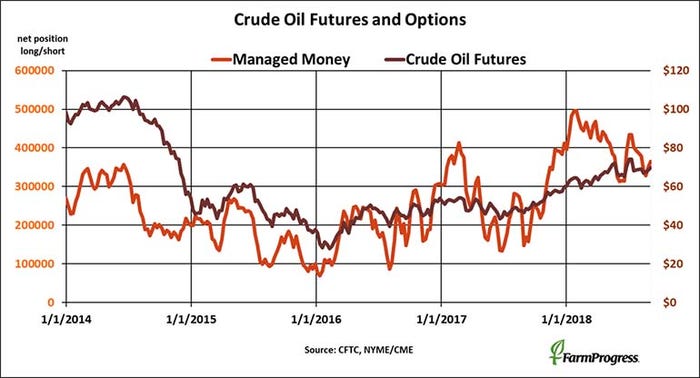

Money managers bought crude oil for the second straight week, and those holdings benefited from rising prices due to Tropical Storm Gordon. In all funds added $945 million worth of crude oil futures and options.

About the Author(s)

You May Also Like