End-of-the-month position squaring helped lift the grain market Friday. But funds who bought were selling earlier in the week before their abrupt turnaround.

Here’s what funds were up to through Tuesday, Aug. 28, when the CFTC collected data for its latest Commitment of Traders.

![]()

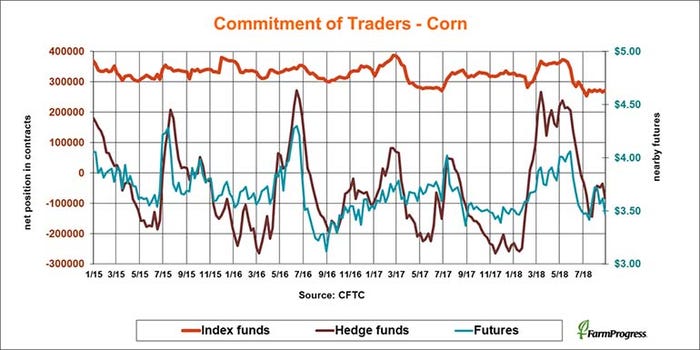

In reverse

Big speculators moved close to even a week ago, nearly ending their bearish bets in crops and livestock. But the hedge funds turn sellers again this week, adding back 94.169 contracts to their net short position as prices swooned.

Second half

After buying back some of their bearish bets in corn for most of the second half of summer, big speculators were aggressive sellers last week. They extended their net short position by 46,84 contracts.

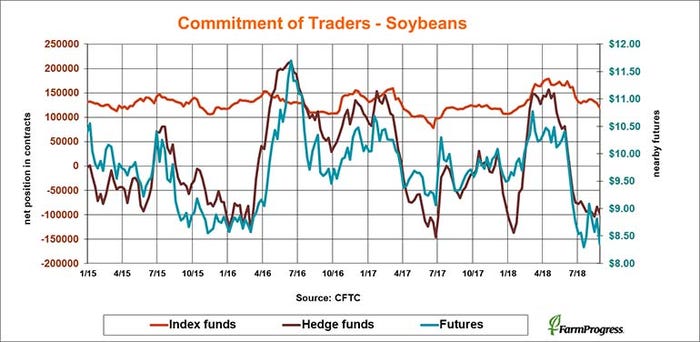

Winter chill

Big speculators sold soybeans last week, boosting bearish bets by 13,497 contracts. Investors using index funds to gain exposure to commodities were almost as aggressive. They sold a net 10,055 lots, whittling their net long position down to its smallest level since January.

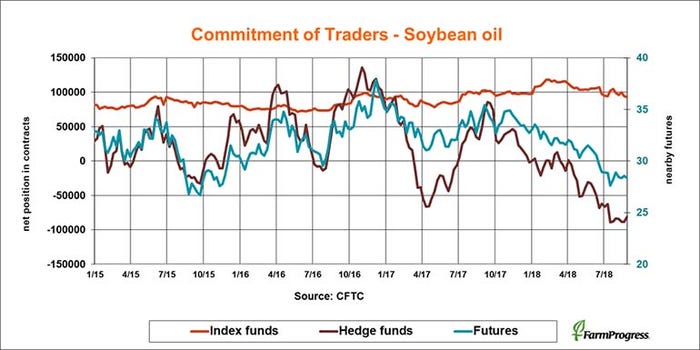

Getting out

Big speculators built up a record bearish bet in soybean oil this summer. But they covered some of that short position this week, buying back a net 7,203 contracts.

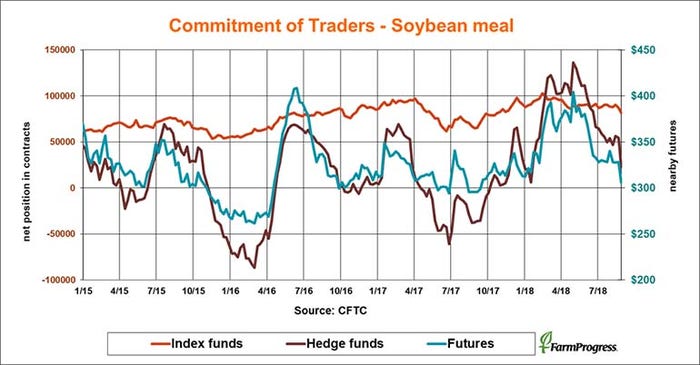

Out of gas

Big speculators bought soybean meal aggressively this year, hoping to cash in on lower production in Argentina, the world’s leading soy product exporter. They’ve all but given up that dream now, cutting another 31,537 contracts off their net long position, leaving them holding 23,127, 83% less they their spring record.

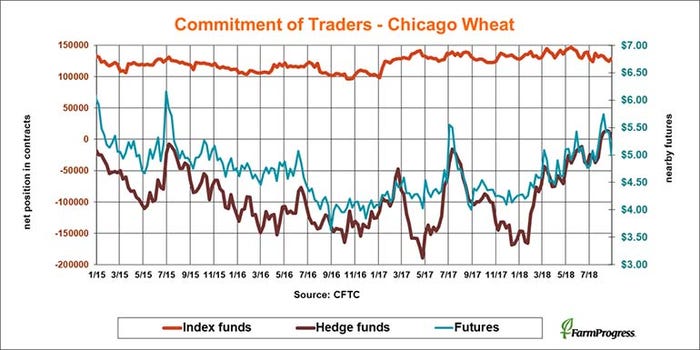

Wavering wheat

Big speculators helped boost buying on in soft red winter wheat on Wednesday and Friday. But these speculators were culling their small bullish bet earlier in the week. Hedge funds sold a net 8,737 contracts as of Tuesday, when they were long only 3,872 lots.

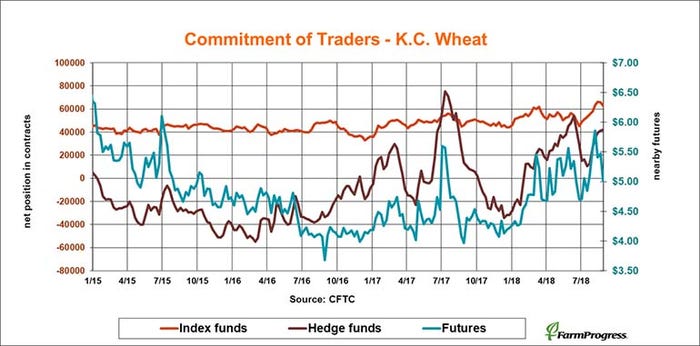

Not the fuel

Big speculators didn’t appear to be the source of selling in hard red winter wheat ahead of September delivery. Hedge funds bought 516 lots of HRW as of Tuesday, even though prices dropped around 45 cents.

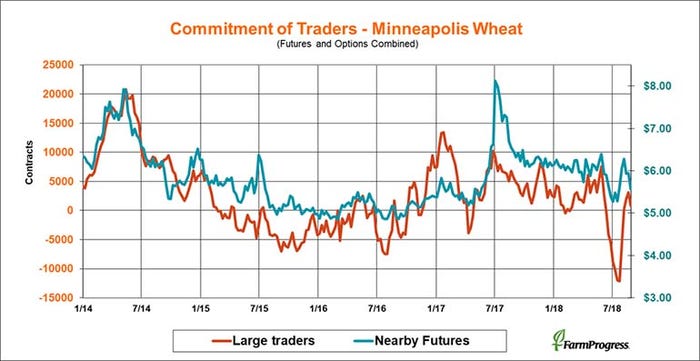

Stop sign

Large spring wheat traders bought for four straight weeks in August, closing a record short position. But the funds started selling again this week, dumping 2,312 contracts.

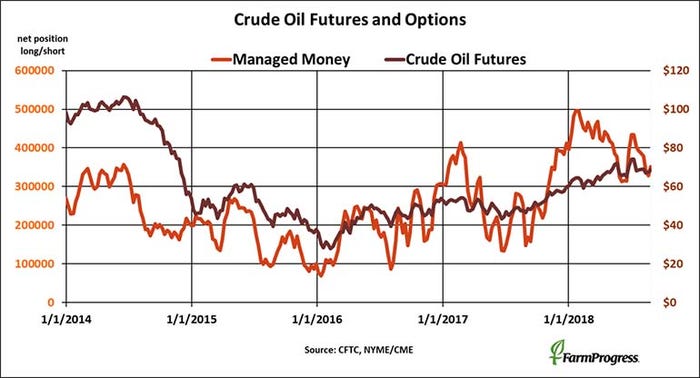

Change of heart

Money managers have been mostly selling crude oil recently. But they jumped back in on the buy side this week, boosting their net long position by more than $1.6 billion.

About the Author(s)

You May Also Like