Corn bulls saw strong export sales Jan. 26 in the morning of 1,445,900 MT for 2017-18. This easily topped expectations and was up 59% from the prior four-week average weekly report, which was delayed because of the government shutdown.

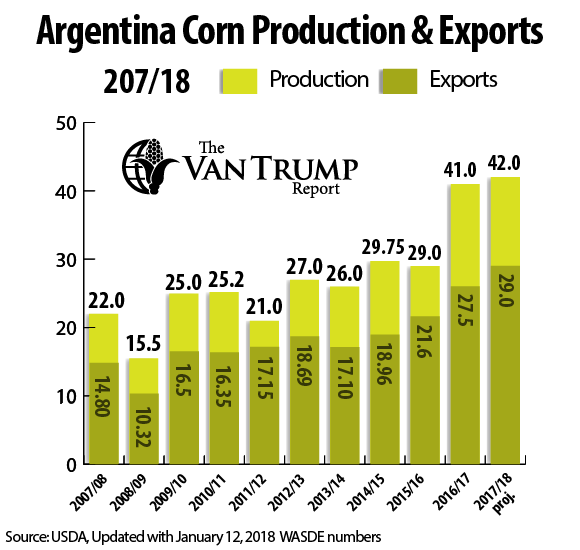

The weather in Argentina still remains a wildcard with several sources thinking the USDA currently has their production estimate 2-4 MMTs too high. Bulls also think the Brazilian and South African production estimates might also need to eventually be adjusted lower.

Technically, there's some talk that the MAR18 contract could struggle closing above the 100-day Moving Average, which is right around $3.58, without some fresh new bullish headlines. Perhaps weather forecasts in South America over the weekend will trend more bullish.

Also keep in mind, the new-crop DEC18 contract is trading at or around $3.89 this morning and hasn't closed back above $3.90 since early November. The contract high was posted in early July at just under $4.30 per bushel. If you are a producer who didn't take advantage of these levels and reduce a portion of your longer-term risk you might soon get a reprieve. Make certain you are paying extremely close attention and put yourself in a position to "execute."

As a spec, I continue to stay conservatively bullish, believing there's more upside potential in the days and weeks ahead. I'm looking for Argentine weather headlines to get a bit worse before they get better.

Get more market news from The Van Trump Report.

About the Author(s)

You May Also Like